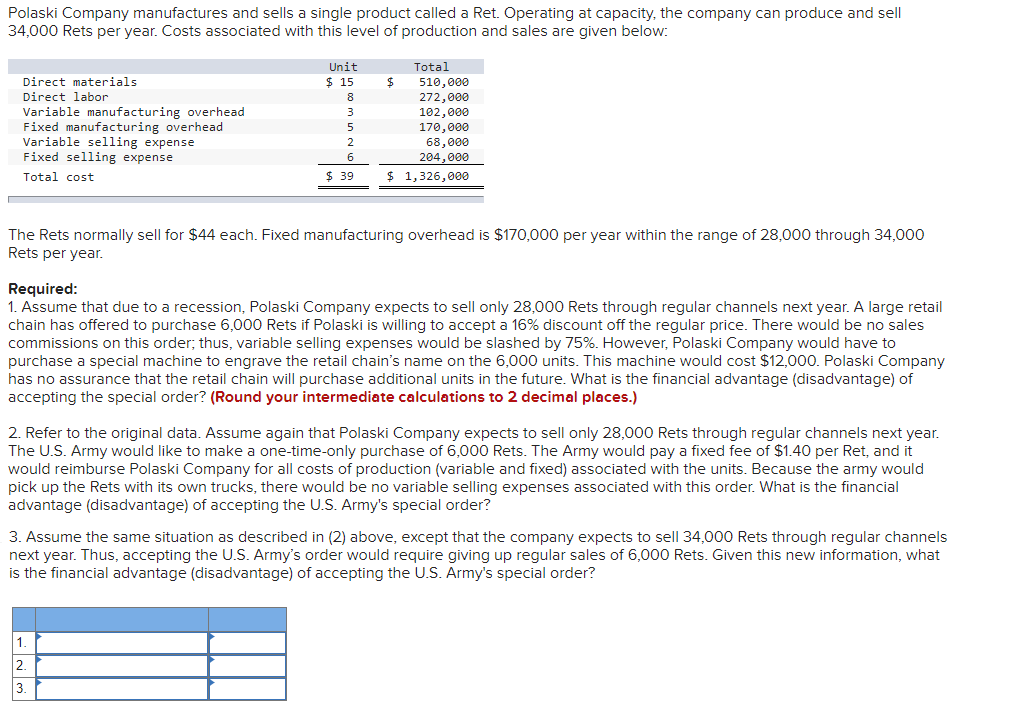

Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 34,000 Rets per year. Costs associated with this level of production and sales are given below: Unit Total Direct materials $ 15 $ 510,000 272,000 102,000 170,000 68,000 204,000 Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expense Fixed selling expense 2. 6 Total cost $ 39 $ 1,326,000

Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 34,000 Rets per year. Costs associated with this level of production and sales are given below: Unit Total Direct materials $ 15 $ 510,000 272,000 102,000 170,000 68,000 204,000 Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expense Fixed selling expense 2. 6 Total cost $ 39 $ 1,326,000

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 7PB: Remarkable Enterprises requires four units of part A for every unit of Al that it produces....

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

100%

Transcribed Image Text:Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell

34,000 Rets per year. Costs associated with this level of production and sales are given below:

Unit

Total

Direct materials

$ 15

510,000

272,000

102,000

170,000

68,000

Direct labor

8

Variable manufacturing overhead

Fixed manufacturing overhead

Variable selling expense

Fixed selling expense

3

5

2.

6

204,000

Total cost

$ 39

$ 1,326,000

The Rets normally sell for $44 each. Fixed manufacturing overhead is $170,000 per year within the range of 28,000 through 34,000

Rets per year.

Required:

1. Assume that due to a recession, Polaski Company expects to sell only 28,000 Rets through regular channels next year. A large retail

chain has offered to purchase 6,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There would be no sales

commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company would have to

purchase a special machine to engrave the retail chain's name on the 6,000 units. This machine would cost $12,000. Polaski Company

has no assurance that the retail chain will purchase additional units in the future. What is the financial advantage (disadvantage) of

accepting the special order? (Round your intermediate calculations to 2 decimal places.)

2. Refer to the original data. Assume again that Polaski Company expects to sell only 28,000 Rets through regular channels next year.

The U.S. Army would like to make a one-time-only purchase of 6,000 Rets. The Army would pay a fixed fee of $1.40 per Ret, and it

would reimburse Polaski Company for all costs of production (variable and fixed) associated with the units. Because the army would

pick up the Rets with its own trucks, there would be no variable selling expenses associated with this order. What is the financial

advantage (disadvantage) of accepting the U.S. Army's special order?

3. Assume the same situation as described in (2) above, except that the company expects to sell 34,000 Rets through regular channels

next year. Thus, accepting the U.S. Army's order would require giving up regular sales of 6,000 Rets. Given this new information, what

is the financial advantage (disadvantage) of accepting the U.S. Army's special order?

1.

2.

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub