pls answer and provide solution and explanation

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 18E

Related questions

Question

pls answer and provide solution and explanation

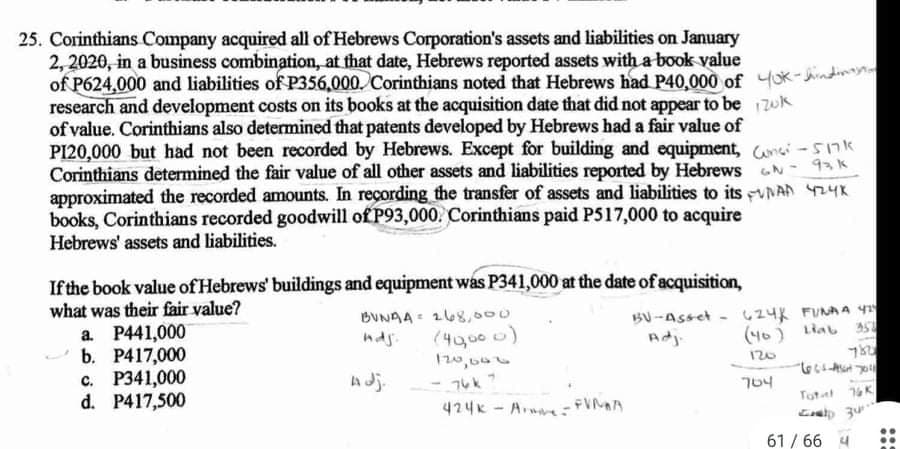

Transcribed Image Text:25. Corinthians Company acquired all of Hebrews Corporation's assets and liabilities on January

2, 2020, in a business combination, at that date, Hebrews reported assets with a book value

of P624,000 and liabilities of P356,000. Corinthians noted that Hebrews had P40.000 of 4ok-Jindi

research and development costs on its books at the acquisition date that did not appear to be 17wk

of value. Corinthians also determined that patents developed by Hebrews had a fair value of

PI20,000 but had not been recorded by Hebrews. Except for building and equipment, anei -517k

Corinthians determined the fair value of all other assets and liabilities reported by Hebrews N- 93K

approximated the recorded amounts. In recording the transfer of assets and liabilities to its VNAD 24K

books, Corinthians recorded goodwill of P93,000, Corinthians paid P517,000 to acquire

Hebrews' assets and liabilities.

If the book value of Hebrews' buildings and equipment was P341,000 at the date of acquisition,

what was their fair value?

a. P441,000

b. P417,000

c. P341,000

d. P417,500

BVNAA : 268,000

BU-Asset - 24K FUNA A 41

(40) Liab 5

nds.

(49000)

120

AJ.

704

424K - A FVMA

Totat K

61 / 66 4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning