Please solve on EXCEL and share the tables! Answers: B-A 13.7% select A, C-B 12.4% select B, D-B 14.3% select D The New Englaad Soap Company is conasidering adding some processing equipument to the plant to aid in the removal of impurities from some raw materials. By adding the processing equipment, the firm can purchase lower-grade raw material at reduced cost and upgrade it for use in its products. Four different pieces of processing equipment with 15-year lives are being considered: B D Initial investment s8.500 S18.500. 026,500 $30.000 Annual saving in materials costs 3.500 6.000 7,400 9.000 Anmal operating cost 2.100 3.000 3,200 4.100 The comparny cam obtain a 13% amual returi cn its investment in oter projects and is willing to invest money alternatives should be selected? Use a challenger-defender rate of return analysis. the processing equiprment only as long as it cam ebtain 14% mmual retuna on cach inereament of money invested. Which one, if any, of the

Please solve on EXCEL and share the tables! Answers: B-A 13.7% select A, C-B 12.4% select B, D-B 14.3% select D The New Englaad Soap Company is conasidering adding some processing equipument to the plant to aid in the removal of impurities from some raw materials. By adding the processing equipment, the firm can purchase lower-grade raw material at reduced cost and upgrade it for use in its products. Four different pieces of processing equipment with 15-year lives are being considered: B D Initial investment s8.500 S18.500. 026,500 $30.000 Annual saving in materials costs 3.500 6.000 7,400 9.000 Anmal operating cost 2.100 3.000 3,200 4.100 The comparny cam obtain a 13% amual returi cn its investment in oter projects and is willing to invest money alternatives should be selected? Use a challenger-defender rate of return analysis. the processing equiprment only as long as it cam ebtain 14% mmual retuna on cach inereament of money invested. Which one, if any, of the

Chapter17: Capital And Time

Section: Chapter Questions

Problem 17.5P

Related questions

Question

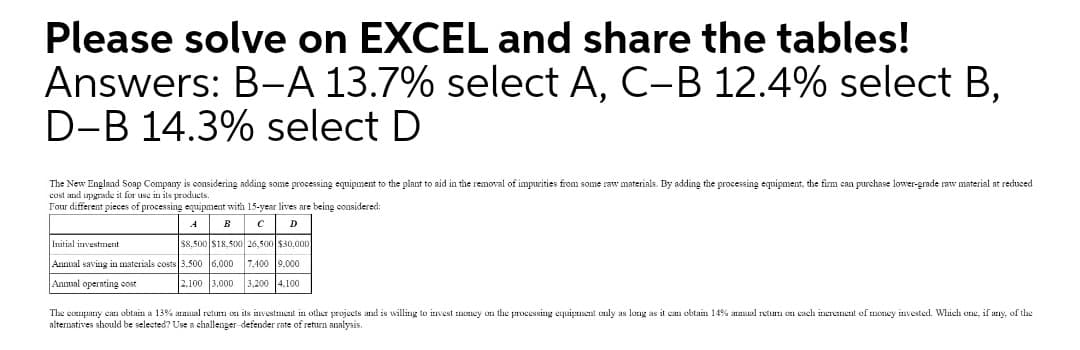

Transcribed Image Text:Please solve on EXCEL and share the tables!

Answers: B-A 13.7% select A, C-B 12.4% select B,

D-B 14.3% select D

The New England Soap Company is considering adding some processing equipment to the plant to aid in the removal of impurities from some raw materials. By adding the processing equipment, the firm can purchase lower-grade raw material at reduced

cost and upgrade it for use in its products.

Four different pieces of processing equipment with 15-year lives are being oonsidered:

D

Initial investment

$8.500 S18,500 26,500 $30,000

Annual saving in materials costs 3.500 6,000 7,400 9,000

Anmal operating cost

2.100 3,000 3,200 4.100

The company cam obtain a 13% amual retum on its investment in other projects and is willing to invest money on the processing equipment only as long as it can obtain 14% anual retum cn each inerement of money invested. Which one, if any, of the

alternatives should be selected? Use a challenger-defender rate of return analysis.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you