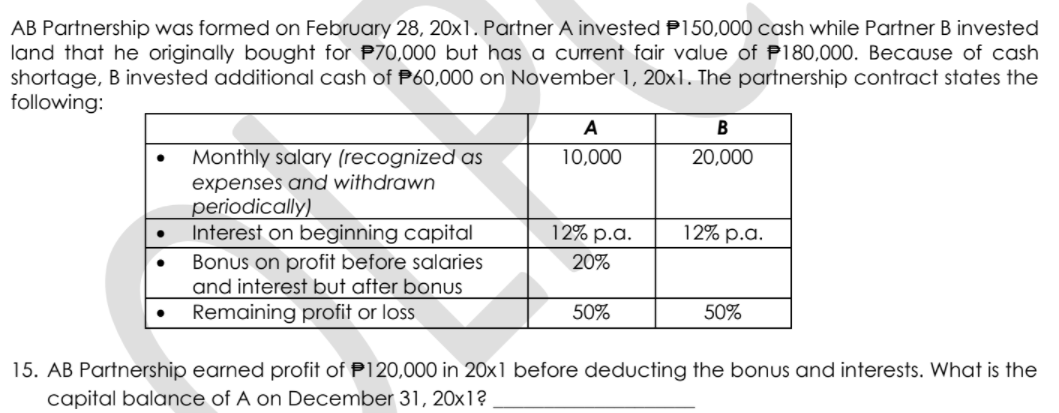

AB Partnership was formed on February 28, 20x1. Partner A invested P150,000 cash while Partner B invested land that he originally bought for P70,000 but has a current fair value of P180,000. Because of cash shortage, B invested additional cash of P60,000 on November 1, 20x1. The partnership contract states the following: A Monthly salary (recognized as 10,000 20,000 expenses and withdrawn periodically) Interest on beginning capital Bonus on profit before salaries and interest but after bonus Remaining profit or loss 12% p.a. 12% p.a. 20% 50% 50% 15. AB Partnership earned profit of P120,000 in 20x1 before deducting the bonus and interests. What is the capital balance of A on December 31, 20x1?

AB Partnership was formed on February 28, 20x1. Partner A invested P150,000 cash while Partner B invested land that he originally bought for P70,000 but has a current fair value of P180,000. Because of cash shortage, B invested additional cash of P60,000 on November 1, 20x1. The partnership contract states the following: A Monthly salary (recognized as 10,000 20,000 expenses and withdrawn periodically) Interest on beginning capital Bonus on profit before salaries and interest but after bonus Remaining profit or loss 12% p.a. 12% p.a. 20% 50% 50% 15. AB Partnership earned profit of P120,000 in 20x1 before deducting the bonus and interests. What is the capital balance of A on December 31, 20x1?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:AB Partnership was formed on February 28, 20x1. Partner A invested P150,000 cash while Partner B invested

land that he originally bought for P70,000 but has a current fair value of P180,000. Because of cash

shortage, B invested additional cash of P60,000 on November 1, 20x1. The partnership contract states the

following:

A

Monthly salary (recognized as

10,000

20,000

expenses and withdrawn

periodically)

Interest on beginning capital

Bonus on profit before salaries

and interest but after bonus

Remaining profit or loss

12% p.a.

12% p.a.

20%

50%

50%

15. AB Partnership earned profit of P120,000 in 20x1 before deducting the bonus and interests. What is the

capital balance of A on December 31, 20x1?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,