Please help me evaluate these financial ratios to identify any trends or issues and potential reasons for them. Could Covid have played a role? Please help me interpret the ratios in Group C from an investors view point from period 12/31/19 & 6/30/20

Please help me evaluate these financial ratios to identify any trends or issues and potential reasons for them. Could Covid have played a role? Please help me interpret the ratios in Group C from an investors view point from period 12/31/19 & 6/30/20

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 15.17EX: Profitability ratios The following selected data were taken from the financial statements of...

Related questions

Question

Please help me evaluate these financial ratios to identify any trends or issues and potential reasons for them. Could Covid have played a role?

Please help me interpret the ratios in Group C from an investors view point from period 12/31/19 & 6/30/20

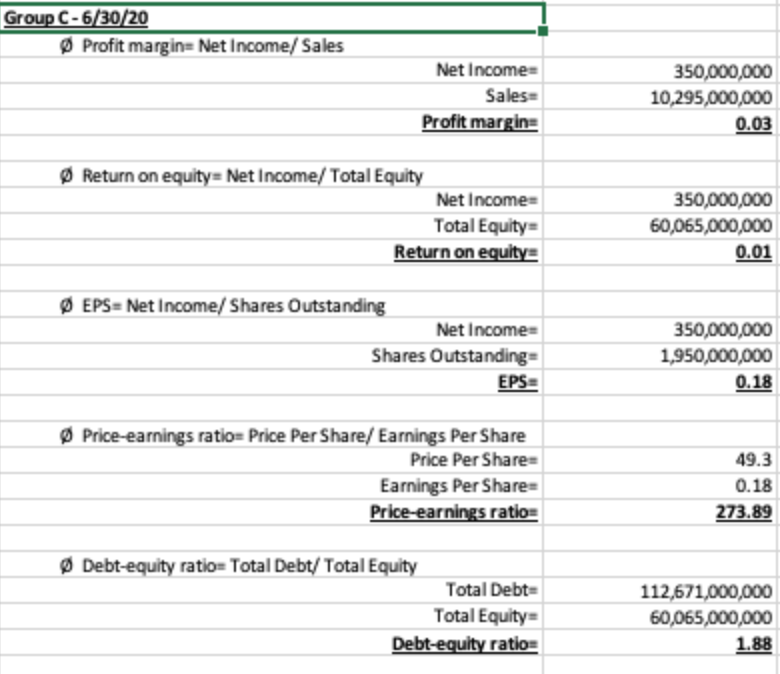

Transcribed Image Text:Group C-6/30/20

Ø Profit margin= Net Income/ Sales

Net Income=

350,000,000

Sales=

Profit margin=

10,295,000,000

0.03

Ø Return on equity= Net Income/ Total Equity

Net Income

350,000,000

Total Equity=

Return on equity=

60,065,000,000

0.01

Ø EPS= Net Income/ Shares Outstanding

Net Income=

350,000,000

Shares Outstanding=

EPS=

1,950,000,000

0.18

Ø Price-earnings ratio= Price Per Share/ Earnings Per Share

Price Per Share=

49.3

Earnings Per Share=

Price-earnings ratio=

0.18

273.89

Ø Debt-equity ratio= Total Debt/ Total Equity

Total Debt=

112,671,000,000

Total Equity=

60,065,000,000

Debt-equity ratio=

1.88

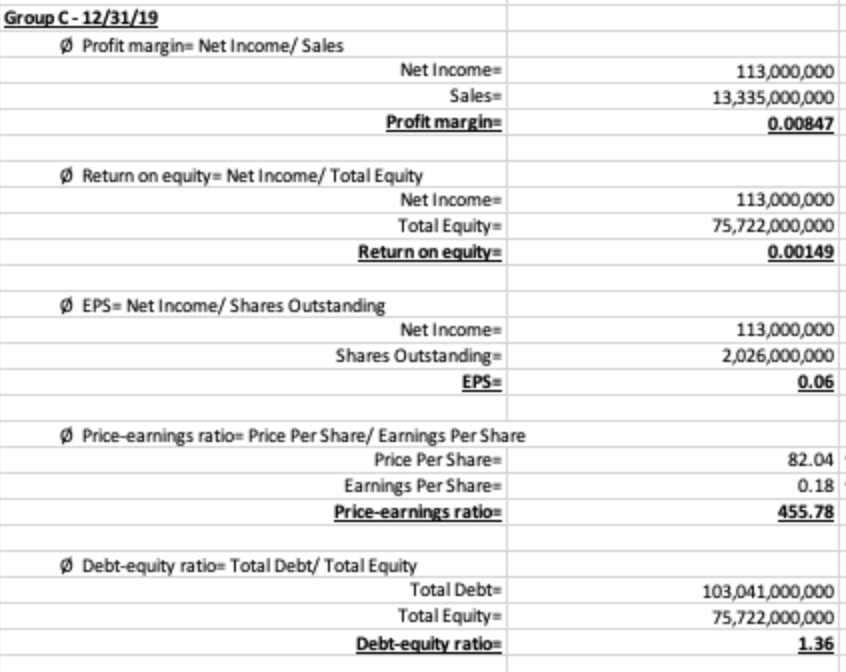

Transcribed Image Text:Group C-12/31/19

Ø Profit margin= Net Income/ Sales

Net Income

113,000,000

Sales=

13,335,000,000

Profit margin=

0.00847

Ø Return on equity= Net Income/ Total Equity

Net Income=

113,000,000

Total Equity=

Return on equity=

75,722,000,000

0.00149

Ø EPS= Net Income/ Shares Outstanding

Net Income=

113,000,000

Shares Outstanding=

EPS=

2,026,000,000

0.06

Ø Price-earnings ratio= Price Per Share/ Earnings Per Share

Price Per Share=

82.04

Earnings Per Share=

Price-earnings ratio=

0.18

455.78

Ø Debt-equity ratio= Total Debt/ Total Equity

Total Debt=

103,041,000,000

Total Equity=

75,722,000,000

Debt-equity ratio=

1.36

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,