Prepare a bank reconciliation statement of the given information above.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 21CE: Cornerstone Exercise 4-21 Cash Over and Short On a recent day, Pence Company obtained the following...

Related questions

Question

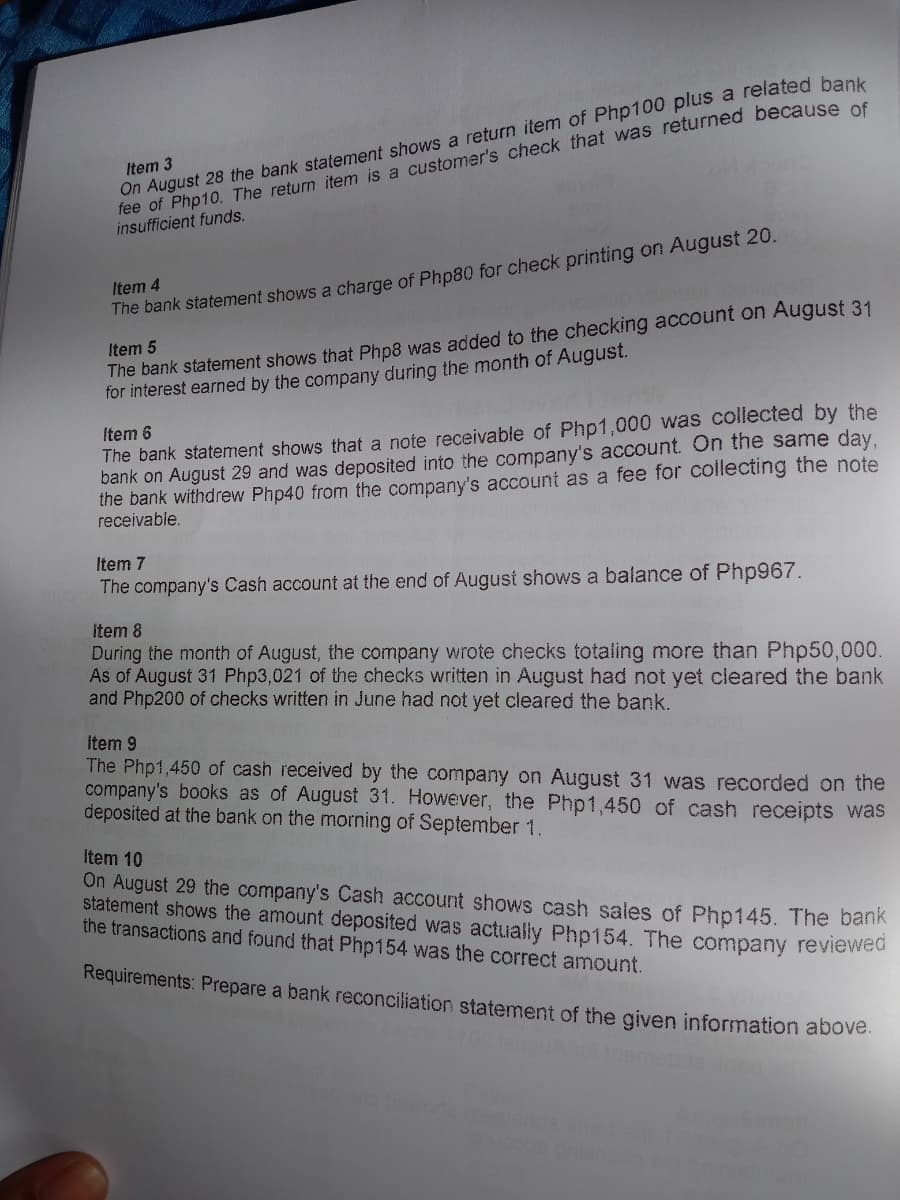

Transcribed Image Text:On August 28 the bank statement shows a return item of Php100 plus a related bank

fee of Php10. The return item is a customer's check that was returned because of

insufficient funds.

Item 3

Item 4

The bank statement shows a charge of Php80 for check printing on August 20.

The bank statement shows that Php8 was added to the checking account on August 31

for interest earned by the company during the month of August.

Item 5

The bank statement shows that a note receivable of Php1,000 was collected by the

bank on August 29 and was deposited into the company's account. On the same day,

the bank withdrew Php40 from the company's account as a fee for collecting the note

receivable.

Item 6

Item 7

The company's Cash account at the end of August shows a balance of Php967.

Item 8

During the month of August, the company wrote checks totaling more than Php50,000.

As of August 31 Php3,021 of the checks written in August had not yet cleared the bank

and Php200 of checks written in June had not yet cleared the bank.

Item 9

The Php1,450 of cash received by the company on August 31 was recorded on the

company's books as of August 31. However, the Php1,450 of cash receipts was

deposited at the bank on the morning of September 1.

Item 10

On August 29 the company's Cash account shows cash sales of Php145. The bank

statement shows the amount deposited was actually Php154. The company reviewed

the transactions and found that Php154 was the correct amount.

Requirements: Prepare a bank reconciliation statement of the given information above.

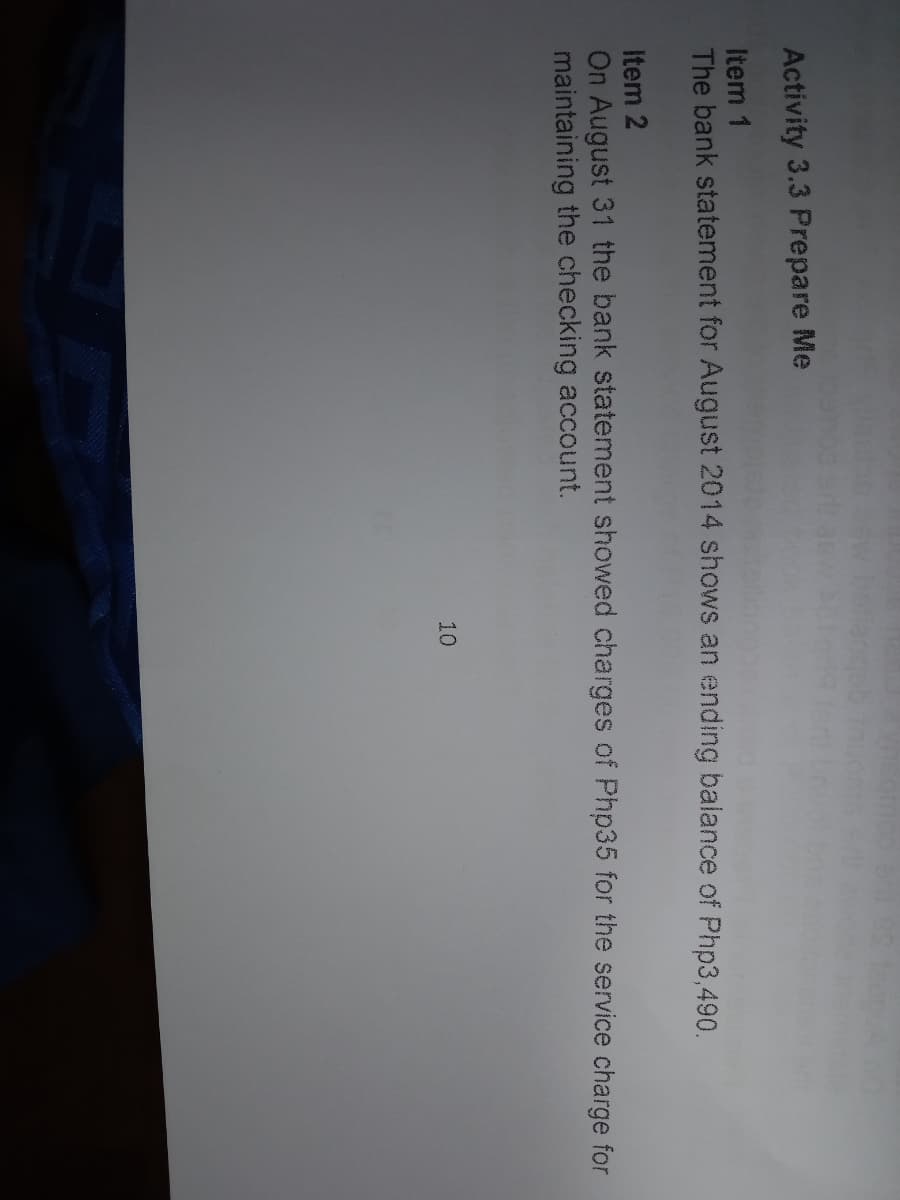

Transcribed Image Text:Activity 3.3 Prepare Me

Item 1

The bank statement for August 2014 shows an ending balance of Php3,490.

Item 2

On August 31 the bank statement showed charges of Php35 for the service charge for

maintaining the checking account.

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning