Prepaid expenses Rent revenue Retained earnings Salaries and wages expense Sales revenue (7 E Unearned sales revenue D C ه R Prepare a multiple-step income statement. (List Other revenue and gains before Other expenses and losses.) F % 5 T 5: 6 Y H 31,600 25,800 541,000 706,000 2,585,000 * 18,500 N WILDHORSE CORPORATION Income Statement Year Ended December 31, 2025 U 0 ال M pis 0 F12 لال ــــــــــال ارا - 71°F C _____ delete ا۔

Prepaid expenses Rent revenue Retained earnings Salaries and wages expense Sales revenue (7 E Unearned sales revenue D C ه R Prepare a multiple-step income statement. (List Other revenue and gains before Other expenses and losses.) F % 5 T 5: 6 Y H 31,600 25,800 541,000 706,000 2,585,000 * 18,500 N WILDHORSE CORPORATION Income Statement Year Ended December 31, 2025 U 0 ال M pis 0 F12 لال ــــــــــال ارا - 71°F C _____ delete ا۔

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 18CE: CORNERSTONE 2.1 Four statements are given below. Pewterschmidt Company values its inventory reported...

Related questions

Question

Transcribed Image Text:3

Prepaid expenses

Rent revenue

Retained earnings

Salaries and wages expense

Sales revenue

E

Unearned sales revenue

$

F4

R

DE

Tc

C

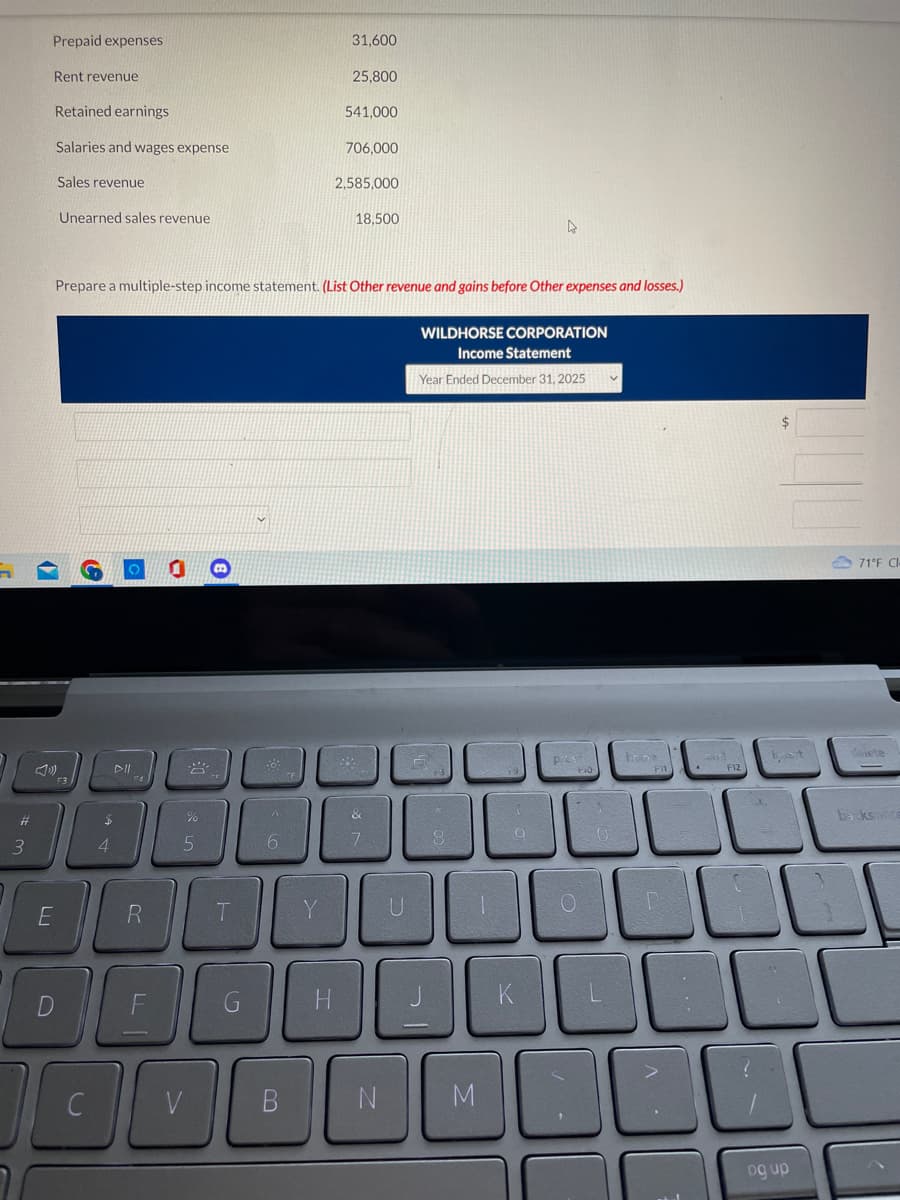

Prepare a multiple-step income statement. (List Other revenue and gains before Other expenses and losses.)

%

5

V

m

T

G

Fő!

A

6

B

Y

H

31,600

25,800

541,000

706,000

2,585,000

28

18,500

&

7

N

U

WILDHORSE CORPORATION

Income Statement

Year Ended December 31, 2025

21

8

M

9

PAS

K

hone

OLL

000000

000C

000

20

and

• F12

t

og up

71°F Cl-

delete

backsonce

Transcribed Image Text:C

#m

X

3

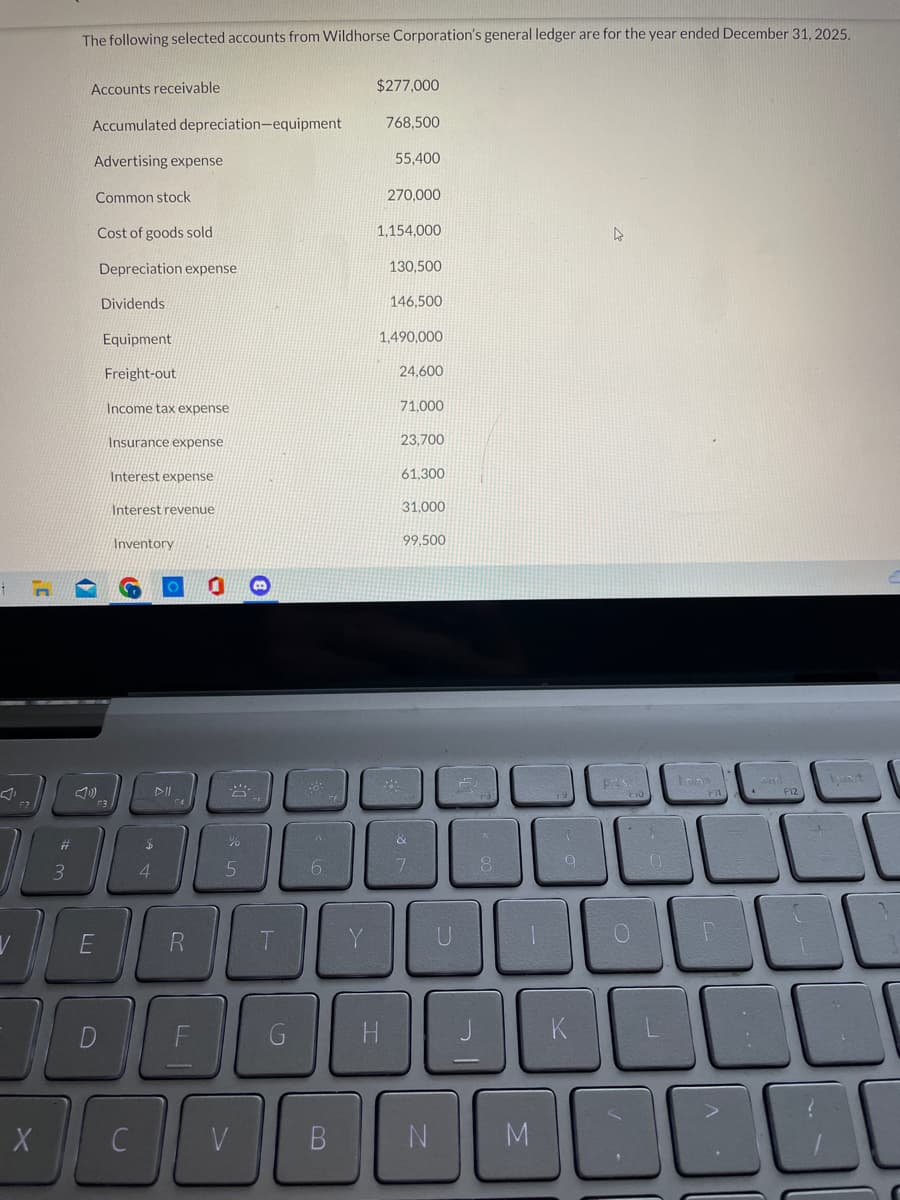

The following selected accounts from Wildhorse Corporation's general ledger are for the year ended December 31, 2025.

Accounts receivable

Accumulated depreciation-equipment

Advertising expense

Common stock

4

Cost of goods sold

Depreciation expense

Dividends

Equipment

Freight-out

Income tax expense

F3

Insurance expense

Interest expense

Interest revenue

Inventory

C

DII

$

4

R

0

100

и до

V

T

A

6

m

$277,000

768,500

T

55,400

270.000

1,154,000

130.500

146,500

1,490,000

24,600

71,000

23,700

61,300

31,000

99,500

7

N

D

기

8

-

7

M

a

▷

prisc

home

O

FA

3000

JOOL

0000

a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning