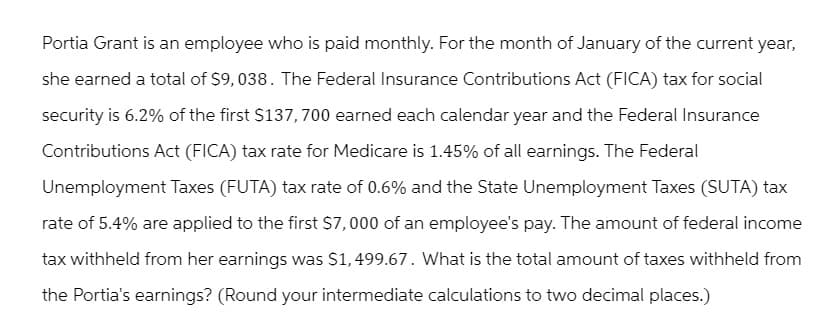

Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of $9,038. The Federal Insurance Contributions Act (FICA) tax for social security is 6.2% of the first $137,700 earned each calendar year and the Federal Insurance Contributions Act (FICA) tax rate for Medicare is 1.45% of all earnings. The Federal Unemployment Taxes (FUTA) tax rate of 0.6% and the State Unemployment Taxes (SUTA) tax rate of 5.4% are applied to the first $7,000 of an employee's pay. The amount of federal income tax withheld from her earnings was $1,499.67. What is the total amount of taxes withheld from the Portia's earnings? (Round your intermediate calculations to two decimal places.)

Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of $9,038. The Federal Insurance Contributions Act (FICA) tax for social security is 6.2% of the first $137,700 earned each calendar year and the Federal Insurance Contributions Act (FICA) tax rate for Medicare is 1.45% of all earnings. The Federal Unemployment Taxes (FUTA) tax rate of 0.6% and the State Unemployment Taxes (SUTA) tax rate of 5.4% are applied to the first $7,000 of an employee's pay. The amount of federal income tax withheld from her earnings was $1,499.67. What is the total amount of taxes withheld from the Portia's earnings? (Round your intermediate calculations to two decimal places.)

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter10: Payroll Register (pr)

Section: Chapter Questions

Problem 4R

Related questions

Question

Only typed solution

Transcribed Image Text:Portia Grant is an employee who is paid monthly. For the month of January of the current year,

she earned a total of $9,038. The Federal Insurance Contributions Act (FICA) tax for social

security is 6.2% of the first $137,700 earned each calendar year and the Federal Insurance

Contributions Act (FICA) tax rate for Medicare is 1.45% of all earnings. The Federal

Unemployment Taxes (FUTA) tax rate of 0.6% and the State Unemployment Taxes (SUTA) tax

rate of 5.4% are applied to the first $7,000 of an employee's pay. The amount of federal income

tax withheld from her earnings was $1,499.67. What is the total amount of taxes withheld from

the Portia's earnings? (Round your intermediate calculations to two decimal places.)

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,