what isAccumulated Depreciation-F&F, Accumulated Depreciation-Eqpt,, Depreciation Expense-F&F, Depreciation Expense-Eqptl,

what isAccumulated Depreciation-F&F, Accumulated Depreciation-Eqpt,, Depreciation Expense-F&F, Depreciation Expense-Eqptl,

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter5: Professional Auditing Standards And The Audit Opinion Formulation Process

Section: Chapter Questions

Problem 51RSCQ: Ray, the owner of a small company, asked Holmes, CPA, to conduct an audit of the company’s records....

Related questions

Question

what isAccumulated

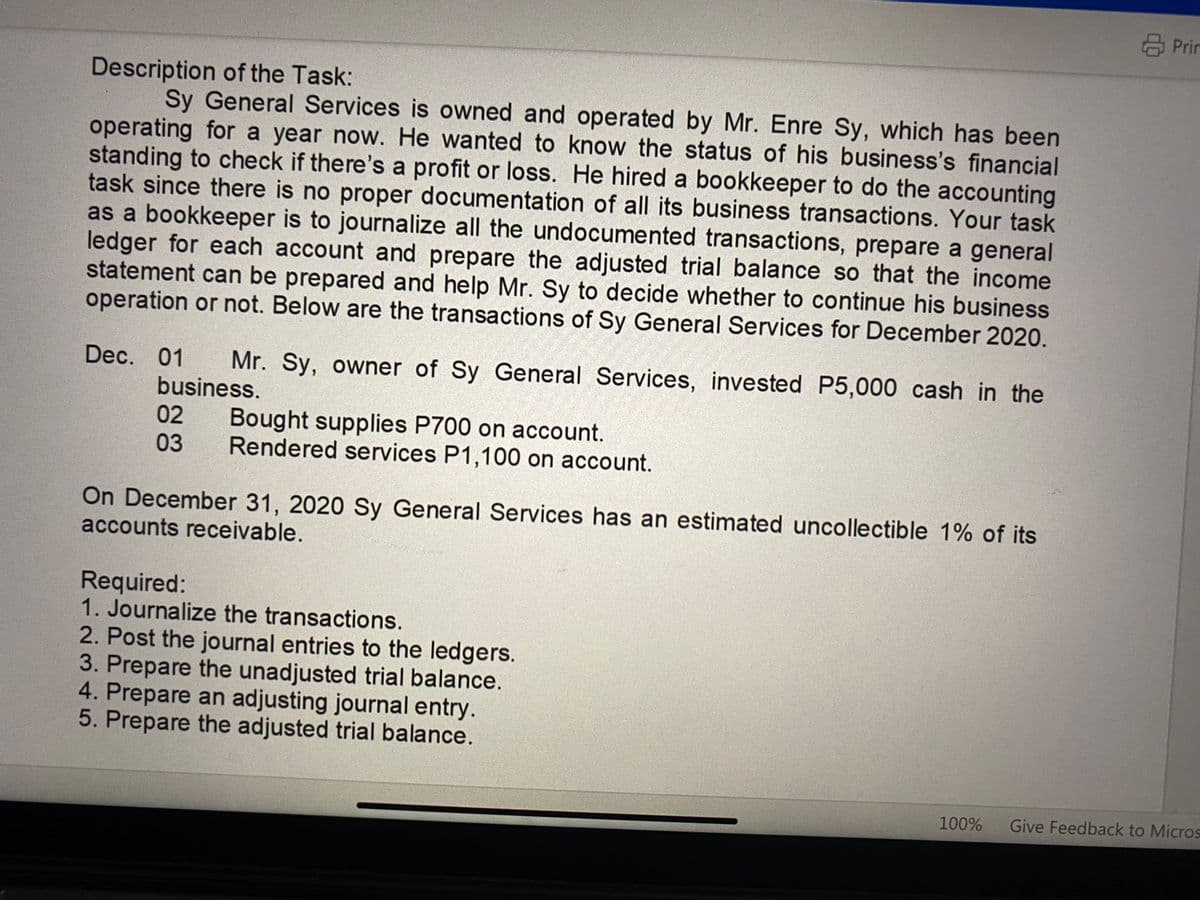

Transcribed Image Text:Description of the Task:

Sy General Services is owned and operated by Mr. Enre Sy, which has been

operating for a year now. He wanted to know the status of his business's financial

standing to check if there's a profit or loss. He hired a bookkeeper to do the accounting

task since there is no proper documentation of all its business transactions. Your task

as a bookkeeper is to journalize all the undocumented transactions, prepare a general

ledger for each account and prepare the adjusted trial balance so that the income

statement can be prepared and help Mr. Sy to decide whether to continue his business

operation or not. Below are the transactions of Sy General Services for December 2020.

Dec. 01 Mr. Sy, owner of Sy General Services, invested P5,000 cash in the

business.

02

Bought supplies P700 on account.

03 Rendered services P1,100 on account.

On December 31, 2020 Sy General Services has an estimated uncollectible 1% of its

accounts receivable.

WADERS

Required:

1. Journalize the transactions.

2. Post the journal entries to the ledgers.

3. Prepare the unadjusted trial balance.

4. Prepare an adjusting journal entry.

5. Prepare the adjusted trial balance.

Prin

100% Give Feedback to Micros

Transcribed Image Text:1 of 3

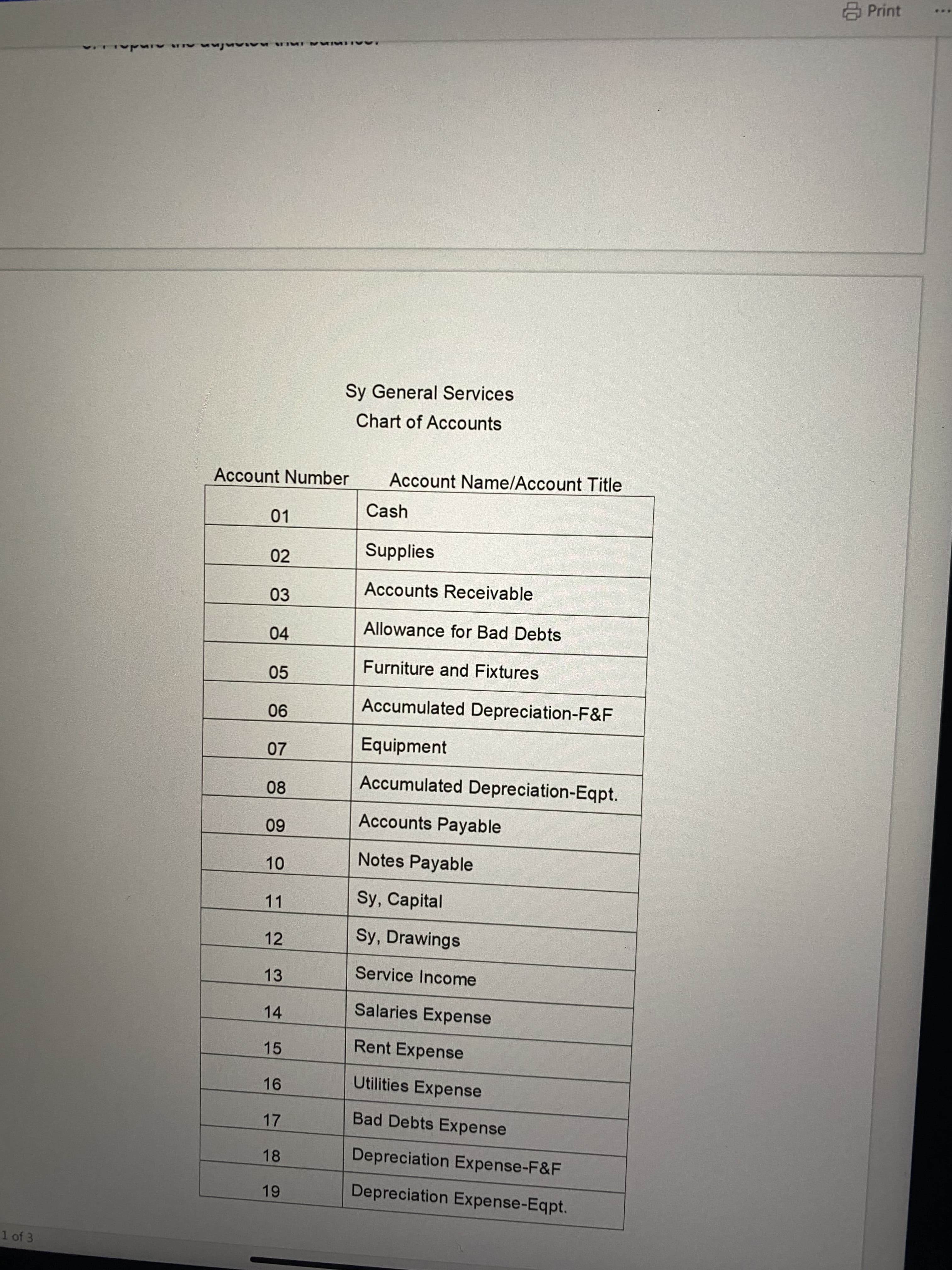

Sy General Services

Chart of Accounts

Account Number

01

02

03

04

05

06

07

08

09

10

11

12

13

14

15

16

17

18

19

Account Name/Account Title

Cash

Supplies

Accounts Receivable

Allowance for Bad Debts

Furniture and Fixtures

Accumulated Depreciation-F&F

Equipment

Accumulated Depreciation-Eqpt.

Accounts Payable

Notes Payable

Sy, Capital

Sy, Drawings

Service Income

Salaries Expense

Rent Expense

Utilities Expense

Bad Debts Expense

Depreciation Expense-F&F

Depreciation Expense-Eqpt.

Print

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub