Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $234,000 and would yield the following annual net cash flows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Net cash flows Project C1 Project C2 Year 1 $ 14,000 $ 98,000 Year 2 110,000 98,000 Year 3 170,000 98,000 Totals $ 294,000 $ 294,000 a. The company requires a 10% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted. b. Using the answer from part a, is the internal rate of return higher or lower than 10% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR to answer this question.

Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $234,000 and would yield the following annual net cash flows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Net cash flows Project C1 Project C2 Year 1 $ 14,000 $ 98,000 Year 2 110,000 98,000 Year 3 170,000 98,000 Totals $ 294,000 $ 294,000 a. The company requires a 10% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted. b. Using the answer from part a, is the internal rate of return higher or lower than 10% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR to answer this question.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter12: Valuation: Cash-flow Based Approaches

Section: Chapter Questions

Problem 12PC

Related questions

Question

Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $234,000 and would yield the following annual net cash flows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

| Net cash flows | Project C1 | Project C2 |

|---|---|---|

| Year 1 | $ 14,000 | $ 98,000 |

| Year 2 | 110,000 | 98,000 |

| Year 3 | 170,000 | 98,000 |

| Totals | $ 294,000 | $ 294,000 |

a. The company requires a 10% return from its investments. Compute

b. Using the answer from part a, is the

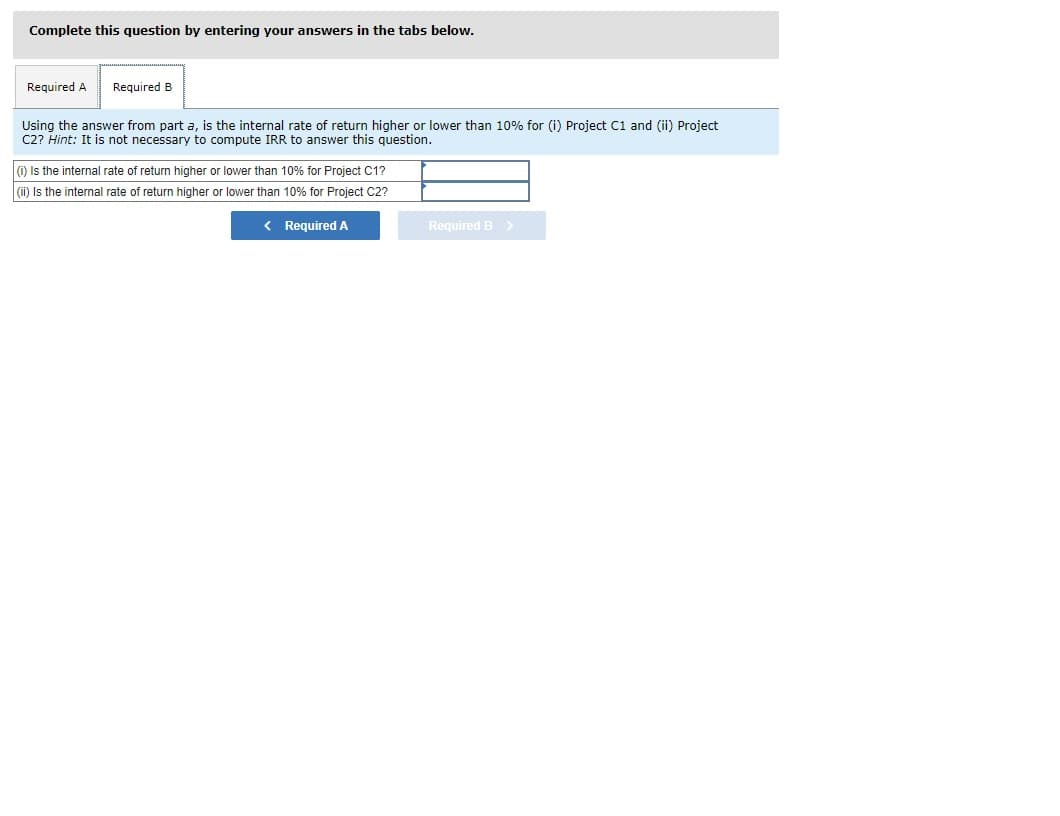

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required A

Required B

Using the answer from part a, is the internal rate of return higher or lower than 10% for (i) Project C1 and (ii) Project

C2? Hint: It is not necessary to compute IRR to answer this question.

0 Is the internal rate of return higher or lower than 10% for Project C1?

(i) Is the internal rate of return higher or lower than 10% for Project C2?

< Required A

Required B>

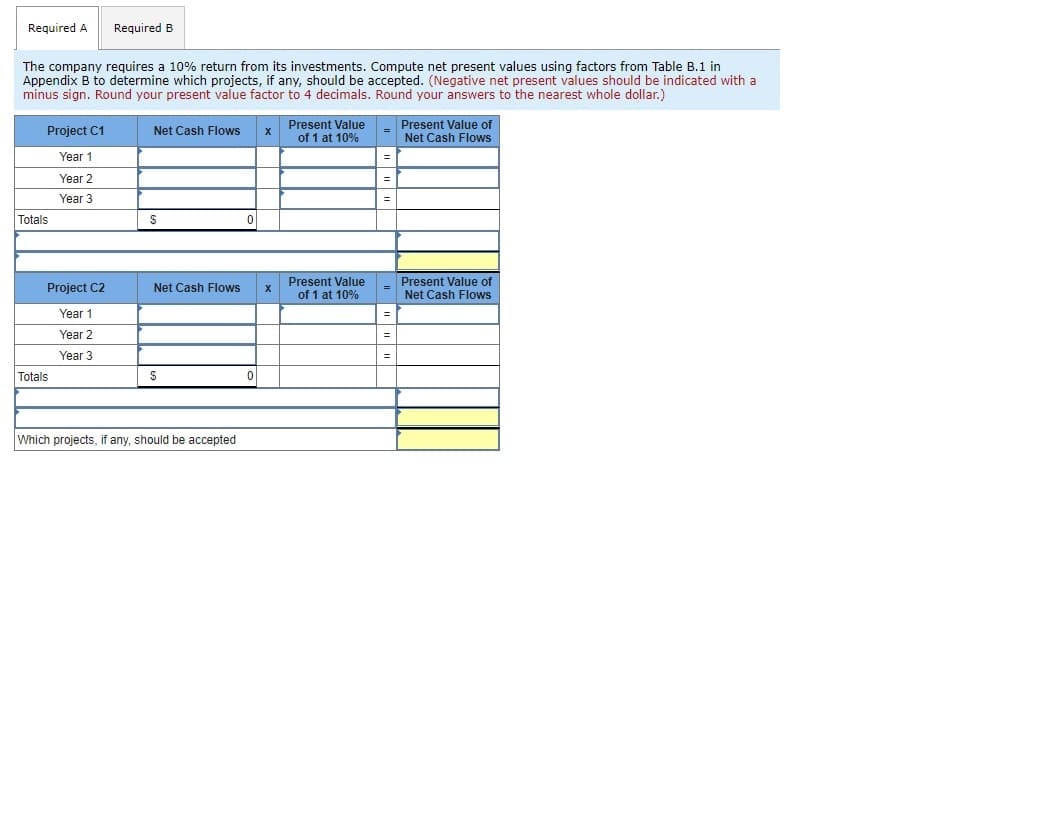

Transcribed Image Text:Required A

Required B

The company requires a 10% return from its investments. Compute net present values using factors from Table B.1 in

Appendix B to determine which projects, if any, should be accepted. (Negative net present values should be indicated with a

minus sign. Round your present value factor to 4 decimals. Round your answers to the nearest whole dollar.)

Present Value

of 1 at 10%

Present Value of

Net Cash Flows

Project C1

Net Cash Flows

Year 1

Year 2

Year 3

Totals

Present Value

Project C2

Present Value of

Net Cash Flows

Net Cash Flows

of 1 at 10%

Year 1

Year 2

=

Year 3

Totals

Which projects, if any, should be accepted

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT