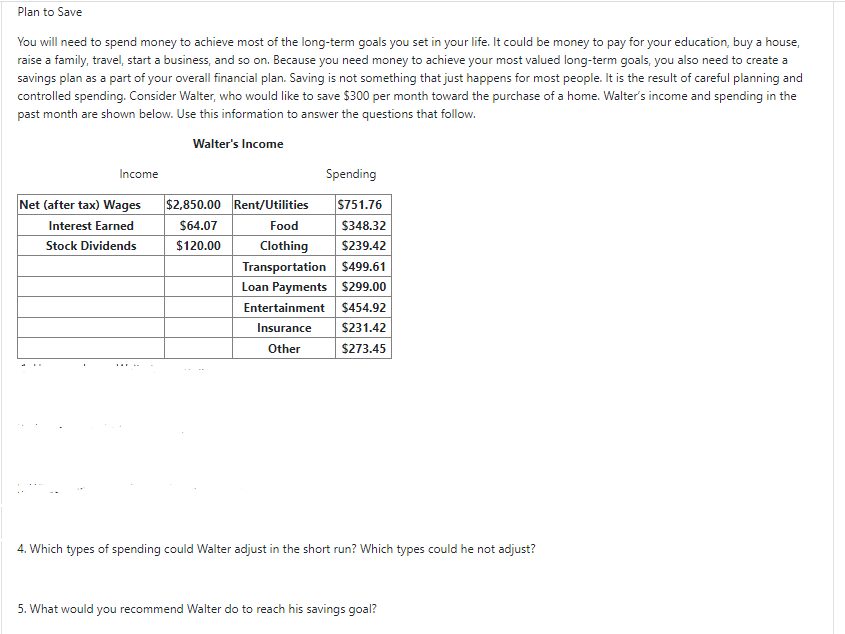

Plan to Save You will need to spend money to achieve most of the long-term goals you set in your life. It could be money to pay for your education, buy a house, raise a family, travel, start a business, and so on. Because you need money to achieve your most valued long-term goals, you also need to create a savings plan as a part of your overall financial plan. Saving is not something that just happens for most people. It is the result of careful planning and controlled spending. Consider Walter, who would like to save $300 per month toward the purchase of a home. Walter's income and spending in the past month are shown below. Use this information to answer the questions that follow. Walter's Income Income Spending Net (after tax) Wages $2,850.00 Rent/Utilities 5751.76 Interest Earned S64.07 Food $348.32 Stock Dividends $120.00 $239.42 Clothing Transportation $499.61 Loan Payments $299.00 Entertainment $454.92 Insurance $231.42 Other S273.45 4. Which types of spending could Walter adjust in the short run? Which types could he not adjust? 5. What would you recommend Walter do to reach his savings goal?

Plan to Save You will need to spend money to achieve most of the long-term goals you set in your life. It could be money to pay for your education, buy a house, raise a family, travel, start a business, and so on. Because you need money to achieve your most valued long-term goals, you also need to create a savings plan as a part of your overall financial plan. Saving is not something that just happens for most people. It is the result of careful planning and controlled spending. Consider Walter, who would like to save $300 per month toward the purchase of a home. Walter's income and spending in the past month are shown below. Use this information to answer the questions that follow. Walter's Income Income Spending Net (after tax) Wages $2,850.00 Rent/Utilities 5751.76 Interest Earned S64.07 Food $348.32 Stock Dividends $120.00 $239.42 Clothing Transportation $499.61 Loan Payments $299.00 Entertainment $454.92 Insurance $231.42 Other S273.45 4. Which types of spending could Walter adjust in the short run? Which types could he not adjust? 5. What would you recommend Walter do to reach his savings goal?

Economics Today and Tomorrow, Student Edition

1st Edition

ISBN:9780078747663

Author:McGraw-Hill

Publisher:McGraw-Hill

Chapter6: Saving And Investing

Section: Chapter Questions

Problem 20AA

Related questions

Question

Transcribed Image Text:Plan to Save

You will need to spend money to achieve most of the long-term goals you set in your life. It could be money to pay for your education, buy a house,

raise a family, travel, start a business, and so on. Because you need money to achieve your most valued long-term goals, you also need to create a

savings plan as a part of your overall financial plan. Saving is not something that just happens for most people. It is the result of careful planning and

controlled spending. Consider Walter, who would like to save $300 per month toward the purchase of a home. Walter's income and spending in the

past month are shown below. Use this information to answer the questions that follow.

Walter's Income

Income

Spending

Net (after tax) Wages

$2,850.00 Rent/Utilities

S751.76

Interest Earned

$64.07

Food

$348.32

Stock Dividends

$120.00

$239.42

Clothing

Transportation $499.61

Loan Payments S299.00

Entertainment $454.92

Insurance

$231.42

Other

$273.45

4. Which types of spending could Walter adjust in the short run? Which types could he not adjust?

5. What would you recommend Walter do to reach his savings goal?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co