please answers these three fallowing questions: B-1. What is the labor efficiency variance? Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). The amount of the labor efficiency variance ? U c-1. What is the variable overhead efficiency variance? Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). The amount of the variable overhead efficiency variance U c-2. What is the variable overhead rate variance? Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). The amount of the variable overhead rate variance U

please answers these three fallowing questions: B-1. What is the labor efficiency variance? Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). The amount of the labor efficiency variance ? U c-1. What is the variable overhead efficiency variance? Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). The amount of the variable overhead efficiency variance U c-2. What is the variable overhead rate variance? Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). The amount of the variable overhead rate variance U

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter9: Standard Costing: A Functional-based Control Approach

Section: Chapter Questions

Problem 16E: Refer to the data in Exercise 9.15. Required: 1. Compute overhead variances using a two-variance...

Related questions

Question

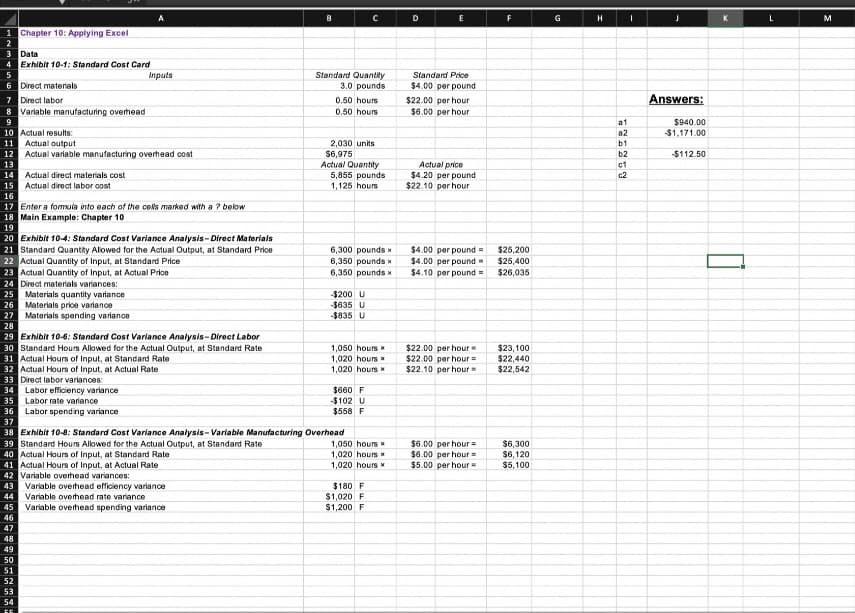

Looking at the excel worksheet please answers these three fallowing questions:

B-1. What is the labor efficiency variance?

Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).

The amount of the labor efficiency variance ? U

c-1. What is the variable overhead efficiency variance?

Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).

The amount of the variable overhead efficiency variance U

c-2. What is the variable overhead rate variance?

Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).

The amount of the variable overhead rate variance U

Transcribed Image Text:1 Chapter 10: Applying Excel

2

3 Data

4 Exhibit 10-1: Standard Cost Card

6

7 Direct labor

8

9

Direct materials

Variable manufacturing overhead

27

10 Actual results:

11 Actual output

12 Actual variable manufacturing overhead cost

13

14

15 Actual direct labor cost

16

17 Enter a formula into each of the cells marked with a ? below

18 Main Example: Chapter 10

19

Actual direct materials cost

25 Materials quantity variance

26

Materials price variance

Materials spending variance

20 Exhibit 10-4: Standard Cost Variance Analysis-Direct Materials

21 Standard Quantity Allowed for the Actual Output, at Standard Price

22 Actual Quantity of Input, at Standard Price

23 Actual Quantity of Input, at Actual Price

24 Direct materials variances:

A

Inputs

28

29 Exhibit 10-6: Standard Cost Variance Analysis-Direct Labor

30 Standard Hours Allowed for the Actual Output, at Standard Rate

31 Actual Hours of Input, at Standard Rate

34 Labor efficiency variance

35 Labor rate variance

32 Actual Hours of Input, at Actual Rate

33 Direct labor variances:

36 Labor spending variance

37

50

51

52

53

54

CE

45 Variable overhead spending variance

46

47

48

49

8

Standard Quantity

3.0 pounds

0.50 hours

0.50 hours

2,030 units

$6,975

Actual Quantity

5,855 pounds.

1,125 hours

C

6,300 pounds

6,350 pounds x

6,350 pounds

-$200 U

$635 U

-$835 U

38 Exhibit 10-8: Standard Cost Variance Analysis-Variable Manufacturing Overhead

39 Standard Hours Allowed for the Actual Output, at Standard Rate

40 Actual Hours of Input, at Standard Rate

41 Actual Hours of Input, at Actual Rate

42 Variable overhead variances:

43 Variable overhead efficiency variance

44 Variable overhead rate variance

1,050 hours *

1,020 hours

1,020 hours *

$660 F

-$102 U

$558 F

1,050 hours

1,020 hours *

1,020 hours *

$180 F

$1,020 F

$1,200 F

D

E

Standard Price

$4.00 per pound

$22.00 per hour

$6.00 per hour

Actual price

$4.20 per pound

$22.10 per hour

$4.00 per pound=

$4.00 per pound

$4.10 per pound=

$22.00 per hour

$22.00 per hour =

$22.10 per hour =

$6.00 per hour

$6.00 per hour =

$5.00 per hour =

F

$25,200

$25,400

$26,035

$23,100

$22,440

$22,542

$6,300

$6,120

$5,100

G

H

a1

82

b1

b2

c1

c2

I

J

Answers:

$940.00

$1,171.00

-$112.50

K

L

M

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning