Pls help and show all work and explain everything thoroughly pls. Pls do all questions. Pls pls. Pls look at both images as the second image has the questions. Pls pls pls pls do this question.

Pls help and show all work and explain everything thoroughly pls. Pls do all questions. Pls pls. Pls look at both images as the second image has the questions. Pls pls pls pls do this question.

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 28P

Related questions

Question

100%

Pls help and show all work and explain everything thoroughly pls. Pls do all questions. Pls pls. Pls look at both images as the second image has the questions. Pls pls pls pls do this question.

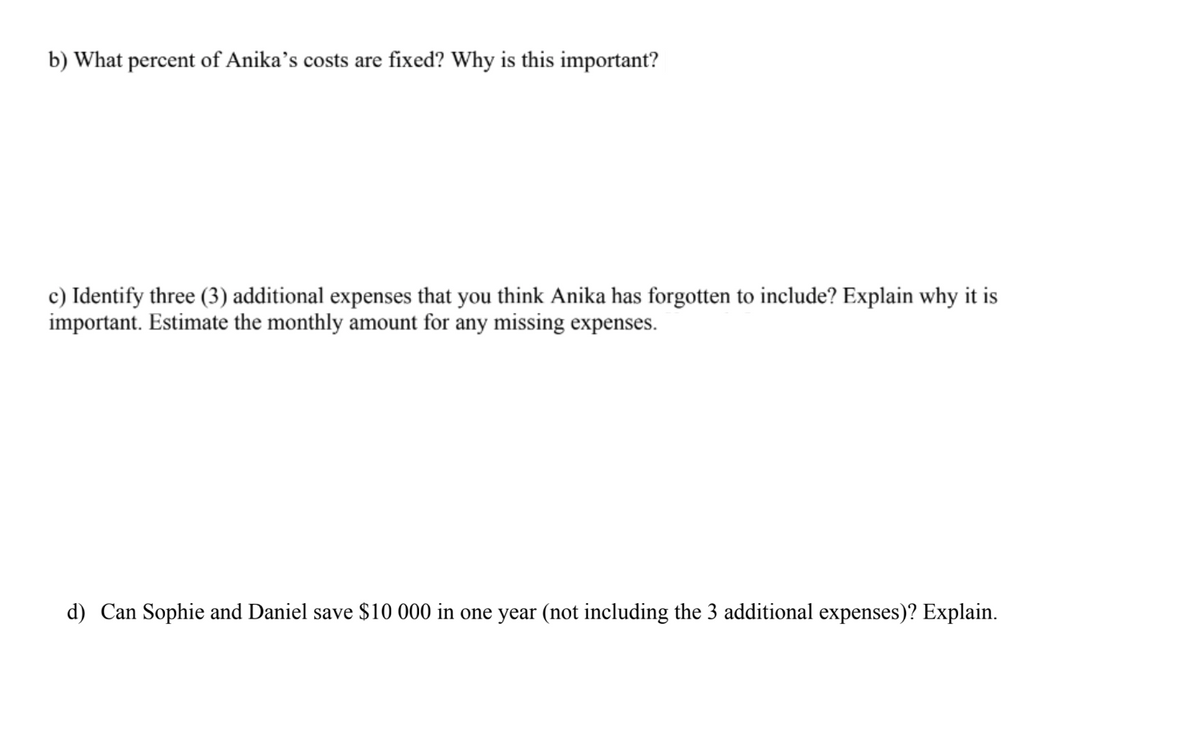

Transcribed Image Text:b) What percent of Anika's costs are fixed? Why is this important?

c) Identify three (3) additional expenses that you think Anika has forgotten to include? Explain why it is

important. Estimate the monthly amount for any missing expenses.

d) Can Sophie and Daniel save $10 000 in one year (not including the 3 additional expenses)? Explain.

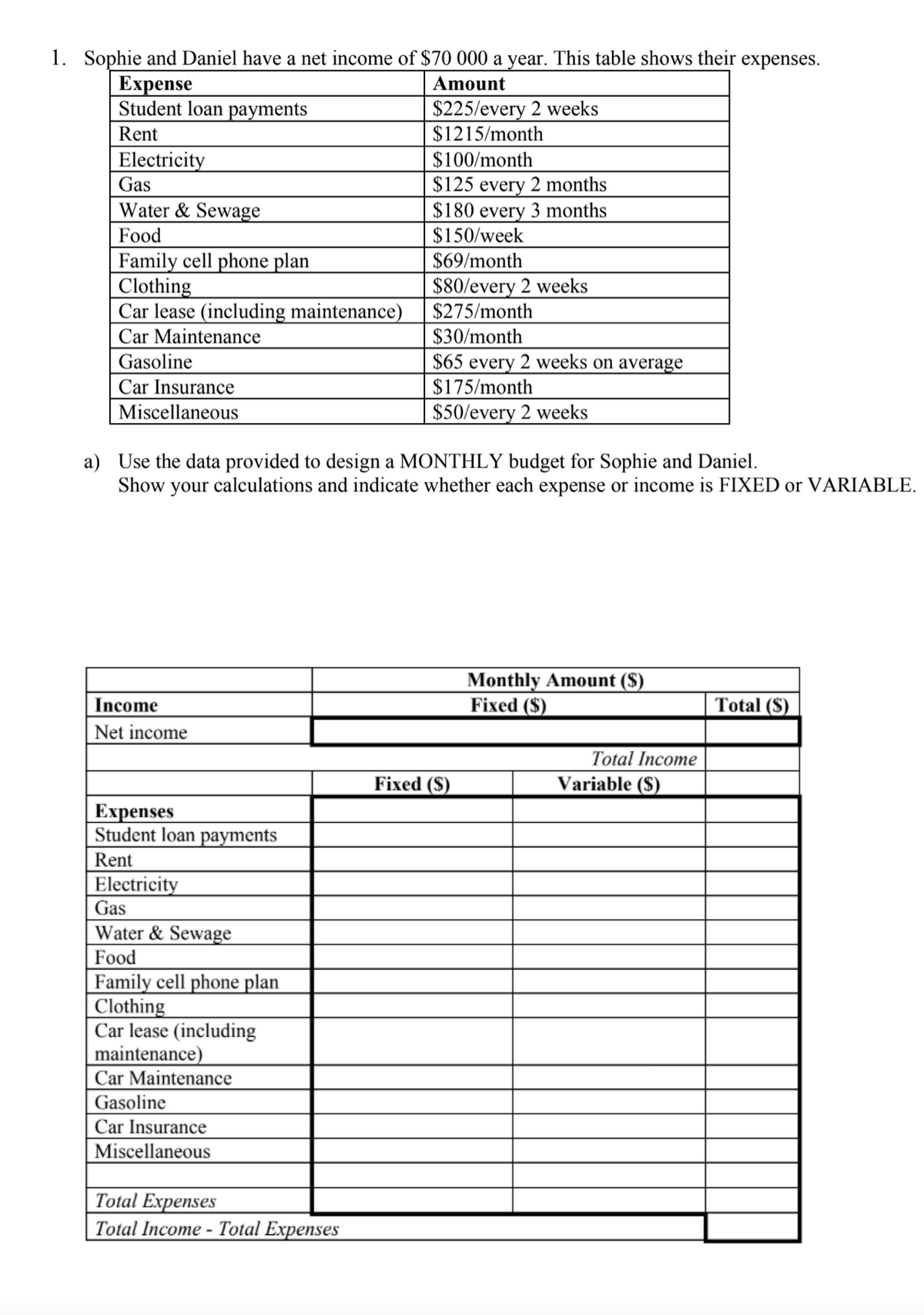

Transcribed Image Text:1. Sophie and Daniel have a net income of $70 000 a year. This table shows their expenses.

Expense

Student loan payments

Amount

$225/every 2 weeks

$1215/month

Rent

Electricity

Gas

$100/month

$125 every 2 months

$180 every 3 months

$150/week

$69/month

Water & Sewage

Food

Family cell phone plan

Clothing

Car lease (including maintenance)

$80/every 2 weeks

$275/month

Car Maintenance

$30/month

Gasoline

$65 every 2 weeks on average

$175/month

Car Insurance

Miscellaneous

$50/every 2 weeks

a) Use the data provided to design a MONTHLY budget for Sophie and Daniel.

Show your calculations and indicate whether each expense or income is FIXED or VARIABLE.

Monthly Amount ($)

Fixed ($)

Income

Total (S)

Net income

Total Income

Fixed ($)

Variable ($)

Еxpenses

Student loan payments

Rent

Electricity

Gas

Water & Sewage

Food

Family cell phone plan

|Clothing

Car lease (including

maintenance)

Car Maintenance

Gasoline

Car Insurance

Miscellaneous

Total Expenses

Total Income - Total Expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning