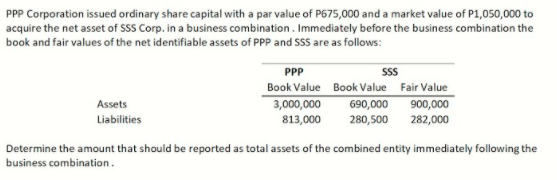

PPP Corporation issued ordinary share capital with a par value of P675,000 and a market value of P1,050,000 to acquire the net asset of SSS Corp. in a business combination. Immediately before the business combination the book and fair values of the net identifiable assets of PPP and SSS are as follows: PPP SS Book Value Book Value Fair Value 690,000 280,500 3,000,000 900,000 Assets Liabilities 813,000 282,000 Determine the amount that should be reported as total assets of the combined entity immediately following the business combination.

PPP Corporation issued ordinary share capital with a par value of P675,000 and a market value of P1,050,000 to acquire the net asset of SSS Corp. in a business combination. Immediately before the business combination the book and fair values of the net identifiable assets of PPP and SSS are as follows: PPP SS Book Value Book Value Fair Value 690,000 280,500 3,000,000 900,000 Assets Liabilities 813,000 282,000 Determine the amount that should be reported as total assets of the combined entity immediately following the business combination.

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

Transcribed Image Text:PPP Corporation issued ordinary share capital with a par value of P675,000 and a market value of P1,050,000 to

acquire the net asset of SSS Corp. in a business combination. Immediately before the business combination the

book and fair values of the net identifiable assets of PPP and SSS are as follows:

SSS

Book Value Book Value Fair Value

690,000

280,500

PPP

Assets

3,000,000

900,000

Liabilities

813,000

282,000

Determine the amount that should be reported as total assets of the combined entity immediately following the

business combination.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you