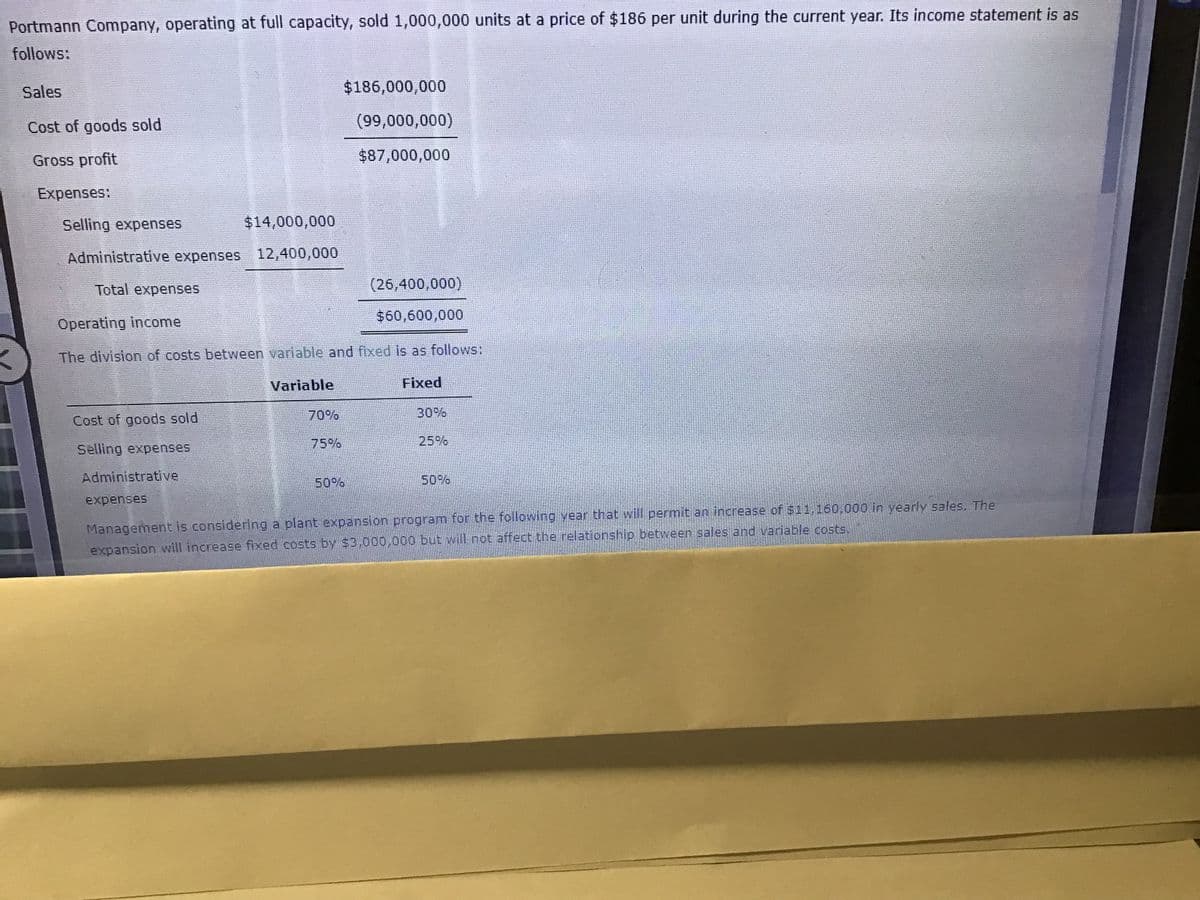

Portmann Company, operating at full capacity, sold 1,000,000 units at a price of $186 per unit during the current year. Its income statement is as follows: Sales $186,000,000 Cost of goods sold (99,000,000) Gross profit $87,000,000 Expenses: Selling expenses $14,000,000 Administrative expenses 12,400,000 Total expenses (26,400,000) $60,600,000 Operating income The division of costs between variable and fixed is as follows: Variable Fixed 70% 30% Cost of goods sold 75% 25% Selling expenses Administrative 50% 50% Management is considering a plant expansion program for the following year that will permit an increase of $11,160,000 in yearly sales, The rinn will increase fixed costs by $3,000,000 but will not affect the relationship between sales and variable costs. expenses

Portmann Company, operating at full capacity, sold 1,000,000 units at a price of $186 per unit during the current year. Its income statement is as follows: Sales $186,000,000 Cost of goods sold (99,000,000) Gross profit $87,000,000 Expenses: Selling expenses $14,000,000 Administrative expenses 12,400,000 Total expenses (26,400,000) $60,600,000 Operating income The division of costs between variable and fixed is as follows: Variable Fixed 70% 30% Cost of goods sold 75% 25% Selling expenses Administrative 50% 50% Management is considering a plant expansion program for the following year that will permit an increase of $11,160,000 in yearly sales, The rinn will increase fixed costs by $3,000,000 but will not affect the relationship between sales and variable costs. expenses

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 1RE: Brandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of...

Related questions

Question

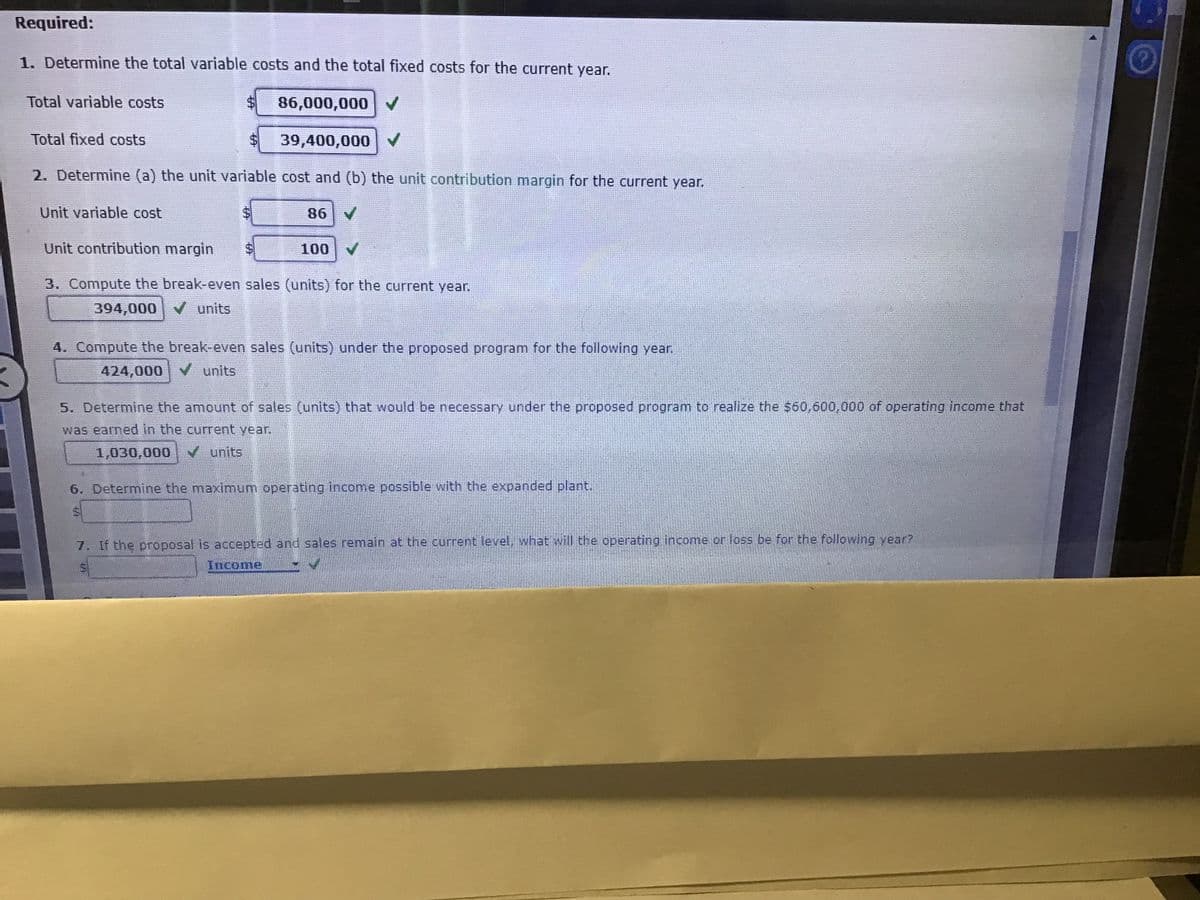

Transcribed Image Text:Required:

1. Determine the total variable costs and the total fixed costs for the current year.

Total variable costs

86,000,000 V

Total fixed costs

39,400,000

2. Determine (a) the unit variable cost and (b) the unit contribution margin for the current year.

Unit variable cost

86

Unit contribution margin

100

3. Compute the break-even sales (units) for the current year.

394,000 V units

4. Compute the break-even sales (units) under the proposed program for the following year.

424,000 V units

5. Determine the amount of sales (units) that would be necessary under the proposed program to realize the $60,600,000 of operating income that

was earned in the current year.

1,030,000 units

6. Determine the maximum operating income possible with the expanded plant.

7. If the proposal is accepted and sales remain at the current level, what will the operating income or loss be for the following year?

Income

Transcribed Image Text:Portmann Company, operating at full capacity, sold 1,000,000 units at a price of $186 per unit during the current year. Its income statement is as

follows:

Sales

$186,000,000

Cost of goods sold

(99,000,000)

Gross profit

$87,000,000

Expenses:

Selling expenses

$14,000,000

Administrative expenses 12,400,000

Total expenses

(26,400,000)

$60,600,000

Operating income

The division of costs between variable and fixed is as follows:

Variable

Fixed

70%

30%

Cost of goods sold

75%

25%

Selling expenses

Administrative

50%

50%

expenses

Management is considering a plant expansion program for the following year that will permit an increase of 511,160,000 in yearly sales. The

expansion will increase fixed costs by $3,000,0000 but will not affect the relationship between sales and variable costs,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College