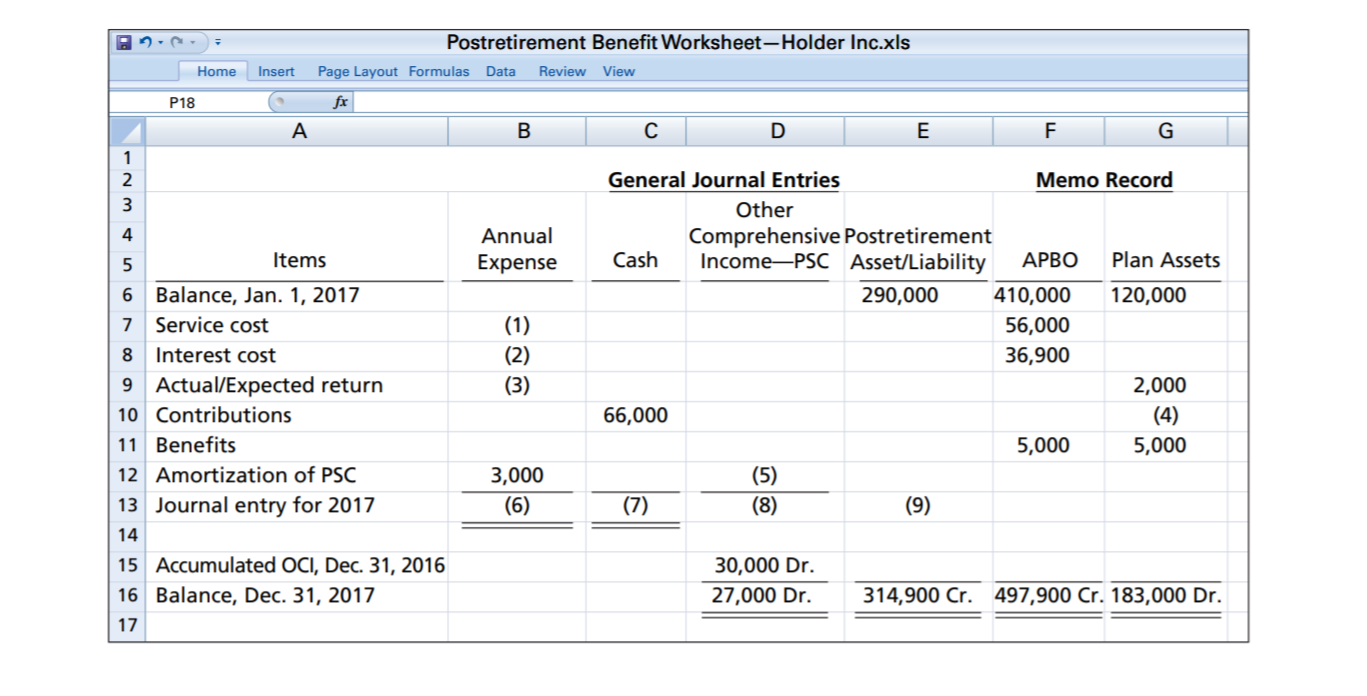

Postretirement Benefit Worksheet–Holder Inc.xls Home Insert Page Layout Formulas Data Review View P18 fx A В F G 1 2 General Journal Entries Memo Record 3 Other Comprehensive Postretirement Income-PSC Asset/Liability 4 Annual 5 Items Expense Cash АРВО Plan Assets 6 Balance, Jan. 1, 2017 290,000 410,000 120,000 Service cost (1) (2) (3) 7 56,000 8 Interest cost 36,900 9 Actual/Expected return 2,000 10 Contributions 66,000 (4) 11 Benefits 5,000 5,000 12 Amortization of PSC 3,000 (5) (8) 13 Journal entry for 2017 (6) (7) (9) 14 30,000 Dr. 27,000 Dr. 15 Accumulated OCI, Dec. 31, 2016 16 Balance, Dec. 31, 2017 314,900 Cr. 497,900 Cr. 183,000 Dr. 17

(Postretirement Benefit Worksheet—Missing Amounts) The accounting staff of Holder Inc. has prepared the following postretirement benefit worksheet. Unfortunately, several entries in the worksheet are not decipherable. The company has asked your assistance in completing the worksheet and completing the accounting tasks related to the pension plan for 2017.

Check the below image for the postretirement worksheet.

Instructions

(a) Determine the missing amounts in the 2017 postretirement worksheet, indicating whether the amounts are debits or credits.

(b) Prepare the

(c) What discount rate is Holder using in accounting for the interest on its other postretirement benefit plan? Explain.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images