PLEASE DO ALL REQUIREMENTS AND SHOW STEP BY STEP SOLUTION C D

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 11EA: Mirror Mart uses the balance sheet aging method to account for uncollectible debt on receivables....

Related questions

Question

PLEASE DO ALL REQUIREMENTS AND SHOW STEP BY STEP SOLUTION

C

D

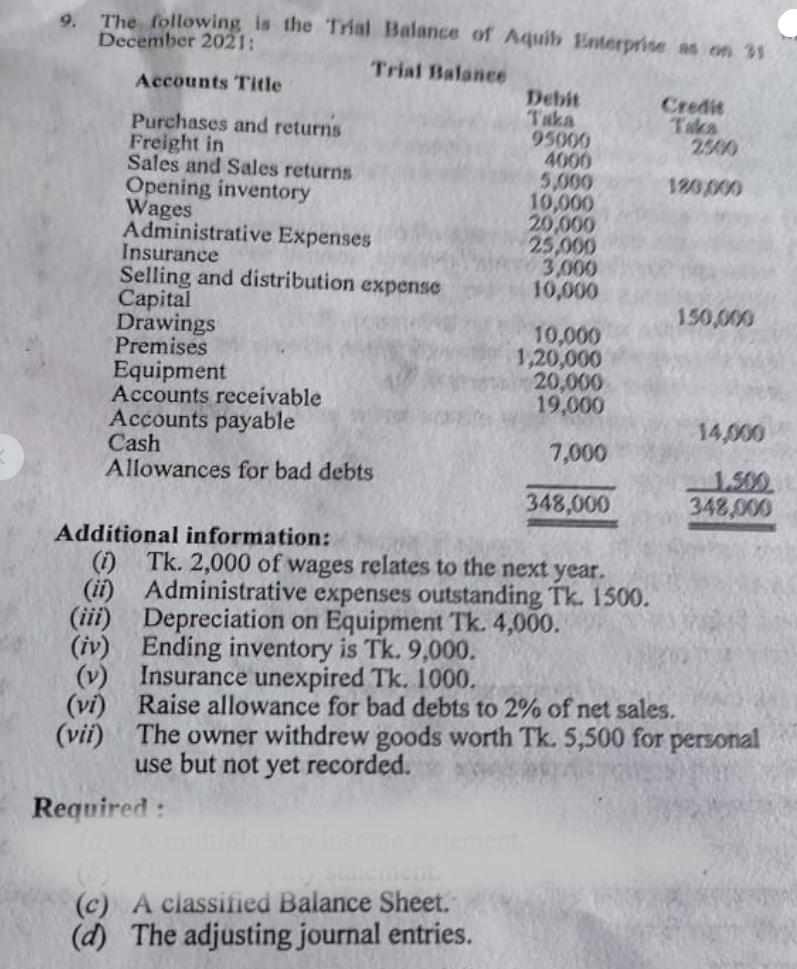

Transcribed Image Text:The following is the Trial Balance of Aquib Enterprise as on 31

December 2021:

Trial Balance

Accounts Title

Purchases and returns

Freight in

Sales and Sales returns

Opening inventory

Wages

(vi)

(vii)

Administrative Expenses

Insurance

Selling and distribution expense

Capital

Drawings

Premises

Equipment

Accounts receivable

Accounts payable

Cash

Allowances for bad debts

Required:

Debit

Taka

95000

4000

5,000

10,000

20,000

25,000

(c) A classified Balance Sheet.

(d) The adjusting journal entries.

3,000

10,000

10,000

1,20,000

20,000

19,000

7,000

348,000

Credit

Taka

2500

120,000

150,000

Additional information:

(ii)

(iii)

(1) Tk. 2,000 of wages relates to the next year.

Administrative expenses outstanding Tk. 1500.

Depreciation on Equipment Tk. 4,000.

Ending inventory is Tk. 9,000.

Insurance unexpired Tk. 1000.

(iv)

(v)

Raise allowance for bad debts to 2% of net sales.

The owner withdrew goods worth Tk. 5,500 for personal

use but not yet recorded.

14,000

1.500

348,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning