ppose the spot rate is A$1.77/GBP. An Audi can be purchased in Sydney, Australia, for A$30,00 in London, United Kingdom, for £17,860. The real interest rate is 3.5% p.a. for AUD and 1.5% P alculate the real exchange rate of Sydney Audi per London Audi Is the real exchange rate istent with the prediction of the absolute PPP? Explain ppose the real interest parity holds, calculate the expected real exchange rate of ondon Audi. Will the change in the real exchange rate lead to an increase in the alia? Explain. YAL port View Insert Format Tools Table

ppose the spot rate is A$1.77/GBP. An Audi can be purchased in Sydney, Australia, for A$30,00 in London, United Kingdom, for £17,860. The real interest rate is 3.5% p.a. for AUD and 1.5% P alculate the real exchange rate of Sydney Audi per London Audi Is the real exchange rate istent with the prediction of the absolute PPP? Explain ppose the real interest parity holds, calculate the expected real exchange rate of ondon Audi. Will the change in the real exchange rate lead to an increase in the alia? Explain. YAL port View Insert Format Tools Table

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter19: Multinational Financial Management

Section: Chapter Questions

Problem 6P

Related questions

Question

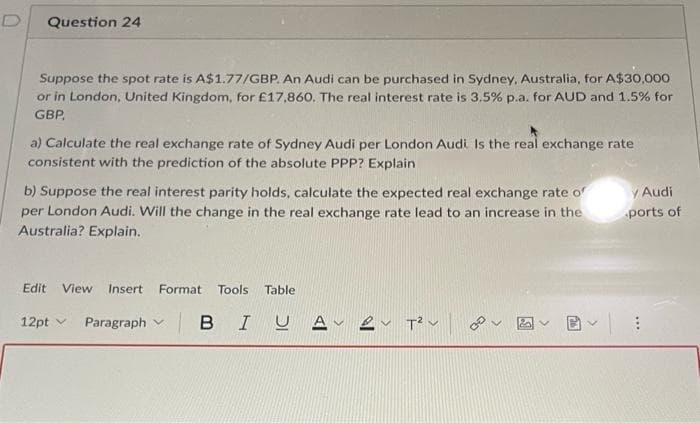

Transcribed Image Text:Question 24

Suppose the spot rate is A$1.77/GBP. An Audi can be purchased in Sydney, Australia, for A$30,000

or in London, United Kingdom, for £17,860. The real interest rate is 3.5% p.a. for AUD and 1.5% for

GBP,

a) Calculate the real exchange rate of Sydney Audi per London Audi Is the real exchange rate

consistent with the prediction of the absolute PPP? Explain

b) Suppose the real interest parity holds, calculate the expected real exchange rate of

per London Audi. Will the change in the real exchange rate lead to an increase in the

Australia? Explain.

y Audi

ports of

Edit View Insert Format Tools Table

12pt Paragraph

BIU AV2v T²V 2

120

***

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning