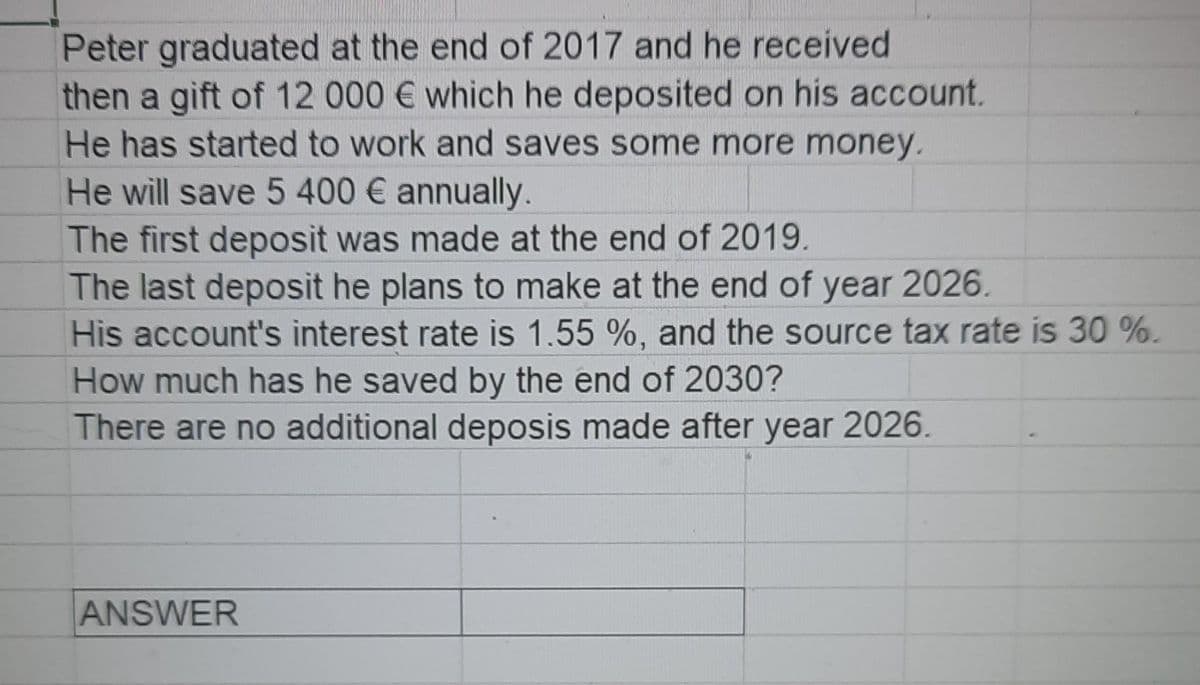

Peter graduated at the end of 2017 and he received then a gift of 12 000 € which he deposited on his account. He has started to work and saves some more money. He will save 5 400 € annually. The first deposit was made at the end of 2019. The last deposit he plans to make at the end of year 2026. His account's interest rate is 1.55 %, and the source tax rate is 30 %. How much has he saved by the end of 2030? There are no additional deposis made after year 2026.

Peter graduated at the end of 2017 and he received then a gift of 12 000 € which he deposited on his account. He has started to work and saves some more money. He will save 5 400 € annually. The first deposit was made at the end of 2019. The last deposit he plans to make at the end of year 2026. His account's interest rate is 1.55 %, and the source tax rate is 30 %. How much has he saved by the end of 2030? There are no additional deposis made after year 2026.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

ChapterA: Appendix - Time Value Of Cash Flows: Compound Interest Concepts And Applications

Section: Chapter Questions

Problem 14E

Related questions

Question

Transcribed Image Text:Peter graduated at the end of 2017 and he received

then a gift of 12 000 € which he deposited on his account.

He has started to work and saves some more money.

He will save 5 400 € annually.

The first deposit was made at the end of 2019.

The last deposit he plans to make at the end of year 2026.

His account's interest rate is 1.55 %, and the source tax rate is 30 %.

How much has he saved by the end of 2030?

There are no additional deposis made after year 2026.

ANSWER

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning