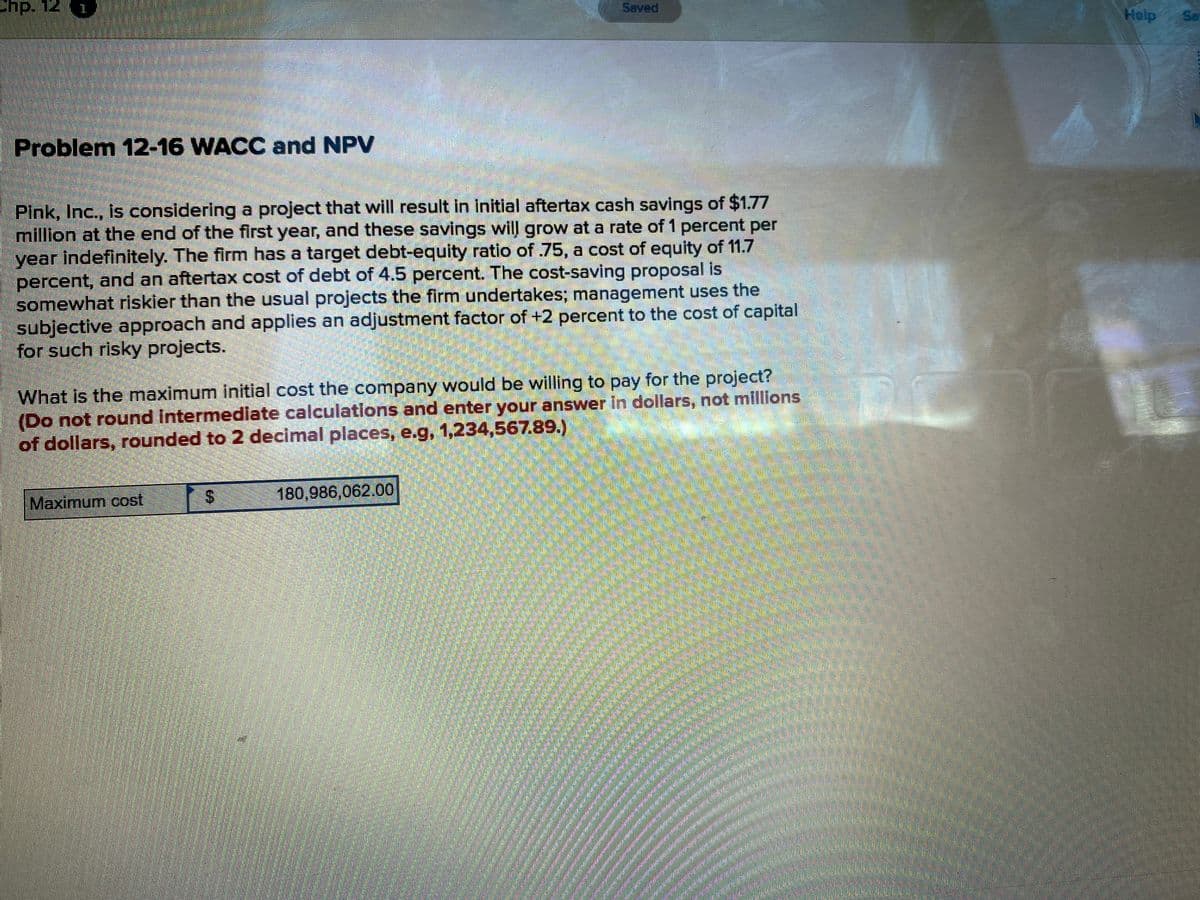

Pink, Inc., is considering a project that will result in initial aftertax cash savings of $1.77 million at the end of the first year, and these savings wil grow at a rate of 1 percent per year indefinitely. The firm has a target debt-equity ratio of 75, a cost of equity of 11.7 percent, and an aftertax cost of debt of 4.5 percent. The cost-saving proposal is somewhat riskier than the usual projects the firm undertakes; management uses the subjective approach and applies an adjustment factor of +2 percent to the cost of capital for such risky projects. What is the maximum initial cost the company would be willing to pay for the project? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g, 1,234,567.89.)

Pink, Inc., is considering a project that will result in initial aftertax cash savings of $1.77 million at the end of the first year, and these savings wil grow at a rate of 1 percent per year indefinitely. The firm has a target debt-equity ratio of 75, a cost of equity of 11.7 percent, and an aftertax cost of debt of 4.5 percent. The cost-saving proposal is somewhat riskier than the usual projects the firm undertakes; management uses the subjective approach and applies an adjustment factor of +2 percent to the cost of capital for such risky projects. What is the maximum initial cost the company would be willing to pay for the project? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g, 1,234,567.89.)

Chapter9: Capital Budgeting Techniques

Section: Chapter Questions

Problem 7PROB

Related questions

Question

Transcribed Image Text:Saved

Help

Sa

Problem 12-16 WACC and NPV

Pink, Inc., is considering a project that will result in Initial aftertax cash savings of $1.77

million at the end of the first year, and these savings will grow at a rate of 1 percent per

year indefinitely. The firm has a target debt-equity ratio of 75, a cost of equity of 11.7

percent, and an aftertax cost of debt of 4.5 percent. The cost-saving proposal is

somewhat riskler than the usual projects the firm undertakes; management uses the

subjective approach and applies an adjustment factor of +2 percent to the cost of capital

for such risky projects.

What is the maximum initial cost the company would be willing to pay for the project?

(Do not round intermedlate calculations and enter your answer in dollars, not millions

of dollars, rounded to 2 decimal places, e.g, 1,234,567.89.)

Maximum cost S

180,986,062.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning