plan for this partnership. ns transpire during the liquidation of the Wingler, Norris, Rodgers, and Guthrie partnership: of the total accounts receivable with the rest judged to be uncollectible. g, and equipment for $165,000. ents of cash. who has become personally insolvent, will make no further contributions. $75,000. ents of cash again. expenses of $12,000 only. ursements to the partners based on the assumption that all partners other than Guthrie are personally solvent.

plan for this partnership. ns transpire during the liquidation of the Wingler, Norris, Rodgers, and Guthrie partnership: of the total accounts receivable with the rest judged to be uncollectible. g, and equipment for $165,000. ents of cash. who has become personally insolvent, will make no further contributions. $75,000. ents of cash again. expenses of $12,000 only. ursements to the partners based on the assumption that all partners other than Guthrie are personally solvent.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Please help me to solve this problem

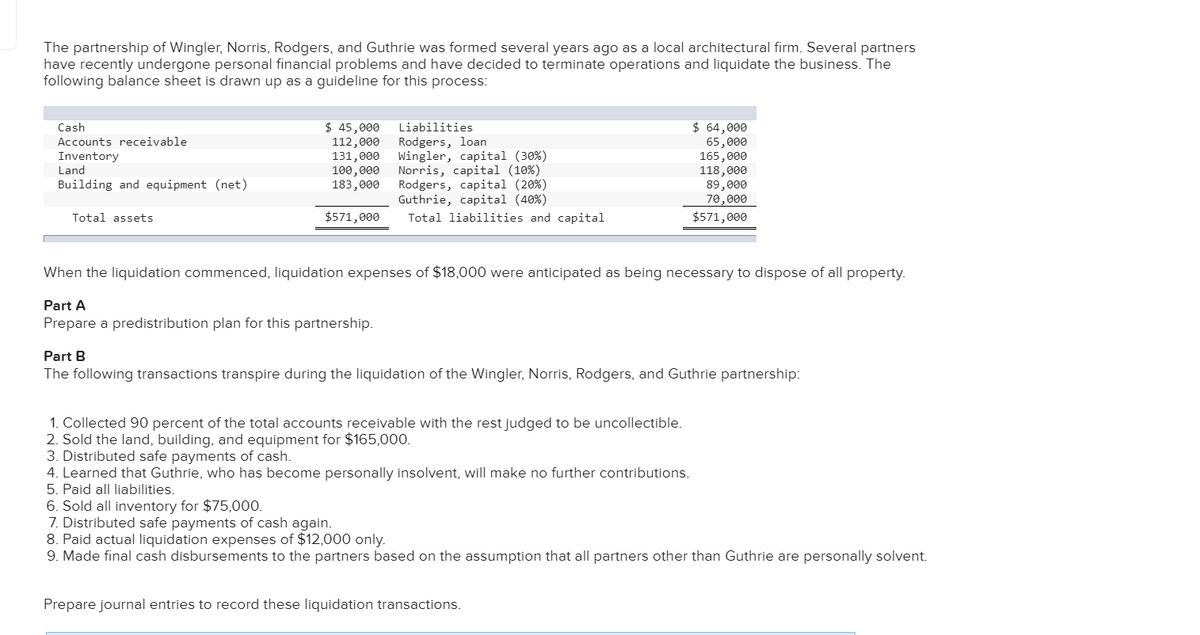

Transcribed Image Text:The partnership of Wingler, Norris, Rodgers, and Guthrie was formed several years ago as a local architectural firm. Several partners

have recently undergone personal financial problems and have decided to terminate operations and liquidate the business. The

following balance sheet is drawn up as a guideline for this process:

Cash

Accounts receivable

Inventory

Land

Building and equipment (net)

Total assets

$ 45,000

112,000

131,000

100,000

183,000

$571,000

Liabilities

Rodgers, loan

Wingler, capital (30%)

Norris, capital (10%)

Rodgers, capital (20%)

Guthrie, capital (40%)

Total liabilities and capital

When the liquidation commenced, liquidation expenses of $18,000 were anticipated as being necessary to dispose of all property.

Part A

Prepare a predistribution plan for this partnership.

$ 64,000

65,000

165,000

118,000

89,000

70,000

$571,000

Part B

The following transactions transpire during the liquidation of the Wingler, Norris, Rodgers, and Guthrie partnership:

1. Collected 90 percent of the total accounts receivable with the rest judged to be uncollectible.

2. Sold the land, building, and equipment for $165,000.

3. Distributed safe payments of cash.

4. Learned that Guthrie, who has become personally insolvent, will make no further contributions.

5. Paid all liabilities.

6. Sold all inventory for $75,000.

7. Distributed safe payments of cash again.

8. Paid actual liquidation expenses of $12,000 only.

9. Made final cash disbursements to the partners based on the assumption that all partners other than Guthrie are personally solvent.

Prepare journal entries to record these liquidation transactions.

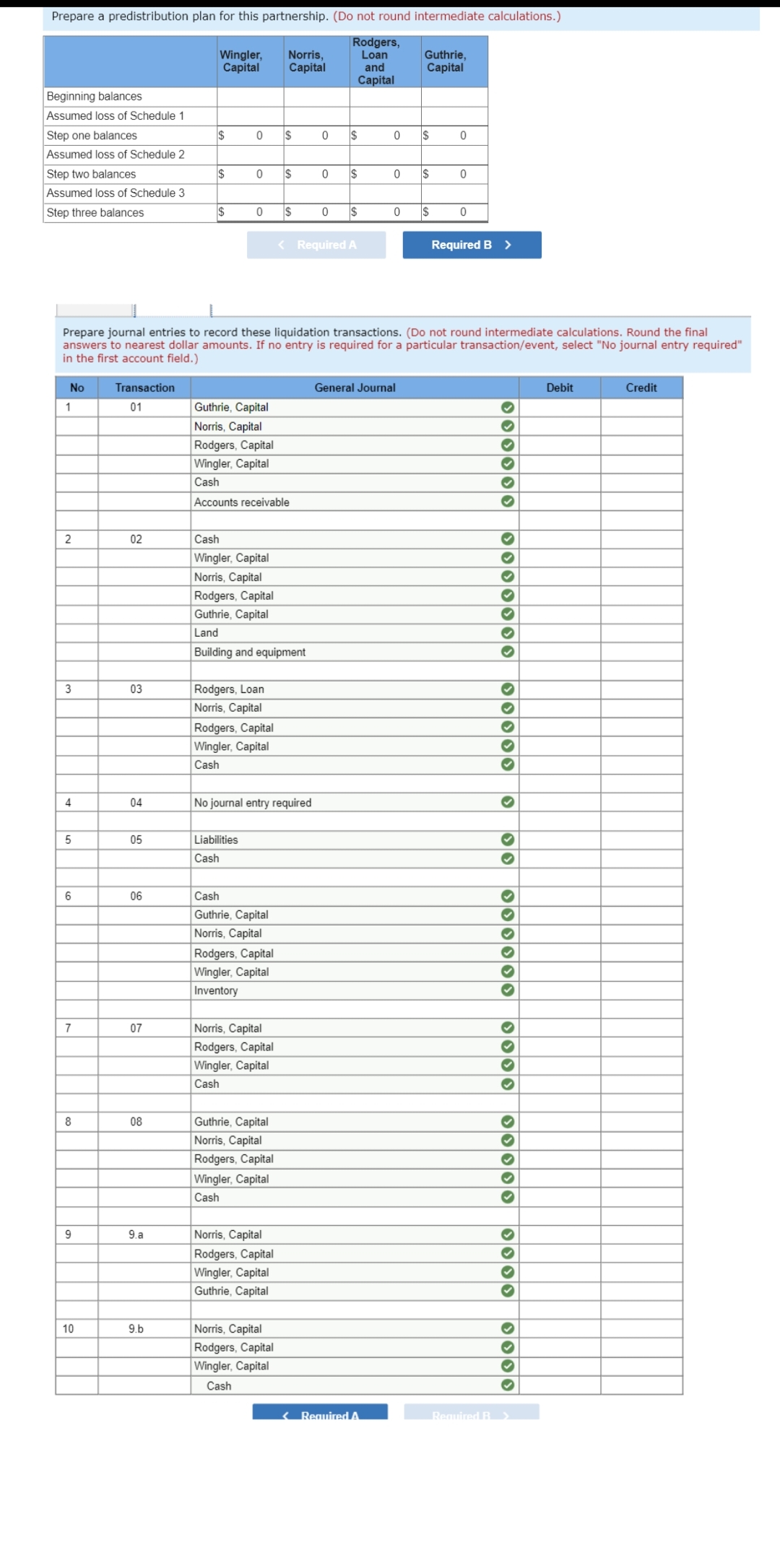

Transcribed Image Text:Prepare a predistribution plan for this partnership. (Do not round intermediate calculations.)

Rodgers,

Loan

Beginning balances

Assumed loss of Schedule 1

Step one balances

Assumed loss of Schedule 2

Step two balances

Assumed loss of Schedule 3

Step three balances

No

1

2

3

4

5

6

7

8

9

10

Transaction

01

02

03

04

05

06

07

08

9.a

Wingler, Norris,

Capital

Capital

9.b

$

$

$

0 $

0

0

Prepare journal entries to record these liquidation transactions. (Do not round intermediate calculations. Round the final

answers to nearest dollar amounts. If no entry is required for a particular transaction/event, select "No journal entry required"

in the first account field.)

Guthrie, Capital

Norris, Capital

Rodgers, Loan

Norris, Capital

Liabilities

Cash

Rodgers, Capital

Wingler, Capital

Cash

Accounts receivable

Rodgers, Capital

Wingler, Capital

Cash

Cash

Wingler, Capital

Norris, Capital

Rodgers, Capital

Guthrie, Capital

Land

Building and equipment

Cash

Guthrie, Capital

Norris, Capital

No journal entry required

Rodgers, Capital

Wingler, Capital

Inventory

$

Norris, Capital

Rodgers, Capital

Wingler, Capital

Cash

$

Guthrie, Capital

Norris, Capital

Rodgers, Capital

Wingler, Capital

Cash

Norris, Capital

Rodgers, Capital

Wingler, Capital

Guthrie, Capital

Norris, Capital

Rodgers, Capital

Wingler, Capital

Cash

0

0

0

$

< Required A

and

Capital

$

$

0

0

< Required A

0

General Journal

Guthrie,

Capital

I$

$

$

0

0

0

Required B >

Required B

* ***** ******* ******

✔

✔

✓

✓

✓

✓

✔

✔

✔

✓

♥

✔✓

✓

✔

✔

♥

✔

✓

✔

✓

✓

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education