Required: Compute for the indicated financial ratios for Palomer Trading financial statements. Choose the correct answer in each of the following.

Required: Compute for the indicated financial ratios for Palomer Trading financial statements. Choose the correct answer in each of the following.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

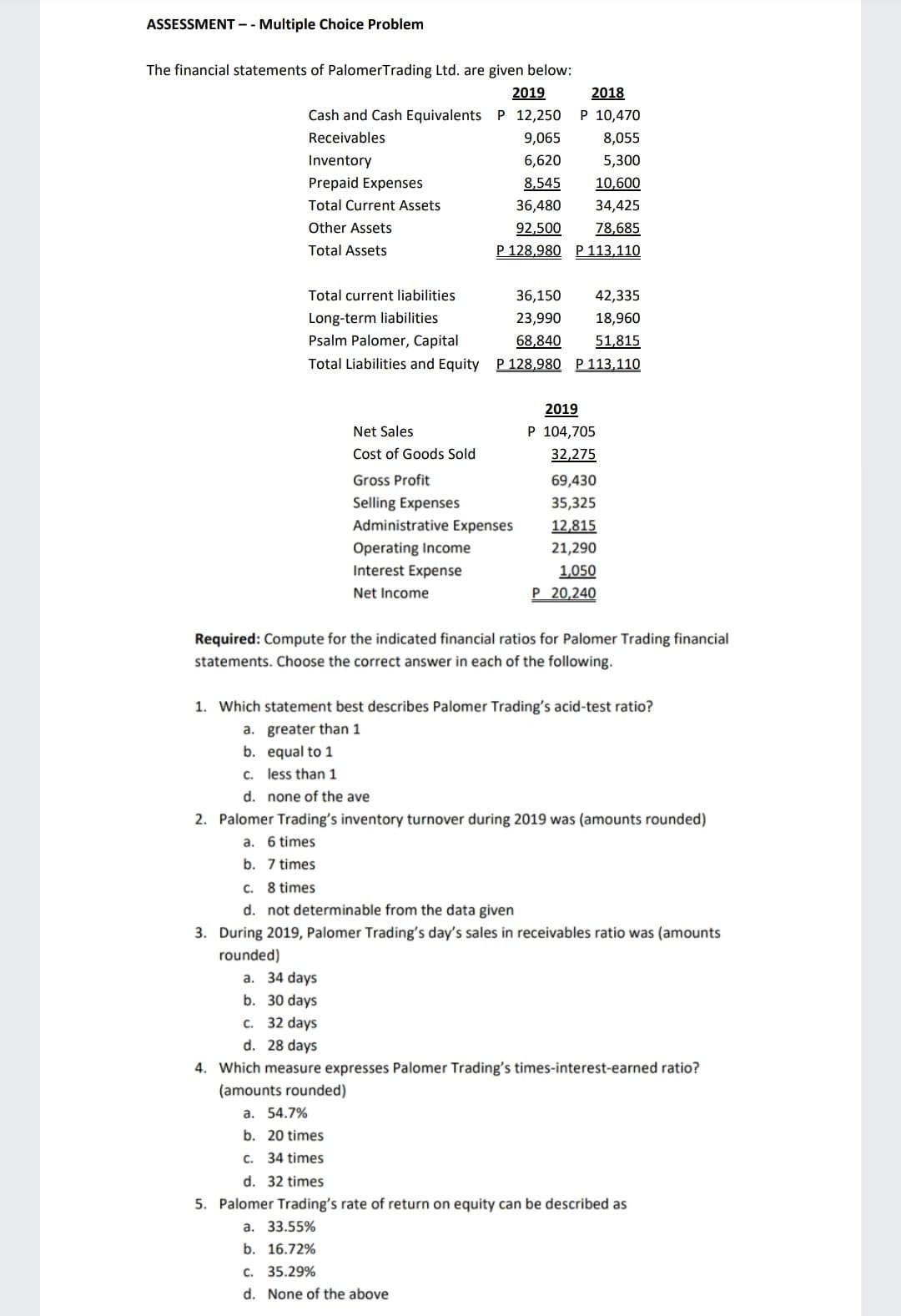

Transcribed Image Text:ASSESSMENT -- Multiple Choice Problem

The financial statements of PalomerTrading Ltd. are given below:

2018

P 10,470

2019

Cash and Cash Equivalents P 12,250

Receivables

9,065

8,055

Inventory

6,620

5,300

Prepaid Expenses

8,545

10,600

Total Current Assets

36,480

34,425

Other Assets

78,685

P 128,980 P 113,110

92,500

Total Assets

Total current liabilities

36,150

42,335

Long-term liabilities

23,990

18,960

Psalm Palomer, Capital

68,840

51,815

Total Liabilities and Equity P 128,980 P 113,110

2019

Net Sales

P 104,705

Cost of Goods Sold

32,275

Gross Profit

69,430

Selling Expenses

35,325

Administrative Expenses

12,815

Operating Income

21,290

Interest Expense

1,050

Net Income

Р 20,240

Required: Compute for the indicated financial ratios for Palomer Trading financial

statements. Choose the correct answer in each of the following.

1. Which statement best describes Palomer Trading's acid-test ratio?

a. greater than 1

b. equal to 1

c. less than 1

d. none of the ave

2. Palomer Trading's inventory turnover during 2019 was (amounts rounded)

a. 6 times

b. 7 times

C. 8 times

d. not determinable from the data given

3. During 2019, Palomer Trading's day's sales in receivables ratio was (amounts

rounded)

a. 34 days

b. 30 days

c. 32 days

d. 28 days

4. Which measure expresses Palomer Trading's times-interest-earned ratio?

(amounts rounded)

а. 54.7%

b. 20 times

c. 34 times

d. 32 times

5. Palomer Trading's rate of return on equity can be described as

а. 33.55%

b. 16.72%

c. 35.29%

d. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education