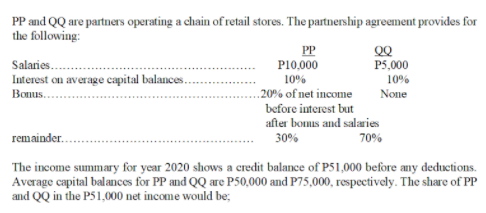

PP and QQ are partners operating a chain of retail stores. The partnership agreement provides for the following: PP Salaries.. QQ P5,000 P10,000 Interest on average capital balances. Bonus. 10% 10% .20% of net income before interest but after bomus and salaries 70% None remainder. 30% The income summary for year 2020 shows a credit balance of P51,000 before any deductions. Average capital balances for PP and QQ are PS0,000 and P75,000, respectively. The share of PP and QQ in the P51,000 net income would be,

Q: The following Balance Sheet for the partnership of Apple, Sam and Sophia were taken from the books…

A: Partnership is an agreement between more than 2 persons to run a business with joint responsibility…

Q: AA and BB are partners with capital accounts that had the following transactions during 2022: AA…

A: Interest on capital to AA: = Opening Capital x 9% = P270,000 x 9% = P24,300

Q: The Partnership agreement of Jones, King and Lane provides for the annual allocation of the…

A: Partnership: Partnership is agreement between two or more persons coming together for business…

Q: YES Partnership started operations on January 2, 2016 with the following capital balances: Yves…

A: Partnership: A partnership is an agreement between two or more people to run a business and share…

Q: Ceradoy, Manongsong and Anuran are partners sharing residual profits in the ratio of 3:2:1. The…

A: Ceradoy Capital = P200,000 Manongsong Capital =P150,000 Anuran Capital =P120,000 Partnership…

Q: On Nov. 8, 2021, Cadag who has her own retail business and Napay, decided to form a partnership…

A: Partnership is an association between two or more than two persons, in which they invest their…

Q: AB Partnership's operation for the year 2022 resulted in a profit of P240,000. Their profit sharing…

A: Profit after salaries = Total profit - Salaries to partner A - Salaries to partner B Bonus to…

Q: A and B's partnership agreement provides the following: • Annual salaries of P96,000 for A and…

A: Calculation of profit after salaries and bonus :- Profit after salaries but before bonus = Profit…

Q: The partnership agreement of Jones, King. and Lane provides for the annual allocation of the…

A: Partnership: When two or more than that person joins together in order to conduct the common…

Q: Sohail, Ali and Aryan are partners with fixed capitals of Rs. 180,000, Rs. 190,000 and Rs. 260,000…

A: Sohail, Ali and Aryan are partners with fixed capitals of Rs. 180,000, Rs. 190,000 and Rs. 260,000…

Q: The partnership agreement of Jones, King, and Lane provides for the annual allocation of the…

A: Partnership It is a promise among the individuals who have decided to carry on a business and share…

Q: 10. Bagcal and Cabatuan was organized and began operations on March 1 2020. On that date, Bagcal…

A: Partnership means where two or more person comes together to do some common business activity and…

Q: Sophia and Anna are partners operating a chain of retail stores. The partnership agreement provides…

A: The agreement between/ among the partners must be to share the profits and losses of the business.…

Q: Kent Deriquito and Jude Suarez are partners of Cebu Vintage Car. The partnership has a net income of…

A: Distribution of profits between…

Q: Miray Sinan and Partners Collective Company's 2019 profit is 200,000 TL. The company was established…

A: The partnership is a form of business organization under which two or more than two person joins…

Q: Ebanks, Brown, and Thomas are partners. They carry on a business jointly as EBT surveyors and share…

A: The calculation of taxable income of each partner requires calculating the income from the income…

Q: At the beginning of the year, Dolce and Gabbana have capital balances of P 50,000 and P 100,000.…

A: Partnership means where two or more person comes together to do some common business activity and…

Q: given 10% interest on beginning capital balances every year - The balance of the profit, or the…

A: Given: To compute the share in net profit or net loss and capital of the each partner as,

Q: YES Partnership started operations on January 1 , 2016 with the following capital balances : Yves…

A: Profit Sharing Ratio (PSR) is the ratio in which partners distribute their Profits and Losses and…

Q: 30 - 2019 profit of Alper Sinan and Partners Collective is 100,000 TL. The company was established…

A: Partnership is an agreement between two or more persons in which they invest capital, run business…

Q: The partnership agreement of Jones, King, and Lane provides for the annual allocation of the…

A: >Partnership Income (Loss) is allocated based on the partnership agreement.>The Net Income or…

Q: Ceradoy. Manongsong and Anuran are partners sharing residual profits in the ratio of 3:2:1. The…

A: Partnership: This is the form of business entity which is formed by an agreement, owned and managed…

Q: Prepare Profit and Loss Appropriation Account and partners’ capital accounts assuming that their…

A: Roaa and Salma were partners in a firm sharing profits in the ratio of their capitals contributed on…

Q: Sohail, Ali and Aryan are partners with fixed capitals of Rs. 160,000, Rs. 180,000 and Rs. 260,000…

A: To record the distribution of net income among the partners, a profit and loss appropriation account…

Q: The partnership agreement of Jones, King, and Lane provides for the annual allocation of the…

A: Partnership is the business type where the partners run business and distribute the profit.

Q: Ceradoy, Manongsong, and Anuran are partners sharing residual profits in the ratio of 3:2:1. The…

A: Partnership agreement is a document which provides for the basis of profit distribution in terms of…

Q: Jpea, Jic, and Jfenix formed a partnership and named it ESBIEYEY. At the end of the year, the…

A: Profit & Loss Appropriation account is prepared by the firm to distribute the profit after…

Q: Tim and Michelle have decided to form a partnership with a 60/40 partnership interest ratio. Tim…

A: Merchandise inventory includes raw materials, work-in process and finished goods held by the firm…

Q: & In its first year of operations, A and B's partnership business eamed profit of P2,500,000. It was…

A: Profit after salary allowance = 2500000 - 100000 = 2400000 Profit after salary and bonus allowance =…

Q: Capital of each partner for 2016 and 2017 • Net income before salary interest bonus (NIBSIB) • Net…

A: Given: To prepare the shares of the net profit or net loss and the capital of the each partner as,

Q: YES Partnership started operations on January 1, 201 balances : with the following capital Yves…

A: Answer In the given question Yves, Ernest, Serge are the partners of Yes partnership. Interest on…

Q: YES Partnership started operations on January 2, 2016 with the following capital balances: Yves…

A: Partnership: A partnership is an agreement between two or more people to run a business and share…

Q: AJ, BJ and CJ are partners in an accounting firm. Their capital account balances at December 31,…

A: Working Notes 1. Bonus is 10% of Net Income after the Bonus , it can be calculated as follows…

Q: On Apr. 8, 2020, Tolentino who has her own retail business and Tan, decided to form a partnership…

A: In a partnership, two or more parties agree to operate and manage a business and share the profits…

Q: HRM Partnership begins its first year of operations with the following capital balances A, capital…

A: Following is the answer to the given question

Q: 17. On January 31, 2021, partners of Lon, Mac & Nan, LLP, had the following loan and capital account…

A: Admission of a new partner to the partnership firm: Unless otherwise agreed upon, a new partner may…

Q: What is the amount of bonus received by Jack? What is the amount of bonus received by Alas? How much…

A: Partnership is the business which is carried by the partners who share profits and losses as per…

Q: Babes and Honey, on January 1, 2022, have respective capital balances of P300,000 and P500,000.…

A: Honey's share will be aggregate of: Honey's Annual salary. Honey's interest on capital. Honey's…

Q: YES Partnership started operations on January 1, 201 balances : with the following capital Yves…

A: Solution :- Note: As per our guidelines only the first three subparts will be solved

Q: YES Partnership started operations on January 1, 201 balances : with the following capital Yves…

A: Note: As per our guidelines only the first three subparts will be solved A. Profit/(Loss) to be…

Q: The partnership agreement of ABC partnership includes the following profit and loss sharing…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: A, B and C formed a partnership on January 1, 2007 with investments of $200,000, $300,000 and…

A: Partnership: Its an agreement between two or more partners forming a business for earning profits.

Q: The partnership agreement of Jones, King, and Lane provides for the annual allocation of the…

A: >Partnership Income (Loss) is allocated based on the partnership agreement. >The Net…

Q: AB Partnership was formed on February 28, 20x1. Partner A invested P150,000 cash while Partner B…

A: Partnership means where two or more person comes together to do some common business activity and…

Q: Several Years ago GO and Bato formed GB Partnershp. The partnership agreement states that each…

A: 1) Prepare Profit and Loss A/c In the Books of GB partnership Trading & Profit and Loss A/c…

Q: Ceradoy, Manongsong and Anuran are partners sharing residual profits in the ratio of 3:2:1. The…

A: Profit sharing ratio of Ceradoy, Manongsong and Anuran=3:2:1 Interest on capital=8% Interest on…

Q: 840 000 Capital account: Maria 500 000 Current account: Wanda (Debit balance at 1 July 2020) 35 000…

A: Appropriation Account : Appropriation is the process of putting money aside for a certain purpose.…

Q: LL, MM and PP are partners with capitals of P40,000; P25,000 and P15,000 respectively. The…

A: Computation of Interest on capital: •LL = 40,000*5% = 2,000 •MM = 25,000*5% = 1,250 •PP = 15,000*5%…

Q: The partnership agreement of Jones, King, and Lane provides for the annual allocation of the…

A: Partnership It is that form of organization which is owned and managed by two or more persons who…

Q: Fit and Ryt are partners operating a grocery store. Their partnership agreement requires that…

A: Calculation of bonus amount of Fit : Net Income before commission and interest but after salaries…

A. PP, P26,541.50; QQ, P24,458.50

Step by step

Solved in 2 steps with 2 images

- The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after Tatum receives a 10,000 salary and Brook receives a 15,000 salary. Prepare a schedule showing how the profit and loss should be divided, assuming the profit or loss for the year is: A. $40,000 B. $25,000 C. ($5,000) In addition, show the resulting entries to each partners capital account. Tatums capital account balance is $50,000 and Brooks is $60,000.YES Partnership started operations on January 1 , 2016 with the following capital balances : Yves P88,000 Ernest 64,000 Serge 90,000 Their profit and loss agreement has the following provisions : Yves will be given an annual salary of P15,000 and Ernest P10,000 All partners will be given 20 % interest on beginning capital balances every year Bonus of 25% of Net Income will be given to Serge The balance of the profit , or the loss , will be divided on a 4/5 / 1 to Yves , Ernest and Serge , respectively . A. Assuming that the company resulted in a net loss of 250.000 in 2016 : 1. What is the share of Yves in Net Profit or Net Loss for 2016 ? 2. What is the share of Ernest in Net Profit or Net Loss for 2016 ? 3. What is the share of Ernest in Net Profit or Net Loss for 2016?Sophia and Anna are partners operating a chain of retail stores. The partnership agreement provides for the following: · Annual salaries to Sophia of P40,000 and P30,000 to Anna. · 12% interest on average capital balances. · Bonus to Sophia of 20% of net income before salaries and bonus but after interest on capital. · Residual income in the ratio 25% to Sophia and 75% to Anna. The Income Summary account for year 2018 shows a credit balance of P244,000 before any allocations. Average capital balances for Sophia and Anna are P100,000 and P150,000, respectively. How much must be the share of Sophia on the partnership net income?

- 19 AA and BB are partners with capital accounts that had the following transactions during 2022: AA BB Debit Credit Debit Credit Beginning balance, January 1 P270,000 P280,000 February 28 P80,000 March 1 120,000 April 30 160,000 June 1 P100,000 August 1 140,000 September 30 40,000 October 31 40,000 The partnership agreement provides for the following: Interest of 9% is to be provided to AA Salaries of P4,000 is to be given to BB per quarter A bonus of 25% is to be given to AA based on net income after interest and salaries Remaining balance is to be allocated on a ratio of 40:60. The income summary account has a credit balance of P1,050,000 before profit distribution. BB has a Drawing account amounting to P40,000 which is a withdrawal made by BB in anticipation of future profits on July 1, 2022. How much is the…As of July 1, 2020, MM and AA decided to form a partnership. Their balance sheets on this date are: MM AA Cash P 15,000 P 38,000 Accounts Receivable 680,000 255,000 Allowance for doubtful accounts (140,000) (30,000) Merchandise Inventory - 202,000 Machinery and Equipment 150,000 270,000 Total P705,000 P735,000 Accounts Payable 135,000 240,000 MM, capital 570,000 AA, capital - 495,000 Total P705,000 P735,000 The partners agreed that the machinery and equipment of MM is under depreciated by P15,000 and that ofAA by P45,000. Allowances for doubtful accounts is to be set up amounting to P120,000 for MM andP40,000 for AA. The partnership agreement provides for the profit and loss ratio and capital interest of60% to MM and 40% to AA with AA’s capital as base. How much cash must MM invest to bring the partner's capital balances proportionate to their profit and loss ratio?AB Partnership's operation for the year 2022 resulted in a profit of P240,000. Their profit sharing agreement provided the following: a. Salaries of P5,000 and P15,000 is to be given to A and B respectively; fres A fr free b. 10% of profit after salaries and bonus is to be given to Partner B; c. The balance is to be divided using the 7:3 ratio, respectively. How much profit is to be allocated to B?

- The partnership agreement of Madi-Maxi Traders provided for the following: Balances on 1 March 20.19:Capital: Madi R 125 000Maxi R 85 000Current Account: Madi R 24 000Maxi R 8 000 (debit) Net profit for the period: R 366 000 Transactions during the year, not included in profit:1. Madi will be full-time employed and will receive a monthly salary of R 12 000.2. Interest on drawings to be charged at 15% per annum.3. Interest on capital will be paid at 12% per annum.4. Interest on current accounts will be charged at 7% per annum.5. The partners will share profits in the ratio of capital contributed.6. On 1 July 20.18, Madi withdrew R 10 000 in cash. On 1 December 20.18, Madi withdrew goods at a cost of R 5 000, this was drawings against expected profits.7. Madi drew R 6 000 of his salary at the end of each month.REQUIRED:Record the journal entries for Madi-Maxi Traders for the year ended 29 February20.20.As of July 1, 2020, MM and AA decided to form a partnership. Their balance sheets on this date are: Cash Accounts Receivable Allowance for doubtful accounts Merchandise Inventory Machinery and Equipment Total P705,000 MM AA P 38,000 255,000 (30,000) 202,000 270,000 P735,000 240,000 495,000 P735,000 P 15,000 680,000 (140,000) - 150,000 Accounts Payable MM, capital AA, capital Total P705,000 135,000 570,000 - The partners agreed that the machinery and equipment of MM is under depreciated by P15,000 and that of AA by P45,000. Allowances for doubtful accounts is to be set up amounting to P120,000 for MM and P40,000 for AA. The partnership agreement provides for the profit and loss ratio and capital interest of 60% to MM and 40% to AA with AA’s capital as base. How much cash must MM invest to bring the partner's capital balances proportionate to their profit and loss ratio?Adam and Boru are partners sharing profit and loss in the ratio of 1:1. Their Statement of Financial Position(Balance Sheet) stood as at 31.12.2020 as follows: A and B Partnership Statement of Financial Position As at 31st December 2020 ASSETS 2020 Current Assets Kshs'000 Kshs'000 Cash and Cash Equivalent 43,500 Short Term Deposits - Prepaid Insurance 1,000 Debtors 20,500 Less Provision for Doubtful Debts (1,000) 19,500 Inventories 30,000 94,000 Non Current Assets Machinery 22,000 Less:Accumulated Depreciation - 22,000 Buildings 30,000 Less:Accumulated Depreciation - 30,000…

- YES Partnership started operations on January 1, 201 balances : with the following capital Yves P88,000 Ernest 64,000 Serge 90,000 Their profit and loss agreement has the following provisions : Yves will be given an annual salary of P16,000 and Serge P8,000 All partners will be given 10% interest on beginning capital balances every year Bonus of 20% of Net Income will be given to Yves The balance of the profit , or the loss, will be divided on a 5 :2:3 to Yves , Ernest and Serge, respectively . A. Assuming that the company resulted in a net loss of 16,000 in 2016 1. What is the share of Yves in Net Profit or Net Loss for 2016? 2. What is the share of Ernest in Net Profit or Net Loss for 2016? 3. What is the share of share in Net Profit or Net Loss for 2016? B. Assuming that the company resulted in a profit of 24.200 in 2016 : 1. What is the share of Yves in Net Profit or Net Lose for 2016? 2. What is the share of Ernest in Net Profit or Net Loss for 2016 ? 3. What is the Serge in Net…YES Partnership started operations on January 1, 201 balances : with the following capital Yves P88,000 Ernest 64,000 Serge 90,000 Their profit and loss agreement has the following provisions : Yves will be given an annual salary of P16,000 and Serge P8,000 All partners will be given 10% interest on beginning capital balances every year Bonus of 20% of Net Income will be given to Yves The balance of the profit , or the loss, will be divided on a 5 :2:3 to Yves , Ernest and Serge, respectively . B. Assuming that the company resulted in a profit 150.000 in 2016 : 1. What is the share of Yves in Net Profit or Net Lose for 2016? 2. What is the share of Ernest in Net Profit or Net Loss for 2016 ? 3. What is the Serge in Net Profit or Net Loss for 2016?Sophia and Anna are partners operating a chain of retail stores. The partnership agreement provides for the following: · Annual salaries to Sophia of P40,000 and P30,000 to Anna. · 12% interest on average capital balances. · Bonus to Sophia of 20% of net income after allowance for salaries, interest, and bonus. · Residual income in the ratio 25% to Sophia and 75% to Anna. The Income Summary account for year shows a credit balance of P244,000 before any allocations. Average capital balances for Sophia and Anna are P100,000 and P150,000, respectively. How much must be the share of Sophia on the partnership net income?