Kindly follow the steps and ans the question given in images attached.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 4PB: Transactions; financial statements 2. Net income: 10,850 On April 1, 20Y8, Maria Adams established...

Related questions

Question

Kindly follow the steps and ans the question given in images attached.

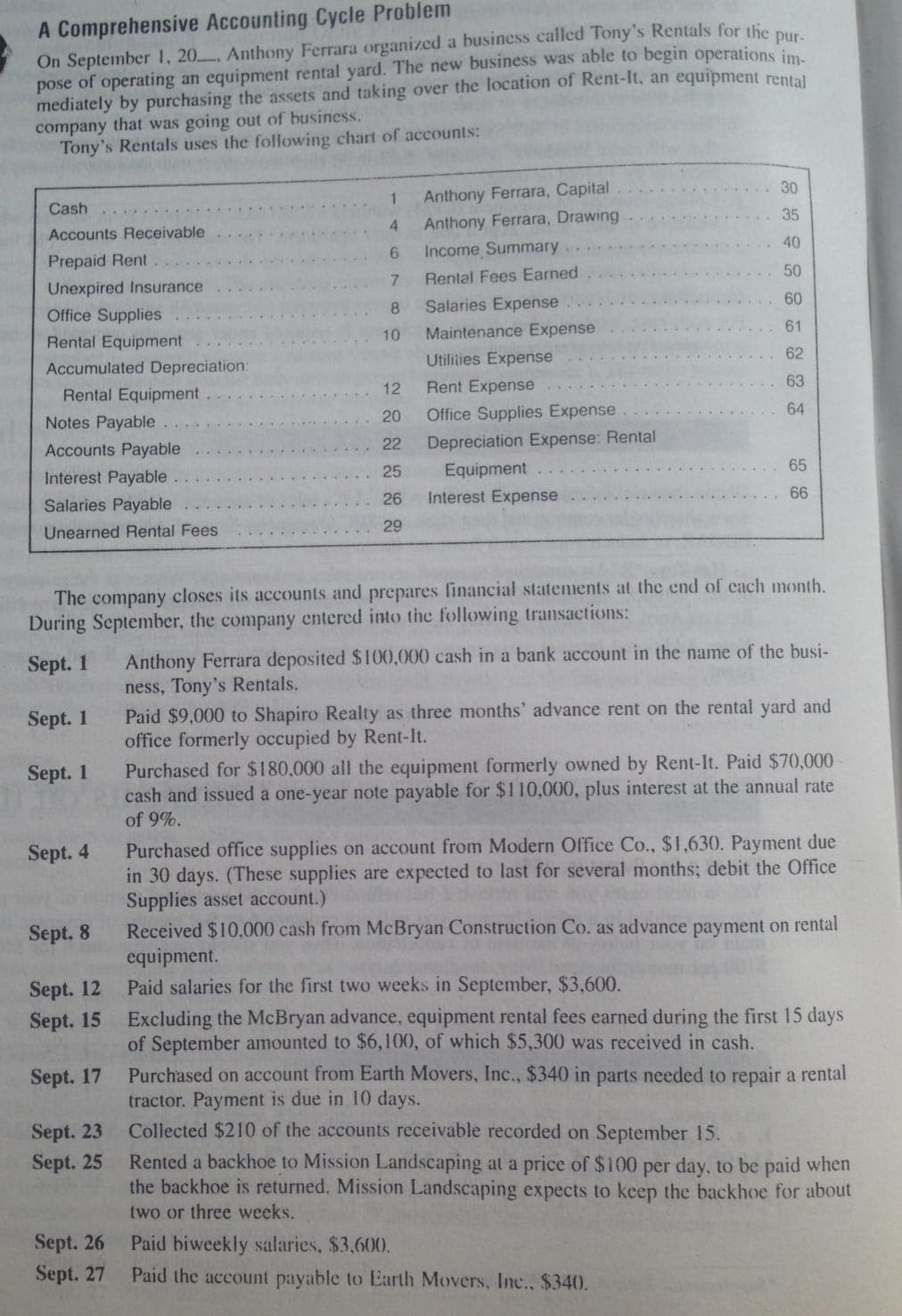

Transcribed Image Text:A Comprehensive Accounting Cycle Problem

On September 1, 20 Anthony Ferrara organized a business called Tony's Rentals for the p

pose of operating an equipment rental yard. The new business was able to begin operations im

mediately by purchasing the assets and taking over the location of Rent-lt, an equipment rental

company that was going out of business.

Tony's Rentals uses the following chart of accounts:

Anthony Ferrara, Capital

30

Cash

Accounts Receivable

4.

Anthony Ferrara, Drawing

35

Prepaid Rent

6.

Income Summary

40

Rental Fees Earned

50

Unexpired Insurance

Office Supplies

8

Salaries Expense

60

Rental Equipment

10

Maintenance Expense

61

Accumulated Depreciation:

Utilities Expense

62

Rental Equipment

12

Rent Expense

63

Notes Payable

20

Office Supplies Expense

64

Accounts Payable

22

Depreciation Expense: Rental

Interest Payable

25

Equipment

65

Salaries Payable

26

Interest Expense

66

Unearned Rental Fees

29

The company closes its accounts and prepares financial statements at the end of each month.

During September, the company entered into the following transactions:

Anthony Ferrara deposited $100,000 cash in a bank account in the name of the busi-

ness, Tony's Rentals.

Paid $9,000 to Shapiro Realty as three months' advance rent on the rental yard and

office formerly occupied by Rent-It.

Purchased for $180,000 all the equipment formerly owned by Rent-It. Paid $70,000

cash and issued a one-year note payable for $110,000, plus interest at the annual rate

of 9%.

Sept. 1

Sept. 1

Sept. 1

Purchased office supplies on account from Modern Office Co., $1,630. Payment due

in 30 days. (These supplies are expected to last for several months; debit the Office

Supplies asset account.)

Received $10,000 cash from McBryan Construction Co. as advance payment on rental

equipment.

Paid salaries for the first two weeks in September, $3,600.

Sept. 4

Sept. 8

Sept. 12

Sept. 15

Excluding the McBryan advance, equipment rental fees earned during the first 15 days

of September amounted to $6,100, of which $5,300 was received in cash.

Purchased on account from Earth Movers, Inc., $340 in parts needed to repair a rental

tractor. Payment is due in 10 days.

Collected $210 of the accounts receivable recorded on September 15.

Sept. 17

Sept. 23

Rented a backhoe to Mission Landscaping at a price of $100 per day, to be paid when

the backhoe is returned. Mission Landscaping expects to keep the backhoe for about

Sept. 25

two or three weeks.

Sept. 26

Sept. 27

Paid biweekly salaries, $3,600.

Paid the account payable to Earth Movers, Inc., $340.

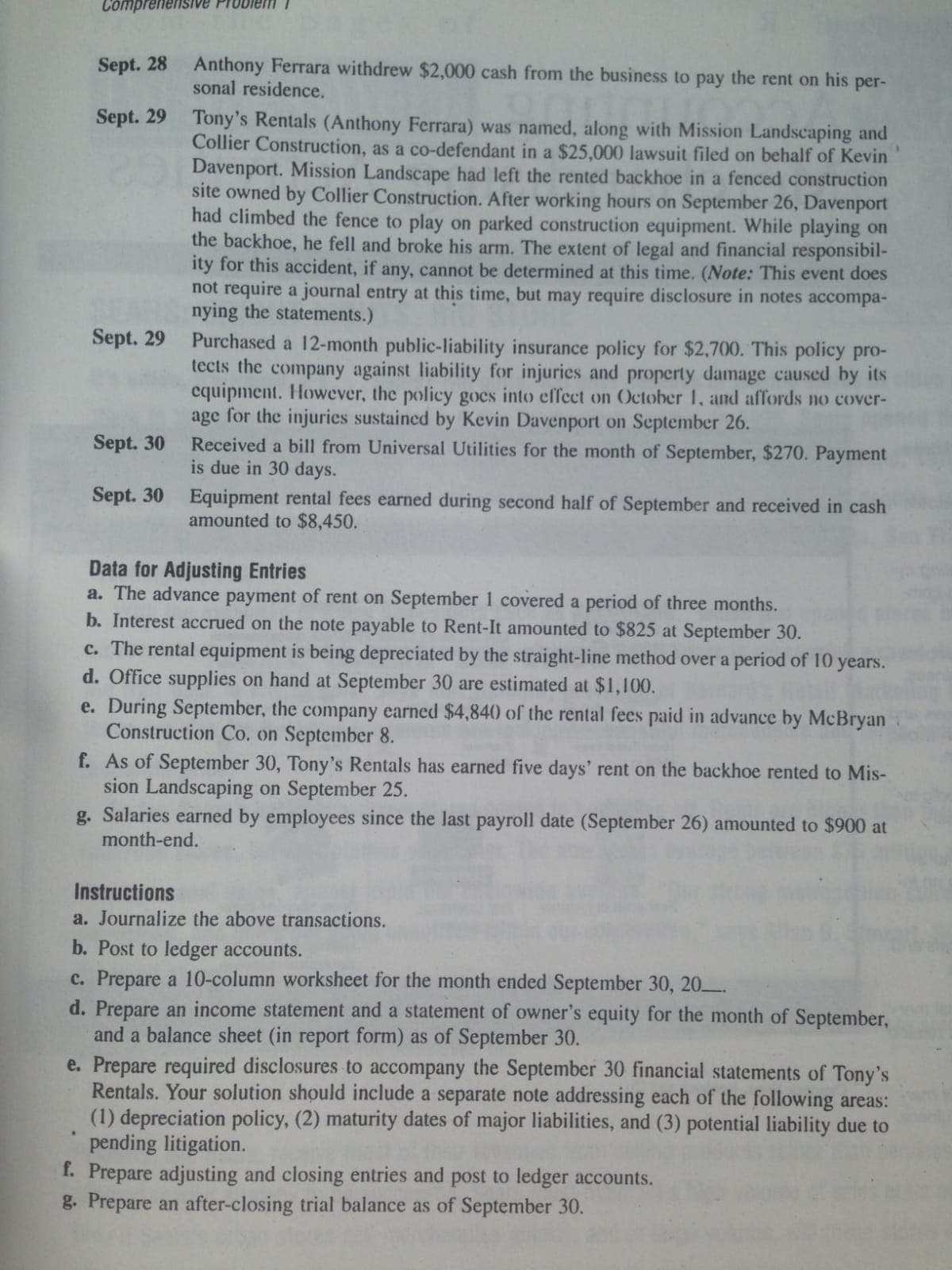

Transcribed Image Text:Сompr

Anthony Ferrara withdrew $2,000 cash from the business to pay the rent on his per-

sonal residence.

Sept. 28

Sept. 29 Tony's Rentals (Anthony Ferrara) was named, along with Mission Landscaping and

Collier Construction, as a co-defendant in a $25,000 lawsuit filed on behalf of Kevin

Davenport. Mission Landscape had left the rented backhoe in a fenced construction

site owned by Collier Construction. After working hours on September 26, Davenport

had climbed the fence to play on parked construction equipment. While playing on

the backhoe, he fell and broke his arm. The extent of legal and financial responsibil-

ity for this accident, if any, cannot be determined at this time. (Note: This event does

not require a journal entry at this time, but may require disclosure in notes accompa-

nying the statements.)

Sept. 29

Purchased a 12-month public-liability insurance policy for $2,700. This policy pro-

tects the company against liability for injuries and property damage caused by its

cquipment. However, the policy goes into effect on October 1, and affords no cover-

age for the injuries sustained by Kevin Davenport on September 26.

Received a bill from Universal Utilities for the month of September, $270. Payment

is due in 30 days.

Sept. 30

Sept. 30

Equipment rental fees earned during second half of September and received in cash

amounted to $8,450.

Data for Adjusting Entries

a. The advance payment of rent on September 1 covered a period of three months.

b. Interest accrued on the note payable to Rent-It amounted to $825 at September 30.

c. The rental equipment is being depreciated by the straight-line method over a period of 10

d. Office supplies on hand at September 30 are estimated at $1,100.

e. During September, the company earned $4,840 of the rental fees paid in advance by McBryan

Construction Co. on September 8.

f. As of September 30, Tony's Rentals has earned five days' rent on the backhoe rented to Mis-

sion Landscaping on September 25.

g. Salaries earned by employees since the last payroll date (September 26) amounted to $900 at

years.

month-end.

Instructions

a. Journalize the above transactions.

b. Post to ledger accounts.

c. Prepare a 10-column worksheet for the month ended September 30, 20.

d. Prepare an income statement and a statement of owner's equity for the month of September,

and a balance sheet (in report form) as of September 30.

e. Prepare required disclosures to accompany the September 30 financial statements of Tony's

Rentals. Your solution should include a separate note addressing each of the following areas:

(1) depreciation policy, (2) maturity dates of major liabilities, and (3) potential liability due to

pending litigation.

f. Prepare adjusting and closing entries and post to ledger accounts.

g. Prepare an after-closing trial balance as of September 30.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning