Please prepare a full trial balance – Trial Balance, Adjustments, Adjusted Trial Balance, Income Statement, Balance Sheet, and Statement of Owner's Equity, as well the individual Balance Sheet, Income Statement, and Statement of Owners Equity. Include any journal entries necessary for this assignment. Use T accounts if you find them helpful. Attached are the files for your use. Check your formulas.

Please prepare a full trial balance – Trial Balance, Adjustments, Adjusted Trial Balance, Income Statement, Balance Sheet, and Statement of Owner's Equity, as well the individual Balance Sheet, Income Statement, and Statement of Owners Equity. Include any journal entries necessary for this assignment. Use T accounts if you find them helpful. Attached are the files for your use. Check your formulas.

Business/Professional Ethics Directors/Executives/Acct

8th Edition

ISBN:9781337485913

Author:BROOKS

Publisher:BROOKS

Chapter8: Subprime Lending Fiasco-ethics Issues

Section: Chapter Questions

Problem 3.7EC

Related questions

Question

Please prepare a full

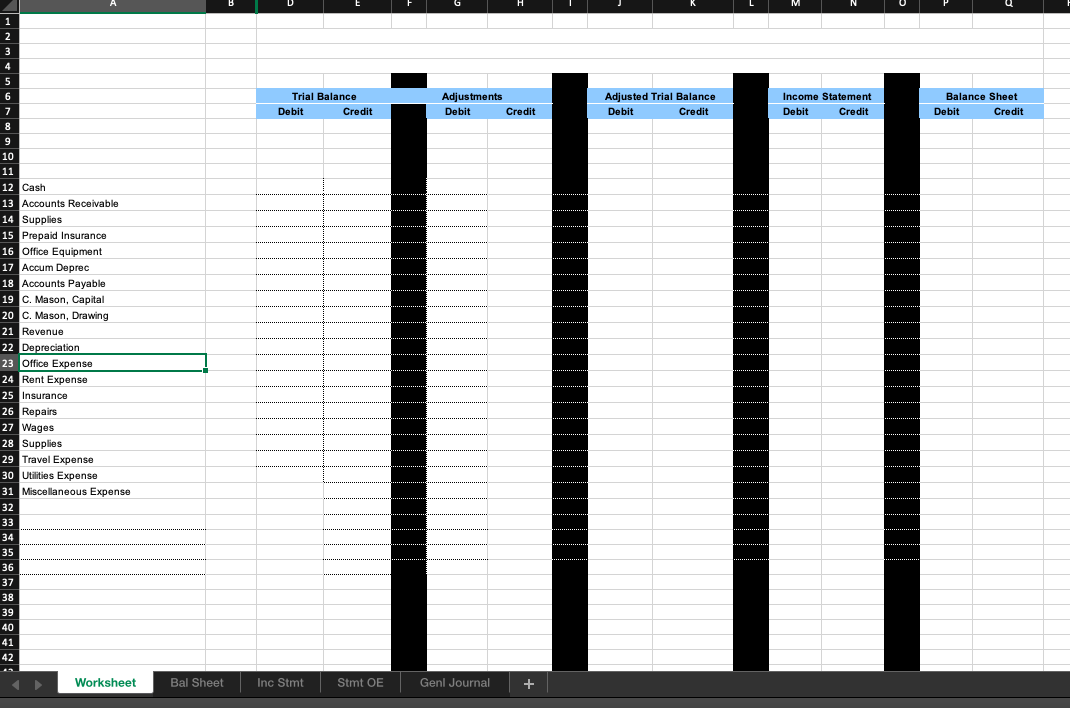

Transcribed Image Text:1

2

4

5

6

Trial Balance

Adjustments

Adjusted Trial Balance

Income Statement

Balance Sheet

7

Debit

Credit

Debit

Credit

Debit

Credit

Debit

Credit

Debit

Credit

8

9

10

11

12 Cash

13 Accounts Receivable

14 Supplies

15 Prepaid Insurance

16 Office Equipment

17 Accum Deprec

18 Accounts Payable

19 C. Mason, Capital

20 C. Mason, Drawing

21 Revenue

22 Depreciation

23 Office Expense

24 Rent Expense

25 Insurance

26 Repairs

27 Wages

28 Supplies

29 Travel Expense

30 Utilities Expense

31 Miscellaneous Expense

32

33

34

35

36

37

38

39

40

41

42

Worksheet

Bal Sheet

Inc Stmt

Stmt OE

Genl Journal

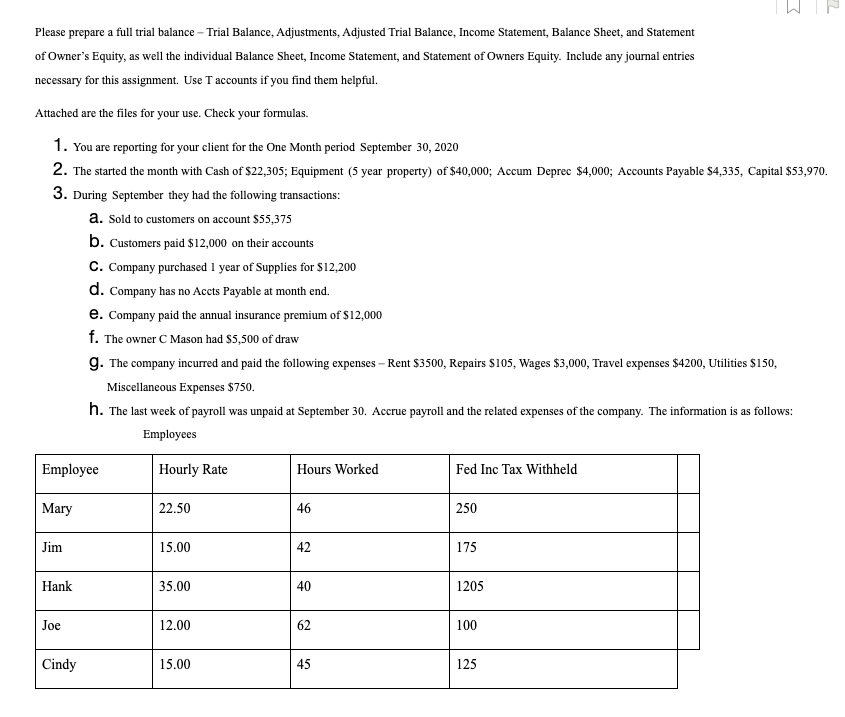

Transcribed Image Text:Please prepare a full trial balance – Trial Balance, Adjustments, Adjusted Trial Balance, Income Statement, Balance Sheet, and Statement

of Owner's Equity, as well the individual Balance Sheet, Income Statement, and Statement of Owners Equity. Include any journal entries

necessary for this assignment. Use T accounts if you find them helpful.

Attached are the files for your use. Check your formulas.

1. You are reporting for your client for the One Month period September 30, 2020

2. The started the month with Cash of $22,305; Equipment (5 year property) of $40,000; Accum Deprec $4,000; Accounts Payable S4,335, Capital $53,970.

3. During September they had the following transactions:

a. Sold to customers on account $55,375

b. Customers paid $12,000 on their accounts

C. Company purchased 1 year of Supplies for $12,200

d. Company has no Accts Payable at month end.

e. Company paid the annual insurance premium of $12,000

f. The owner C Mason had $5,500 of draw

g. The company incurred and paid the following expenses – Rent $3500, Repairs $105, Wages $3,000, Travel expenses $4200, Utilities $150,

Miscellaneous Expenses $750.

h. The last week of payroll was unpaid at September 30. Accrue payroll and the related expenses of the company. The information is as follows:

Employees

Employee

Hourly Rate

Hours Worked

Fed Inc Tax Withheld

Mary

22.50

46

250

Jim

15.00

42

175

Hank

35.00

40

1205

Joe

12.00

62

100

Cindy

15.00

45

125

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage