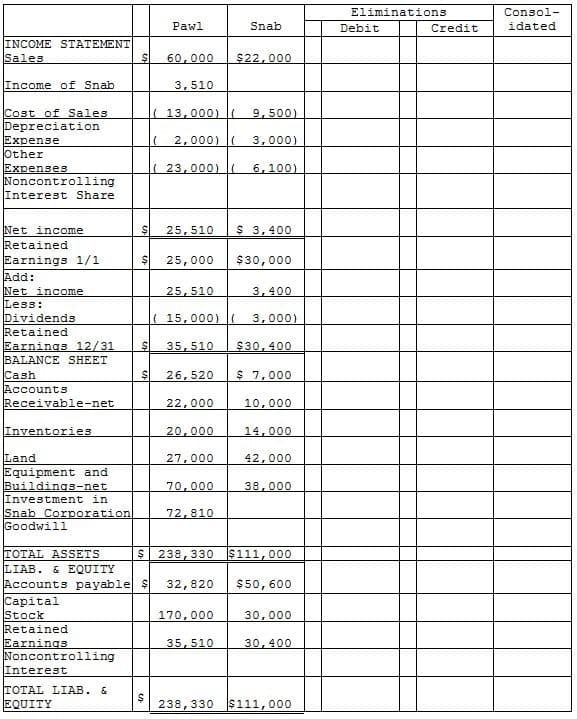

pital Stock and $30,000 of Retained Earnings. The difference between the fair value of Pawl's assets and liabilities and the book value was allocated to a plant asset with a remaining 10-year straight-line life that was overvalued on the books by $5,000. The remainder was attributable to goodwill. The separate company statements for Pawl and Snab appear in the first two columns of the partially completed consolidation working papers.

. Pawl Corporation acquired 90% of Snab Corporation on January 1, 2014 for $72,000 cash when Snab's

Required:

Complete the consolidation working papers for Pawl and Snab for the year 2014.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images