Powell Company began the Year 3 accounting period with $45,000 cash, $91,000 inventory, $65,000 common stock, and $71,000 etained earnings. During Year 3, Powell experienced the following events: 1. Sold merchandise costing $60,500 for $104,500 on account to Prentise Furniture Store. 2. Delivered the goods to Prentise under terms FOB destination. Freight costs were $1,200 cash. 8. Received returned goods from Prentise. The goods cost Powell $4,500 and were sold to Prentise for $6,800. 1. Granted Prentise a $3,500 allowance for damaged goods that Prentise agreed to keep. 5. Collected partial payment of $85,500 cash from accounts receivable.

Powell Company began the Year 3 accounting period with $45,000 cash, $91,000 inventory, $65,000 common stock, and $71,000 etained earnings. During Year 3, Powell experienced the following events: 1. Sold merchandise costing $60,500 for $104,500 on account to Prentise Furniture Store. 2. Delivered the goods to Prentise under terms FOB destination. Freight costs were $1,200 cash. 8. Received returned goods from Prentise. The goods cost Powell $4,500 and were sold to Prentise for $6,800. 1. Granted Prentise a $3,500 allowance for damaged goods that Prentise agreed to keep. 5. Collected partial payment of $85,500 cash from accounts receivable.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 37E: Analyzing the Accounts Casey Company uses a perpetual inventory system and engaged in the following...

Related questions

Question

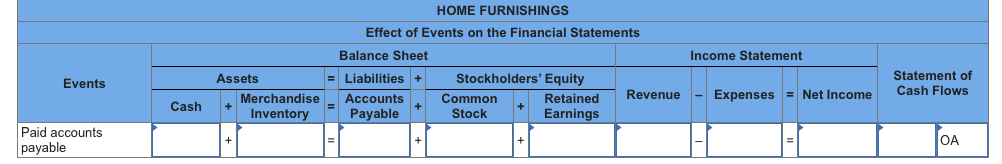

Transcribed Image Text:HOME FURNISHINGS

Effect of Events on the Financial Statements

Balance Sheet

Income Statement

Statement of

Cash Flows

Assets

= Liabilities +

Stockholders' Equity

Events

Merchandise

Revenue

- Expenses = Net Income

Common

Stock

Accounts

Retained

Cash

%3D

Inventory

Payable

Earnings

Paid accounts

payable

OA

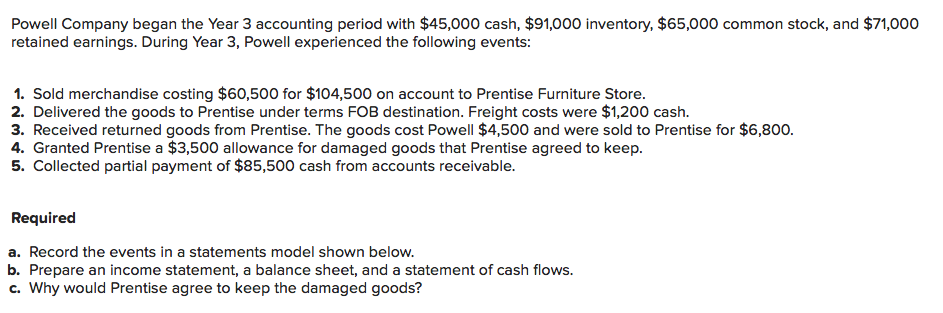

Transcribed Image Text:Powell Company began the Year 3 accounting period with $45,000 cash, $91,000 inventory, $65,000 common stock, and $71,000

retained earnings. During Year 3, Powell experienced the following events:

1. Sold merchandise costing $60,500 for $104,500 on account to Prentise Furniture Store.

2. Delivered the goods to Prentise under terms FOB destination. Freight costs were $1,200 cash.

3. Received returned goods from Prentise. The goods cost Powell $4,500 and were sold to Prentise for $6,800.

4. Granted Prentise a $3,500 allowance for damaged goods that Prentise agreed to keep.

5. Collected partial payment of $85,500 cash from accounts receivable.

Required

a. Record the events in a statements model shown below.

b. Prepare an income statement, a balance sheet, and a statement of cash flows.

c. Why would Prentise agree to keep the damaged goods?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,