preciation expense u

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 17P: On December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and...

Related questions

Question

Determine the audited balance of

Transcribed Image Text:An analysis of incomplete records of Angel Corporation produced the following information applicable

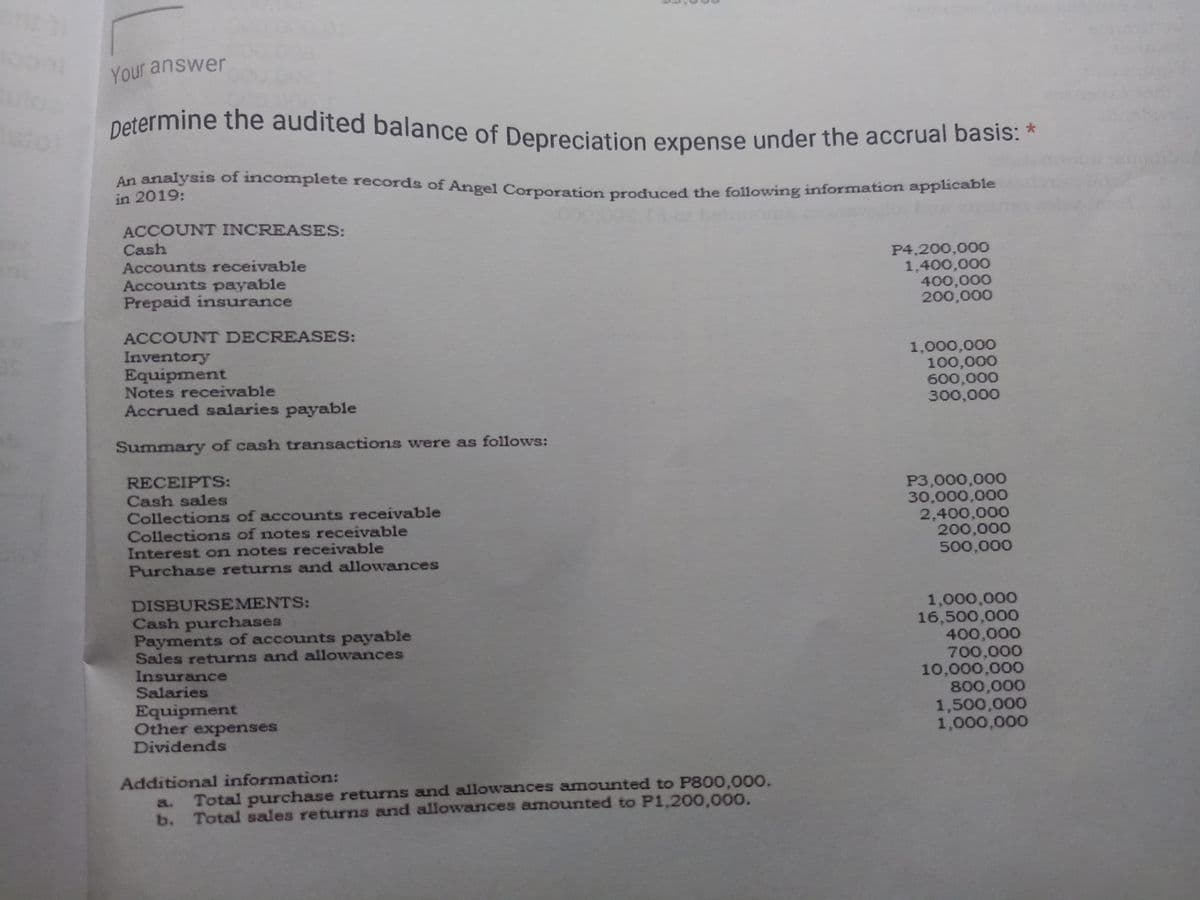

Determine the audited balance of Depreciation expense under the accrual basis: *

Your answer

petermine the audited balance of Depreciation expense under the accrual basis: *

An analysis of incomplete records of Angel Corporation produced the following information appieabie

in 2019:

ACCOUNT INCREASES:

Cash

Accounts receivable

Accounts payable

Prepaid insurance

P4,200,000

1,400,000

400,000

200,000

ACCOUNT DECREASES:

Inventory

Equipment

Notes receivable

1,000,000

100,000

600,000

300,000

Accrued salaries payable

Summary of cash transactions were as follows:

RECEIPTS:

Cash sales

Collections of accounts receivable

Collections of notes receivable

Interest on notes receivable

Purchase returns and allowances

P3,000,000

30,000,000

2,400,000

200,000

500,000

DISBURSEMENTS:

Cash purchases

Payments of accounts payable

Sales returns and allowances

Insurance

Salaries

1,000,000

16,500,000

400,000

700,000

10,000,000

800,000

1,500,000

1,000,000

Equipment

Other expenses

Dividends

Additional information:

a.

Total purchase returns and allowances amounted to P800,000.

b. Total sales returns and allowances amounted to P1,200,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning