Please solve the problem max in 30-60 minutes max. I'm waiting please. Thank u 1. A company partially financed by long-term debt has issued bonds with a characteristic nominal value of IDR 10000, an interest rate of 10% and a maturity of 5 years. If the bond is estimated to have a market price of IDR 9500. Determine the required rate of return (kd) and cost of capital after tax (ki) for the bond if the tax rate is 30%. Notes; to make it easier to find kd you can use the following formula:

Please solve the problem max in 30-60 minutes max. I'm waiting please. Thank u 1. A company partially financed by long-term debt has issued bonds with a characteristic nominal value of IDR 10000, an interest rate of 10% and a maturity of 5 years. If the bond is estimated to have a market price of IDR 9500. Determine the required rate of return (kd) and cost of capital after tax (ki) for the bond if the tax rate is 30%. Notes; to make it easier to find kd you can use the following formula:

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter11: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 11.18E

Related questions

Question

Please solve the problem max in 30-60 minutes max. I'm waiting please. Thank u

1. A company partially financed by long-term debt has issued bonds with a characteristic nominal value of IDR 10000, an interest rate of 10% and a maturity of 5 years. If the bond is estimated to have a market price of IDR 9500. Determine the required rate of return (kd) and cost of capital after tax (ki) for the bond if the tax rate is 30%.

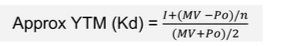

Notes; to make it easier to find kd you can use the following formula:

Transcribed Image Text:1+ (MV — Ро)/n

Approx YTM (Kd) =

%3D

(MV+Po)/2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning