Required: a.) Prepare general journal entries to record the above transaction. Open the accounts listed in the partial chart of accounts on RP Consultancy Services in the general ledger where you will be posting the entries recorded using the running trial balance format. b) Post the adjusting journal entries to the ledger accounts and compute the balance after posting it. Put it also in the worksheet Required: General Journal, General Ledger, Trial Balance, Adjusting Entries and Worksheet

Required: a.) Prepare general journal entries to record the above transaction. Open the accounts listed in the partial chart of accounts on RP Consultancy Services in the general ledger where you will be posting the entries recorded using the running trial balance format. b) Post the adjusting journal entries to the ledger accounts and compute the balance after posting it. Put it also in the worksheet Required: General Journal, General Ledger, Trial Balance, Adjusting Entries and Worksheet

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter3: Journalizing Transactions

Section3.3: Transactions Affecting Owner’s Equity And Asset Accounts

Problem 1OYO

Related questions

Question

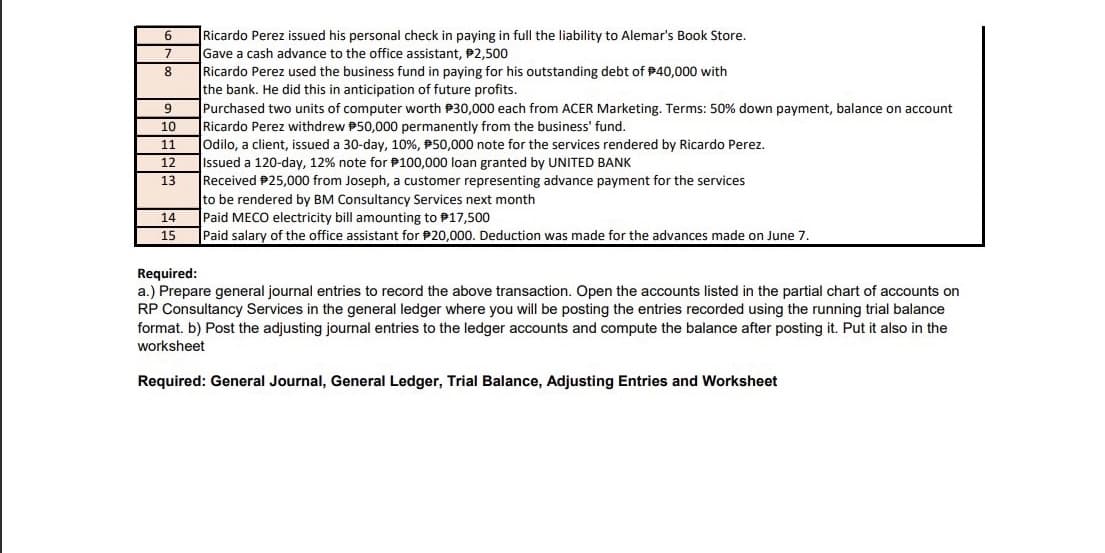

Transcribed Image Text:Ricardo Perez issued his personal check in paying in full the liability to Alemar's Book Store.

Gave a cash advance to the office assistant, P2,500

Ricardo Perez used the business fund in paying for his outstanding debt of P40,000 with

the bank. He did this in anticipation of future profits.

6

8

Purchased two units of computer worth P30,000 each from ACER Marketing. Terms: 50% down payment, balance on account

Ricardo Perez withdrew P50,000 permanently from the business' fund.

Odilo, a client, issued a 30-day, 10%, P50,000 note for the services rendered by Ricardo Perez.

Issued a 120-day, 12% note for P100,000 loan granted by UNITED BANK

Received P25,000 from Joseph, a customer representing advance payment for the services

to be rendered by BM Consultancy Services next month

Paid MECO electricity bill amounting to P17,500

10

11

12

13

14

15

Paid salary of the office assistant for P20,000. Deduction was made for the advances made on June 7.

Required:

a.) Prepare general journal entries to record the above transaction. Open the accounts listed in the partial chart of accounts on

RP Consultancy Services in the general ledger where you will be posting the entries recorded using the running trial balance

format. b) Post the adjusting journal entries to the ledger accounts and compute the balance after posting it. Put it also in the

worksheet

Required: General Journal, General Ledger, Trial Balance, Adjusting Entries and Worksheet

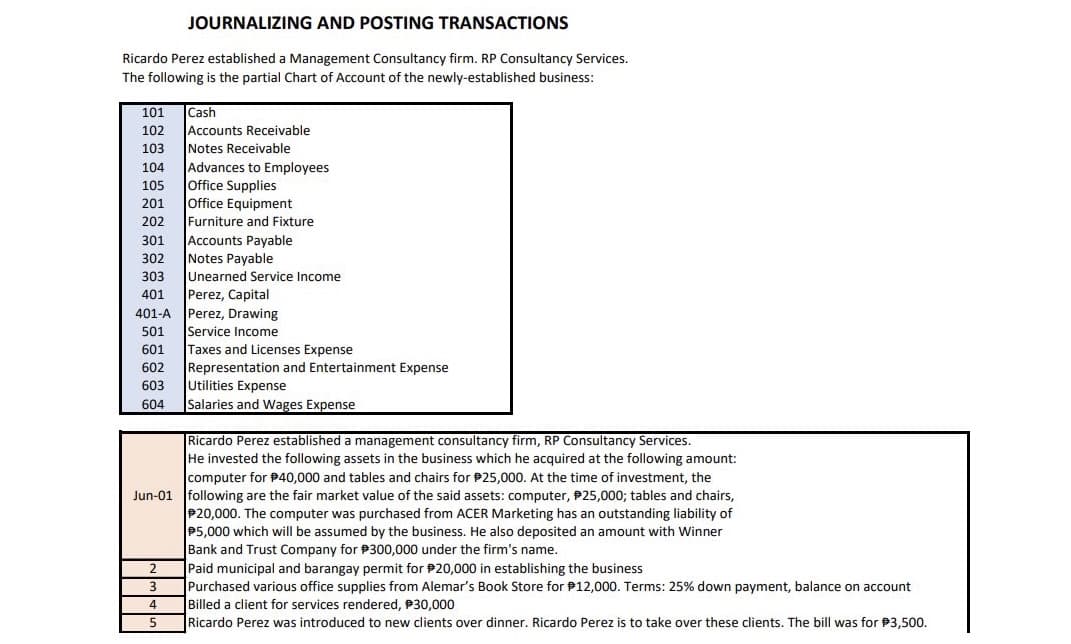

Transcribed Image Text:JOURNALIZING AND POSTING TRANSACTIONS

Ricardo Perez established a Management Consultancy firm. RP Consultancy Services.

The following is the partial Chart of Account of the newly-established business:

Cash

Accounts Receivable

Notes Receivable

Advances to Employees

Office Supplies

loffice Equipment

Furniture and Fixture

Accounts Payable

Notes Payable

Unearned Service Income

Perez, Capital

Perez, Drawing

Service Income

Taxes and Licenses Expense

Representation and Entertainment Expense

Utilities Expense

Salaries and Wages Expense

101

102

103

104

105

201

202

301

302

303

401

401-A

501

601

602

603

604

Ricardo Perez established a management consultancy firm, RP Consultancy Services.

He invested the following assets in the business which he acquired at the following amount:

computer for P40,000 and tables and chairs for P25,000. At the time of investment, the

Jun-01 following are the fair market value of the said assets: computer, P25,000; tables and chairs,

P20,000. The computer was purchased from ACER Marketing has an outstanding liability of

P5,000 which will be assumed by the business. He also deposited an amount with Winner

Bank and Trust Company for P300,000 under the firm's name.

2

|Paid municipal and barangay permit for P20,000 in establishing the business

3

Purchased various office supplies from Alemar's Book Store for P12,000. Terms: 25% down payment, balance on account

Billed a client for services rendered, P30,000

5

4

Ricardo Perez was introduced to new clients over dinner. Ricardo Perez is to take over these clients. The bill was for P3,500.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College