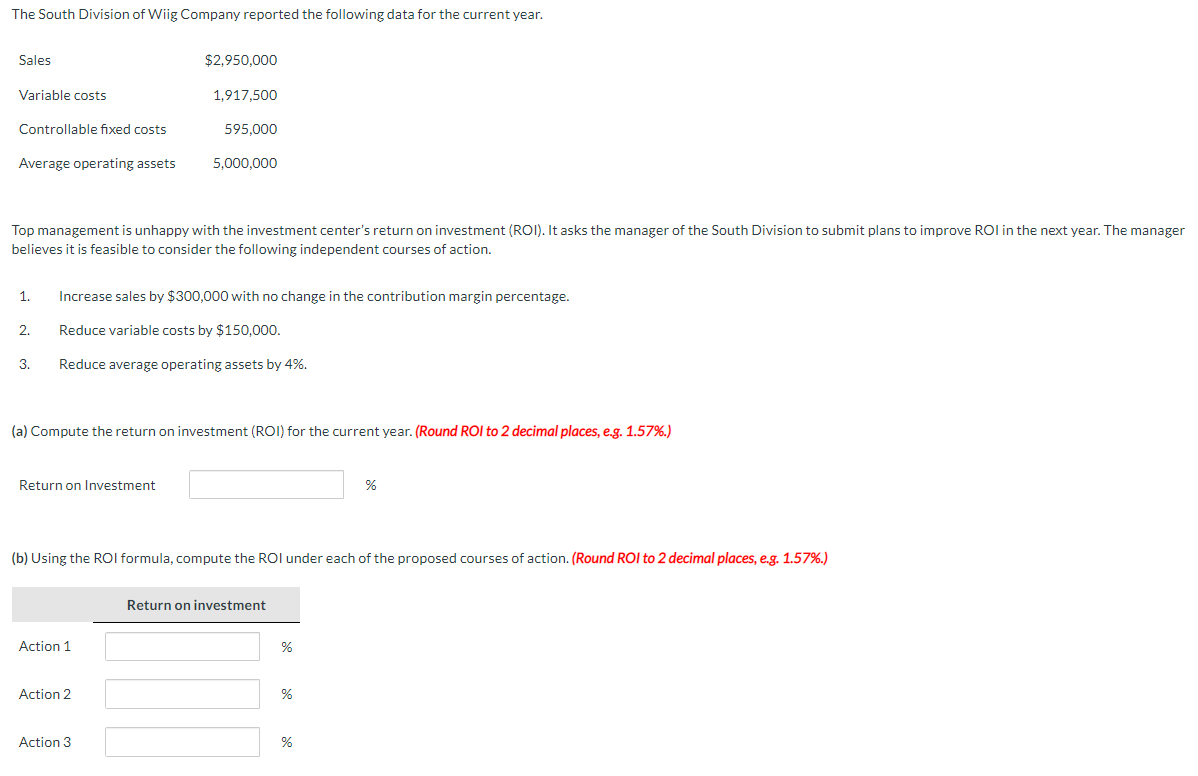

The South Division of Wiig Company reported the following data for the current yea Sales Variable costs Controllable fixed costs Average operating assets $2,950,000 1,917,500 595,000 5,000,000

Q: 1. What is the regular corporate income tax, if the corporation has a total allowable deduction of…

A: As per our rules, in case of multiple questions we are only allowed to solve the first question if…

Q: Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can…

A: NET PRESENT VALUE Net Present Value is one of the Important Capital Budgeting Technique. Net…

Q: Required: 1. What is the financial advantage (disadvantage) of further processing one T-bone steak…

A: The decision to choose between further processing or selling initially depends on various factors,…

Q: ABC Corporation has the following information for the year: Sales revenue: $500,000 Cost of…

A: INCOME STATEMENTIncome Statement is one of the Important Financial Statement of the Company. Income…

Q: BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its…

A: Social Security Taxes is taxable on first $137,700 of earnings. Whereas there is no income limit set…

Q: Pinnacle Inc. manufactures curtains to client specifications. It has two cost categories that are…

A: Predetermined Overhead Rate :— It is the rate used to allocate manufacturing overhead cost to cost…

Q: Starling Corporation started the year on January 1 with the following balances in stockholders'…

A: Stockholder's Equity - Stockholder's Equity includes issuance of Common Stock, Any amount paid over…

Q: Craig has decided to start snow plowing during the winter months. He purchased a heavy-duty dump…

A: As per IRS publication 946, Chapter 4, Under Property Classes, the suggested life of the heavy truck…

Q: Management of Mittel Company would like to reduce the amount of time between when a customer places…

A: Throughput time is the actual time used in the manufacturing of the product. It is a period of time…

Q: Data from the accounting records of Wise Company are presented here. Current assets Current…

A: Current ratio :— It is calculated by dividing current assets by current liabilities. Current ratio…

Q: X Inc. owns 80% of Y Inc. During 2020, X Inc. sold inventory to Y for $10,000. Half of this…

A: The practice of integrating the financial results of many subsidiary firms into the total financial…

Q: A business performs services for a customer for $26,000 on account. Which of the following accounts…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Summer Repair Shop has a monthly target operating income of $40,000. Variable expenses are 85% of…

A: The margin of safety sales means difference between current sales and break even sales. Break even…

Q: The following events occurred last year at Dorder Corporation: Purchase of plant and equipment Sale…

A: To calculate the net cash flow from investing activities, the company needs to assess the cash…

Q: The Cutting Department of Crane Company has the following production and cost data for July 1. 2.…

A: The total cost of producing a product, including raw materials and operating costs, is detailed in a…

Q: For each of the following scenarios, select whether an asset has been impaired (Y for yes and N for…

A: Impairment Loss is that which is recognize when the assets book value is higher than it's current…

Q: Sub : Accounting Pls answer very fast.I ll upvote correct answer. Thank You Financial information…

A: INVENTORY TURNOVER RATIO Inventory Turnover Ratio is the Ratio between Cost of Goods Sold &…

Q: Prepare a Statement of Retained Earnings in the proper format.

A: The statement of retained earnings is one of the financial statements that provide information about…

Q: Edison Leasing leased high-tech electronic equipment to Manufacturers Southern on January 1, 2021.…

A: Amortization Schedule- An amortization schedule, often known an amortization table, spells out…

Q: Sound Tek Inc. manufactures electronic stereo equipment. The manufacturing process includes printed…

A: The amount of time spent on tasks that add value to a process or that customers are willing to pay…

Q: You are developing the policies and procedures in relation to credit sales. What processes would you…

A: Payments for credit sales are made several days or weeks after a product is delivered. In contrast…

Q: a. Interest revenue b. Depreciation expense-Equipment c. Loss on sale of equipment d. Accounts…

A: Net income is the amount which is calculated by deducting all expenses and losses from revenues and…

Q: Suppose McDonald's 2022 financial statements contain the following selected data (in millions).…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: During the past 12 months, Brown Ltd has undertaken major work on its warehouse facilities. In the…

A: Capital expense or capital expenditure is the expenditure incurred by any entity on fixed assets…

Q: a. Interest revenue b. Depreciation expense-Equipment c. Loss on sale of equipment d. Accounts…

A: Income from operations is the amount which is calculated by deducting all expenses and losses from…

Q: ok at your current financial status. You currently have $80 of cash on hand, a checking account with…

A: Cash in hand refers to the total sum value of money remained at a company after it has bear all its…

Q: On November 1, 2025, Concord Company adopted a stock-option plan that granted options to key…

A: Employees Stock Option: When a company grants an employee stock option (ESO), it is referring to a…

Q: t-line to zero over four years. Because of radiation contamination, it will actually be completely…

A: Annuity is a series of equal payments at equal interval for a specified period of time. With…

Q: the unamortized portion of the patent on December 31, 2020, before adjustment for amortization in…

A: Amortization expense is quite similar to depreciation expense, however, depreciation takes place on…

Q: Prepare a schedule of cost of goods manufactured and sold for Lederman Manufacturing Corporation for…

A: SCHEDULE OF COST OF GOODS MANUFACTUREDSchedule Of Cost Of Goods Manufactured are those Cost Which is…

Q: An employee's net (or take-home) pay is determined by gross earnings minus amounts for income tax…

A: FICA is a federal payroll tax in the United States. It is deducted from each paycheck and stands for…

Q: The adjusted trial balance data given below is from Cameron White Company's worksheet for the year…

A: The balance sheet is one of the important financial statements of the business. The balance sheet…

Q: Mia Company uses activity-based costing and reports the following. The company budgets 2,000 machine…

A: The predetermined overhead rate is calculated as estimated overhead cost divided by estimated base…

Q: Assume F&S offers a deal whereby enrolling in a new membership for $700 provides a year of unlimited…

A: Revenue Recognition : It is an accounting principle that says that revenue must be recognized as it…

Q: Determine the following for 2025. a. The number of shares to be used for calculating: (Round answers…

A: EPS stands for Earnings per share which is represented by the entity's profit adjusted for any…

Q: Prepare a classified balance sheet. Assume that $10,000 of the mortgage payable will be paid in…

A: Order of liquidity is the presentation of assets in the balance sheet in the order of the amount of…

Q: Sub : Accounting Pls answer very fast.I ll upvote correct answer. Thank You Financial information…

A: Disclaimer: "Since you have asked multiple questions, we will solve the first three questions for…

Q: Profits have been decreasing for several years at Pegasus Airlines. In an effort to improve the…

A: The financial advantage and disadvantage of discontinue the product is calculated by deducting the…

Q: If Rasputin contributes cash of $20,500 to the partnership, how would this amount be distributed to…

A: If cash is brought in by a partner it will be distributed among partners as per the terms outlined…

Q: On January 1, 2020, Norma Smith and Grant Wood formed a computer sales and service company in…

A: Income Statement - An income Statement is a financial statement that includes revenue earned and…

Q: Bridgeport Corporation is in the business of selling cattle. Due to recent diseases plaguing cattle,…

A: The corporate entities keep track of the business transactions in the journal in order to keep track…

Q: Explain the difference between cash flow statement and fund flow statement and identify why…

A: The Cash Flow Statement is a financial statement that provides information about the cash inflows…

Q: Journalize the transactions. (List all debit entries before credit entries. Record journal entries…

A: The common shares represent the ownership portion of the company. The common shareholder is…

Q: How should a change in accounting estimate be recognized and disclosed in the financial statements?

A: As per IAS 8 Accounting policies, changes in accounting estimates and errors an accounting estimate…

Q: E14.3 01) Tim Latimer Ltd. had the following transactions. dividendo 1. Sold land (cost £12,000) for…

A: In order to record a business transaction in the accounting records of the company, a journal entry…

Q: Number of orders Units per order Sales returns: Number of returns Total units returned Number of…

A: Calculation of total cost for Colleen Company to service Jerry, Incorporated and Kate Company and…

Q: Sub : Accounting Pls answer very fast.I ll upvote correct answer. Thank You Financial information…

A: The inventory turnover ratio indicates the information about how many times the inventory was sold.…

Q: Barley Hopp, Inc., manufactures custom-ordered commemorative beer steins. Its standard cost…

A: Fixed overhead spending variance=Budgeted fixed overhead-Actual fixed overhead Fixed overhead volume…

Q: he firm is paying pretax $100,000 per year for services included in Contract A. There are 5…

A: Pre-tax benefits are those that are taken out of your pay check before taxes are calculated, like a…

Q: Whirly Corporation's contribution format income statement for the most recent month is shown below:…

A: The method for calculating the profitability of a given investment is known in the real estate…

Please do not give solution in image format thanku

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- Danna Martin, president of Mays Electronics, was concerned about the end-of-the year marketing report that she had just received. According to Larry Savage, marketing manager, a price decrease for the coming year was again needed to maintain the companys annual sales volume of integrated circuit boards (CBs). This would make a bad situation worse. The current selling price of 18 per unit was producing a 2-per-unit profithalf the customary 4-per-unit profit. Foreign competitors kept reducing their prices. To match the latest reduction would reduce the price from 18 to 14. This would put the price below the cost to produce and sell it. How could these firms sell for such a low price? Determined to find out if there were problems with the companys operations, Danna decided to hire a consultant to evaluate the way in which the CBs were produced and sold. After two weeks, the consultant had identified the following activities and costs: The consultant indicated that some preliminary activity analysis shows that per-unit costs can be reduced by at least 7. Since the marketing manager had indicated that the market share (sales volume) for the boards could be increased by 50% if the price could be reduced to 12, Danna became quite excited. Required: 1. CONCEPTUAL CONNECTION What is activity-based management? What phases of activity analysis did the consultant provide? What else remains to be done? 2. CONCEPTUAL CONNECTION Identify as many nonvalue-added costs as possible. Compute the cost savings per unit that would be realized if these costs were eliminated. Was the consultant correct in the preliminary cost reduction assessment? Discuss actions that the company can take to reduce or eliminate the nonvalue-added activities. 3. Compute the unit cost required to maintain current market share, while earning a profit of 4 per unit. Now compute the unit cost required to expand sales by 50%, assuming a per-unit profit of 4. How much cost reduction would be required to achieve each unit cost? 4. Assume that further activity analysis revealed the following: switching to automated insertion would save 60,000 of engineering support and 90,000 of direct labor. Now, what is the total potential cost reduction per unit available from activity analysis? With these additional reductions, can Mays achieve the unit cost to maintain current sales? To increase it by 50%? What form of activity analysis is this: reduction, sharing, elimination, or selection? 5. CONCEPTUAL CONNECTION Calculate income based on current sales, prices, and costs. Then calculate the income by using a 14 price and a 12 price, assuming that the maximum cost reduction possible is achieved (including Requirement 4s reduction). What price should be selected?Boxer Production, Inc., is in the process of considering a flexible manufacturing system that will help the company react more swiftly to customer needs. The controller, Mick Morrell, estimated that the system will have a 10-year life and a required return of 10% with a net present value of negative $500,000. Nevertheless, he acknowledges that he did not quantify the potential sales increases that might result from this improvement on the issue of on-time delivery, because it was too difficult to quantify. If there is a general agreement that qualitative factors may offer an additional net cash flow of $150,000 per year, how should Boxer proceed with this Investment?Cost-Volume-Profit, Margin of Safety Victoria Company produces a single product. Last years income statement is as follows: Required: 1. Compute the break-even point in units and sales dollars calculated using the break-even units. 2. What was the margin of safety for Victoria last year in sales dollars? 3. Suppose that Victoria is considering an investment in new technology that will increase fixed cost by 250,000 per year but will lower variable costs to 45% of sales. Units sold will remain unchanged. Prepare a budgeted income statement assuming that Victoria makes this investment. What is the new break-even point in sales dollars, assuming that the investment is made?

- Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).Sales Revenue Approach, Variable Cost Ratio, Contribution Margin Ratio Arberg Companys controller prepared the following budgeted income statement for the coming year: Required: 1. What is Arbergs variable cost ratio? What is its contribution margin ratio? 2. Suppose Arbergs actual revenues are 30,000 more than budgeted. By how much will operating income increase? Give the answer without preparing a new income statement 3. How much sales revenue must Arberg earn to break even? Prepare a contribution margin income statement to verify the accuracy of your answer. 4. What is Arbergs expected margin of safety? 5. What is Arbergs margin of safety if sales revenue is 380,000?Gagnon Company reported the following sales and quality costs for the past four years. Assume that all quality costs are variable and that all changes in the quality cost ratios are due to a quality improvement program. Required: 1. Compute the quality costs for all four years. By how much did net income increase from Year 1 to Year 2 because of quality improvements? From Year 2 to Year 3? From Year 3 to Year 4? 2. The management of Gagnon Company believes it is possible to reduce quality costs to 2.5 percent of sales. Assuming sales will continue at the Year 4 level, calculate the additional profit potential facing Gagnon. Is the expectation of improving quality and reducing costs to 2.5 percent of sales realistic? Explain. 3. Assume that Gagnon produces one type of product, which is sold on a bid basis. In Years 1 and 2, the average bid was 400. In Year 1, total variable costs were 250 per unit. In Year 3, competition forced the bid to drop to 380. Compute the total contribution margin in Year 3 assuming the same quality costs as in Year 1. Now, compute the total contribution margin in Year 3 using the actual quality costs for Year 3. What is the increase in profitability resulting from the quality improvements made from Year 1 to Year 3?

- The president of Poleski would like to know the effect that each of the following suggestions for improving performance would have on contribution margin per unit, sales needed to break even, and projected net income for next year. Each change should be considered independently. Reset the Data Section to its original values after each suggestion is analyzed. Fill in the table following the suggestions with the results of your analysis. a. The president suggests cutting the products price. Since the market is relatively sensitive to price, . . . a 10% cut in price ought to generate a 30% increase in sales (to 156,000 units). How can you lose? b. The sales manager feels that putting all sales personnel on straight commission would help. This would eliminate 77,000 in fixed sales salaries expense. Variable sales commissions would increase to 2.00 per unit. This move would also increase sales volume by 30%. c. Poleskis head of product engineering wants to redesign the package for the product. This will cut 1.00 per unit from direct materials and 0.50 per unit from direct labor, but will increase fixed factory overhead by 100,000 for additional depreciation on the new packaging machine. The package redesign would not affect sales volume. d. The firms consumer marketing manager suggests undertaking a new advertising campaign on Facebook. This would cost 30,000 more than is currently planned for advertising but would be expected to increase sales volume by 30%. e. The production superintendent suggests raising quality and raising price. This will increase direct materials by 1.00 per unit, direct labor by 0.50 per unit, and fixed factory overhead by 110,000. With improved quality, . . . raise the price to 18.50 and advertise the heck out of it. If you double your current planned advertising, Ill bet you can increase your sales volume by 30%.Hammond Company runs a driving range and golf shop. The budgeted income statement for the coming year is as follows. Required: 1. What is Hammonds variable cost ratio? Its contribution margin ratio? 2. Suppose Hammonds actual revenues are 200,000 greater than budgeted. By how much will before-tax profits increase? Give the answer without preparing a new income statement. 3. How much sales revenue must Hammond earn in order to break even? What is the expected margin of safety? (Round your answers to the nearest dollar.) 4. How much sales revenue must Hammond generate to earn a before-tax profit of 130,000? An after-tax profit of 90,000? (Round your answers to the nearest dollar.) Prepare a contribution margin income statement to verify the accuracy of your last answer.Aldovar Company produces a variety of chemicals. One division makes reagents for laboratories. The divisions projected income statement for the coming year is: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. (Note: Round answer to the nearest unit.) Calculate the contribution margin ratio and use it to calculate the break-even sales revenue. (Note: Round contribution margin ratio to four decimal places, and round the break-even sales revenue to the nearest dollar.) 2. The divisional manager has decided to increase the advertising budget by 250,000. This will increase sales revenues by 1 million. By how much will operating income increase or decrease as a result of this action? 3. Suppose sales revenues exceed the estimated amount on the income statement by 1,500,000. Without preparing a new income statement, by how much are profits underestimated? 4. Compute the margin of safety based on the original income statement. 5. Compute the degree of operating leverage based on the original income statement. If sales revenues are 8% greater than expected, what is the percentage increase in operating income? (Note: Round operating leverage to two decimal places.)

- The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that 143,750,000 of assets have been invested in the Consumer Products Division. b. If expenses could be reduced by 3,450,000 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division?At the beginning of the last quarter of 20x1, Youngston, Inc., a consumer products firm, hired Maria Carrillo to take over one of its divisions. The division manufactured small home appliances and was struggling to survive in a very competitive market. Maria immediately requested a projected income statement for 20x1. In response, the controller provided the following statement: After some investigation, Maria soon realized that the products being produced had a serious problem with quality. She once again requested a special study by the controllers office to supply a report on the level of quality costs. By the middle of November, Maria received the following report from the controller: Maria was surprised at the level of quality costs. They represented 30 percent of sales, which was certainly excessive. She knew that the division had to produce high-quality products to survive. The number of defective units produced needed to be reduced dramatically. Thus, Maria decided to pursue a quality-driven turnaround strategy. Revenue growth and cost reduction could both be achieved if quality could be improved. By growing revenues and decreasing costs, profitability could be increased. After meeting with the managers of production, marketing, purchasing, and human resources, Maria made the following decisions, effective immediately (end of November 20x1): a. More will be invested in employee training. Workers will be trained to detect quality problems and empowered to make improvements. Workers will be allowed a bonus of 10 percent of any cost savings produced by their suggested improvements. b. Two design engineers will be hired immediately, with expectations of hiring one or two more within a year. These engineers will be in charge of redesigning processes and products with the objective of improving quality. They will also be given the responsibility of working with selected suppliers to help improve the quality of their products and processes. Design engineers were considered a strategic necessity. c. Implement a new process: evaluation and selection of suppliers. This new process has the objective of selecting a group of suppliers that are willing and capable of providing nondefective components. d. Effective immediately, the division will begin inspecting purchased components. According to production, many of the quality problems are caused by defective components purchased from outside suppliers. Incoming inspection is viewed as a transitional activity. Once the division has developed a group of suppliers capable of delivering nondefective components, this activity will be eliminated. e. Within three years, the goal is to produce products with a defect rate less than 0.10 percent. By reducing the defect rate to this level, marketing is confident that market share will increase by at least 50 percent (as a consequence of increased customer satisfaction). Products with better quality will help establish an improved product image and reputation, allowing the division to capture new customers and increase market share. f. Accounting will be given the charge to install a quality information reporting system. Daily reports on operational quality data (e.g., percentage of defective units), weekly updates of trend graphs (posted throughout the division), and quarterly cost reports are the types of information required. g. To help direct the improvements in quality activities, kaizen costing is to be implemented. For example, for the year 20x1, a kaizen standard of 6 percent of the selling price per unit was set for rework costs, a 25 percent reduction from the current actual cost. To ensure that the quality improvements were directed and translated into concrete financial outcomes, Maria also began to implement a Balanced Scorecard for the division. By the end of 20x2, progress was being made. Sales had increased to 26,000,000, and the kaizen improvements were meeting or beating expectations. For example, rework costs had dropped to 1,500,000. At the end of 20x3, two years after the turnaround quality strategy was implemented, Maria received the following quality cost report: Maria also received an income statement for 20x3: Maria was pleased with the outcomes. Revenues had grown, and costs had been reduced by at least as much as she had projected for the two-year period. Growth next year should be even greater as she was beginning to observe a favorable effect from the higher-quality products. Also, further quality cost reductions should materialize as incoming inspections were showing much higher-quality purchased components. Required: 1. Identify the strategic objectives, classified by the Balanced Scorecard perspective. Next, suggest measures for each objective. 2. Using the results from Requirement 1, describe Marias strategy using a series of if-then statements. Next, prepare a strategy map. 3. Explain how you would evaluate the success of the quality-driven turnaround strategy. What additional information would you like to have for this evaluation? 4. Explain why Maria felt that the Balanced Scorecard would increase the likelihood that the turnaround strategy would actually produce good financial outcomes. 5. Advise Maria on how to encourage her employees to align their actions and behavior with the turnaround strategy.The president of a small manufacturing firm is concerned about the continual increase in manufacturing costs over the past several years. The following figures provide a time series of the cost per unit for the firms leading product over the past eight years: a. Construct a time series plot. What type of pattern exists in the data? b. Use simple linear regression analysis to find the parameters for the line that minimizes MSE for this time series. c. What is the average cost increase that the firm has been realizing per year? d. Compute an estimate of the cost/unit for next year.