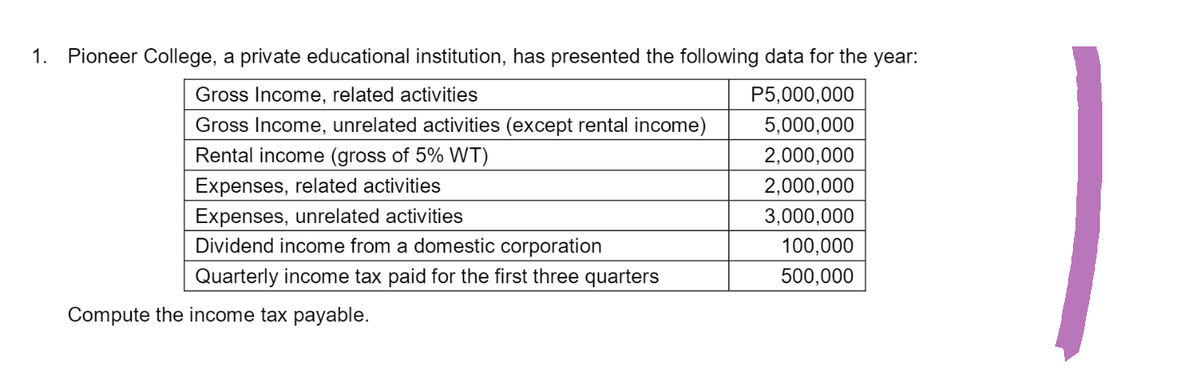

Pioneer College, a private educational institution, has presented the following data for the year: Gross Income, related activities Gross Income, unrelated activities (except rental income) Rental income (gross of 5% WT) Expenses, related activities Expenses, unrelated activities Dividend income from a domestic corporation Quarterly income tax paid for the first three quarters Compute the income tax payable. P5,000,000 5,000,000 2,000,000 2,000,000 3,000,000 100,000 500,000

Pioneer College, a private educational institution, has presented the following data for the year: Gross Income, related activities Gross Income, unrelated activities (except rental income) Rental income (gross of 5% WT) Expenses, related activities Expenses, unrelated activities Dividend income from a domestic corporation Quarterly income tax paid for the first three quarters Compute the income tax payable. P5,000,000 5,000,000 2,000,000 2,000,000 3,000,000 100,000 500,000

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 5BCRQ

Related questions

Question

Please do this typewritten only. Thank you

Transcribed Image Text:1. Pioneer College, a private educational institution, has presented the following data for the year:

Gross Income, related activities

Gross Income, unrelated activities (except rental income)

Rental income (gross of 5% WT)

Expenses, related activities

Expenses, unrelated activities

Dividend income from a domestic corporation

Quarterly income tax paid for the first three quarters

Compute the income tax payable.

P5,000,000

5,000,000

2,000,000

2,000,000

3,000,000

100,000

500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT