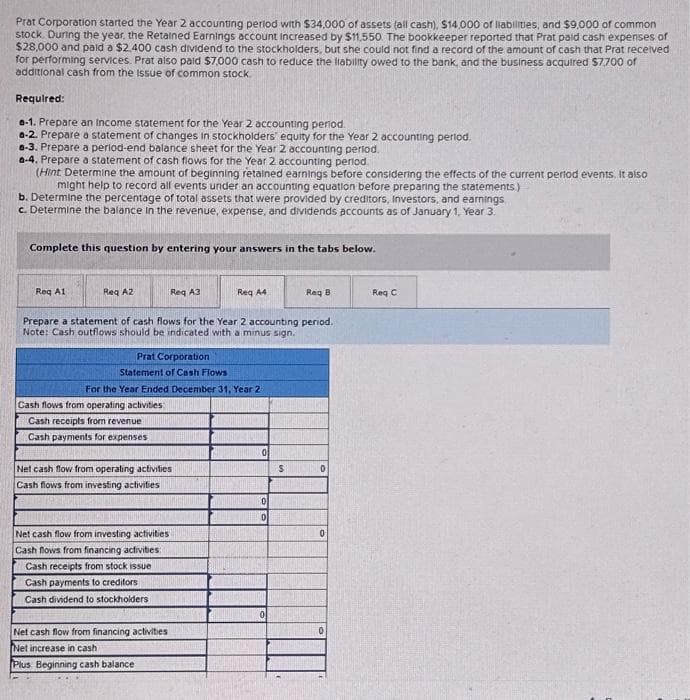

Prat Corporation started the Year 2 accounting period with $34,000 of assets (all cash). $14,000 of liabilities, and $9,000 of common stock. During the year, the Retained Earnings account increased by $11,550. The bookkeeper reported that Prat paid cash expenses of $28,000 and paid a $2.400 cash dividend to the stockholders, but she could not find a record of the amount of cash that Prat received for performing services. Prat also paid $7,000 cash to reduce the liability owed to the bank, and the business acquired $7.700 of additional cash from the issue of common stock. Required: a-1. Prepare an income statement for the Year 2 accounting period. a-2. Prepare a statement of changes in stockholders' equity for the Year 2 accounting period. a-3. Prepare a period-end balance sheet for the Year 2 accounting period. a-4. Prepare a statement of cash flows for the Year 2 accounting period. (Hint Determine the amount of beginning retained earnings before considering the effects of the current period events. It also might help to record all events under an accounting equation before preparing the statements) b. Determine the percentage of total assets that were provided by creditors, Investors, and earnings c. Determine the balance in the revenue, expense, and dividends accounts as of January 1, Year 3. Complete this question by entering your answers in the tabs below. Reg A1 Reg A2 Req A3 Prepare a statement of cash flows for the Year 2 accounting period. Note: Cash outflows should be indicated with a minus sign. Prat Corporation Statement of Cash Flows For the Year Ended December 31, Year 21 Cash flows from operating activities Cash receipts from revenue Cash payments for expenses Net cash flow from operating activities Cash flows from investing activities Req A4 Net cash flow from investing activities Cash flows from financing activities Cash receipts from stock issue Cash payments to creditors Cash dividend to stockholders i Net cash flow from financing activities Net increase in cash Plus Beginning cash balance 0 0 0 Raq B S 0 0 Reg C

Prat Corporation started the Year 2 accounting period with $34,000 of assets (all cash). $14,000 of liabilities, and $9,000 of common stock. During the year, the Retained Earnings account increased by $11,550. The bookkeeper reported that Prat paid cash expenses of $28,000 and paid a $2.400 cash dividend to the stockholders, but she could not find a record of the amount of cash that Prat received for performing services. Prat also paid $7,000 cash to reduce the liability owed to the bank, and the business acquired $7.700 of additional cash from the issue of common stock. Required: a-1. Prepare an income statement for the Year 2 accounting period. a-2. Prepare a statement of changes in stockholders' equity for the Year 2 accounting period. a-3. Prepare a period-end balance sheet for the Year 2 accounting period. a-4. Prepare a statement of cash flows for the Year 2 accounting period. (Hint Determine the amount of beginning retained earnings before considering the effects of the current period events. It also might help to record all events under an accounting equation before preparing the statements) b. Determine the percentage of total assets that were provided by creditors, Investors, and earnings c. Determine the balance in the revenue, expense, and dividends accounts as of January 1, Year 3. Complete this question by entering your answers in the tabs below. Reg A1 Reg A2 Req A3 Prepare a statement of cash flows for the Year 2 accounting period. Note: Cash outflows should be indicated with a minus sign. Prat Corporation Statement of Cash Flows For the Year Ended December 31, Year 21 Cash flows from operating activities Cash receipts from revenue Cash payments for expenses Net cash flow from operating activities Cash flows from investing activities Req A4 Net cash flow from investing activities Cash flows from financing activities Cash receipts from stock issue Cash payments to creditors Cash dividend to stockholders i Net cash flow from financing activities Net increase in cash Plus Beginning cash balance 0 0 0 Raq B S 0 0 Reg C

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter2: Asset And Liability Valuation And Income Recognition

Section: Chapter Questions

Problem 20PC: Analyzing Transactions. Using the analytical framework, indicate the effect of the following related...

Related questions

Question

Transcribed Image Text:Prat Corporation started the Year 2 accounting period with $34,000 of assets (all cash), $14,000 of liabilities, and $9,000 of common

stock. During the year, the Retained Earnings account increased by $11,550. The bookkeeper reported that Prat paid cash expenses of

$28,000 and paid a $2.400 cash dividend to the stockholders, but she could not find a record of the amount of cash that Prat received

for performing services. Prat also paid $7,000 cash to reduce the liability owed to the bank, and the business acquired $7.700 of

additional cash from the issue of common stock.

Required:

a-1. Prepare an Income statement for the Year 2 accounting period.

a-2. Prepare a statement of changes in stockholders' equity for the Year 2 accounting period.

a-3. Prepare a period-end balance sheet for the Year 2 accounting period.

a-4. Prepare a statement of cash flows for the Year 2 accounting period

(Hint Determine the amount of beginning retained earnings before considering the effects of the current period events. It also

might help to record all events under an accounting equation before preparing the statements)

b. Determine the percentage of total assets that were provided by creditors, Investors, and earnings

c. Determine the balance in the revenue, expense, and dividends accounts as of January 1, Year 3.

Complete this question by entering your answers in the tabs below.

Req A1

Req A2

Prat Corporation

Statement of Cash Flows

Prepare a statement of cash flows for the Year 2 accounting period.

Note: Cash outflows should be indicated with a minus sign.

Cash flows from operating activities

Cash receipts from revenue

Cash payments for expenses

Req A3

For the Year Ended December 31, Year 2

Net cash flow from operating activities

Cash flows from investing activities

Net cash flow from investing activities

Cash flows from financing activities:

Cash receipts from stock issue

Cash payments to creditors i

Cash dividend to stockholders

Req A4

Net cash flow from financing activities

Net increase in cash

Plus Beginning cash balance.

0

0

0

Req B

S

0

0

0

Reg C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning