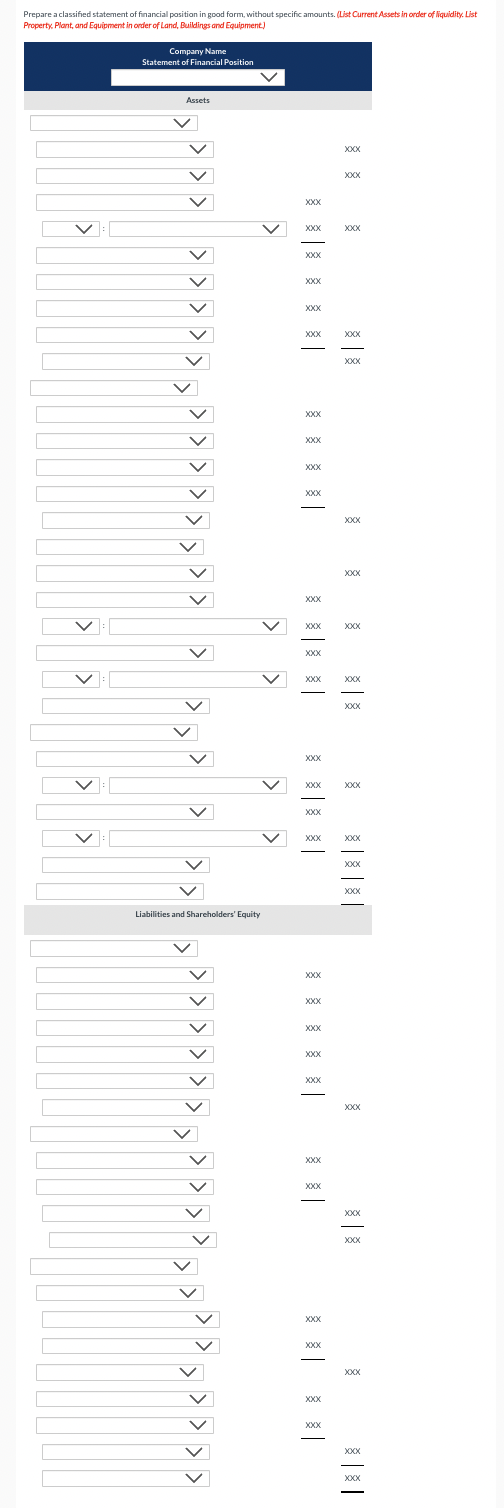

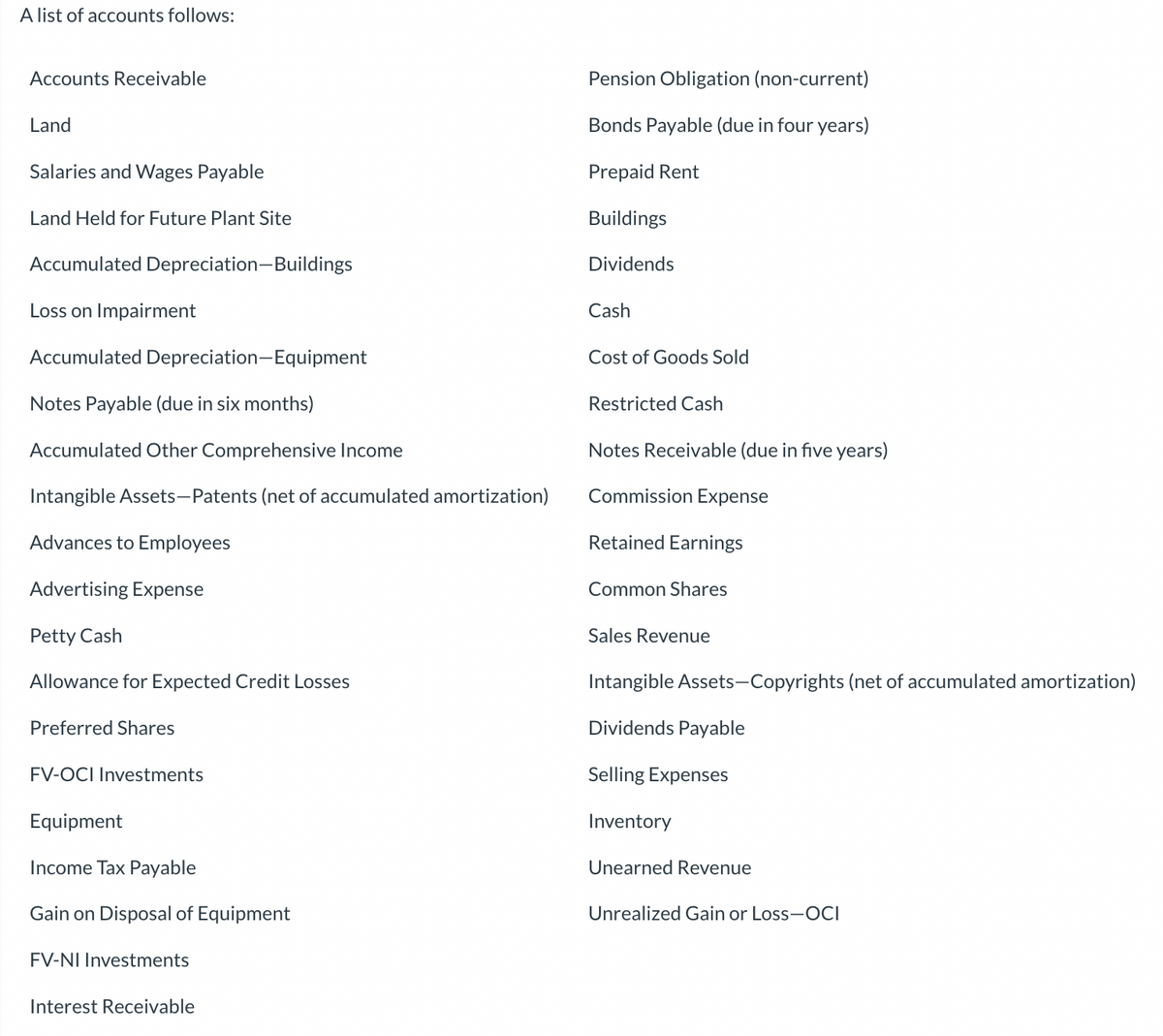

Prepare a classified statement of financial position in good form, without specific amounts. (List Current Assets in order of liquidity List Property Plant, and Equipment in order of Land, Buildings and Equipment)

Q: Morganton Company makes one product and it provided the following information to help prepare the…

A: Ending Finished goods Inventory Finished Goods Ending Stock is the quantity of goods that are…

Q: At the start of production, McKenzie Company adds all the raw materials that will be needed for…

A: Units completed are those units which are completed by an entity during a period. It represents the…

Q: A comparative balance sheet for Bonita Corporation is presented as follows. Assets Cash Accounts…

A: The Cash flow statement is prepared to record the cash flow from various activities during the…

Q: Let's say you made a mistake and overestimated the value of breeding livestock by $15,000. How would…

A: Lets understand the basics. Liquidity ratio calculates company's ability to pay its short term…

Q: One of Matthew Corporation's competitors has learned that Matthew has a total expense per unit of…

A: Variable Cost Per Unit: The quantity of labor, materials, and other resources that are necessary in…

Q: What Are the Relevant Facts?

A: Disclaimer: “Since you have asked multiple questions, we will solve the first question for you. If…

Q: What are the three categories of contributions based on donor intent? pease answer in detail

A: Donor Intent The goal of a donation is determined by the donor's intent, which includes the intended…

Q: Cushman company had $836,000 in sales, sales discounts of $12540, sales returns and allowances of…

A: Net Sales :— It is calculated by deducting sales discount and sales return & allowance from…

Q: PSC 4-5 Define Miscellaneous Deductions Match each of the voluntary deductions listed with the…

A: The deductions refers to the amount that is reduced from the gross income of an individual to…

Q: Every six months for 5 years, a father places Php8,200 in a trust fund for his only child's…

A: The future value of an annuity is the value of a group of recurring payments at a certain date in…

Q: Problem III * Nogueiras Corp's budgeted monthly sales are P5,000, and they are constant from month…

A: Cash budget refers to estimation of cash flows during the specified period of time. It indicates the…

Q: when putting together an income statement do the revenues and expenses have to put in order from…

A: No, it is not necessary that the amount of revenues and expenses have to be in order from highest to…

Q: Grumpy Corporation originally reported $1,200,000 of net income from continuing operations in…

A: Earnings per share indicate the profits per share of common stockholders. It can be calculated by…

Q: ash. accounts Receivable. supplies.. repaid Insurance. Office Equipment.. Accounts Payable..…

A: Trial balance refers to the financial document which reflects the end balances of all the ledger…

Q: Acheson Corporation, which applies manufacturing overhead on the basis of machine-hours, has…

A: The predetermined overhead rate is based on the Estimated manufacturing overhead and the estimated…

Q: The City of Chessie received two contributions during its current fiscal year: A developer…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Wildhorse Company has the following information available for September 2022. Unit selling price of…

A: Cost volume profit analysis is the technique used by management for decision-making. The methods…

Q: S Required information [The following information applies to the questions displayed below.] Hemming…

A: Cost of goods sold = Opening stock + Purchases - Closing Stock

Q: QUESTION 1 The journal entry to reca O о о Manufacturing Ov Work in Process Manufacturing Ov…

A: The correct option with proper explanation are as follows

Q: Griffin Service Company, Inc., was organized by Bennett Griffin and five other investors (that is,…

A: Accounting equation represents that the asses is equal to the sum of liabilities and stockholders'…

Q: Mozzie Ltd has a functional currency of A$. On 1 April 2023, Mozzie Ltd sells goods to a customer on…

A: Solution: Correct answer : (a) DR Account Receivable $130,000 CR…

Q: On December 1, Mogro Corporation had $26,000 of raw materials on hand. During the month, the…

A: The correct option with proper explanation are as follows

Q: Bad Debt Expense: Percentage of Credit Sales Method Gilmore Cash sales Credit sales Accounts…

A: Calculation of above requirement are as follows

Q: Suppose the Federal Reserve increased deposits by $100 billion, but the reserve requirement on all…

A: Money supply refers to the currency and the instruments in the liquid form in the economy of the…

Q: Direct materials. Direct labor Manufacturing overhead Cost of goods sold B300 $ 400,400 $ 120,400…

A: Lets understnad the basics. Traditional costing allocates the overhead based on some individual…

Q: A company reports the following for one of its products. Direct materials standard (4 pounds @ $2…

A: DIRECT MATERIAL COST VARIANCE Direct Material Cost Variance is the Difference between the Actual…

Q: The October transactions were as follows: Oct. 5 Received $800 cash from customers on account. 10…

A: JOURNAL ENTRY Journal entry is the Techniques of Recording initial Transaction in a Proper…

Q: Coy and Matt are equal partners in the Matcoy Partnership. Each partner has a basis in his…

A: Distributed Property: According to the distributive property, the same result is obtained when…

Q: Newly formed S&J Iron Corporation has 53,000 shares of $3 par common stock authorized. On March 1,…

A: calculation of above requirement are as follows

Q: Sports Manufacturing Company produces baseball bats. They have recently moved from handcrafted bats…

A: The question is based on the concept of Cost Accounting.

Q: Cash Accounts receivable Supplies Inventory Land Building $100,000 Less: Accum. Depreciation 20,000…

A: Property, Plant, and Equipment: - Property, Plant, and Equipment (PPE) is the non-current tangible…

Q: The following questions relate to Kyle Company, which manufactures products KA, KB, and KC from a…

A: Two different allocation method are used for joint cost distribution between the three products. The…

Q: Question: Prepare the Journal Entries, General Ledger, Adjusted Trial Balance

A: Journal Entry In order to document a business transaction in the accounting records of the company,…

Q: why it is necessary to monitor cost per product or unit operating cost in order to determine the…

A: Unit cost or unit operating cost is the cost per unit produced. It helps in deciding and formulating…

Q: Mr. Juan Lopez launched Lopez Fiesta Mart on December 1, 2022 with a cash investment of ₱220,000.…

A: Adjusted Trial Balance The general ledger account balances are shown in an adjusted trial balance…

Q: E OR FALSE 2. if there is sufficient proof that the acquisition has been made for a business…

A: Corporation - An organization that has been registered as a corporation under a corporation act has…

Q: Required information [The following information applies to the questions displayed below.] BatCo…

A:

Q: Select from the following list the qualitative characteristic of useful information that best…

A:

Q: When AppGame Company delivers pizza to customers on account and bills its customer accounts, it…

A: CREDIT SALE Credit sales are also known as sales made on account. credit sales are purchases…

Q: a) Prepare a production budget for May & June for OldX and NewX b) Prepare a materials (Component A)…

A: Production Budget for OldX and NewX…

Q: Lillian and Jackson Clark are a married couple in their early 20s living in Los Angeles. Jackson…

A: First, Persons Lillian and Jackson Clark would like to determine the total amount of their itemized…

Q: granted

A:

Q: ABC Company disposed of two different assets. On January 1, prior to their disposal, the accounts…

A: Introduction: A journal entry is a business transaction that is recorded in a company's accounting…

Q: On May 10, Hudson Computing sold 90 Millennium laptop computers to Apex Publishers. At the date of…

A: The question is based on the concept of Cost Accounting.

Q: Twenty sets of office furniture are purchased with a down payment of Php90,000 and the ce at…

A: The monthly installments carry the payment of principal amount and payment for the interest also but…

Q: Pls explain first how you solve it. Thank you. F COMPANY, organized on March 1, 2021, has a very…

A: .

Q: During its first year of operations, Cupola Fan Corporation issued 34,000 of $1 par Class B shares…

A: According to the given question, we are required to prepare the journal entries. Journal entries:…

Q: I cannot believe it is almost year end! Only a few days before it's 2022. As you recall, I was lucky…

A: The fact that the shares are now trading at a price that is eight times higher than the price you…

Q: Prepare the "Stockholders' Equity" section of the balance sheet as of June 30.

A: Given in the question: Common stock $1,38,000.00 Paid in capital from Sale of Treasury…

Q: Sales Revenue Cost of Goods Sold Administrative Expenses Loss on Disposal of Equipment Sales…

A: According to the given question, we are required to compute the net income for 2023. Multi-step…

pls answer the following question

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- For each of the following accounts, identify in which section of the classified balance sheet it would be presented: current assets, property, intangibles, other assets, current liabilities, long-term liabilities, or stockholders equity. A. Building B. Cash C. Common Stock D. Copyright E. Prepaid Advertising F. Notes Payable (due six months later) G. Taxes Payable H. Unearned Rent RevenueFor each of the following accounts, identify in which section of the classified balance sheet it would be presented: current assets, property, intangibles, other assets, current liabilities, long-term liabilities, or stockholders equity. A. Accounts Payable B. Accounts Receivable C. Cash D. Equipment E. Land F. Notes Payable (due two years later) G. Prepaid Insurance H. SuppliesThe following is the ending balances of accounts at June 30, 2018 for Excell Company.Account Title Debits CreditsCash $ 83,000Short-term investments 65,000Accounts receivable 280,000Prepaid expenses (for the next 12 months) 32,000Land 75,000Buildings 320,000Accumulated depreciation—buildings $ 160,000Equipment 265,000Accumulated depreciation—equipment 120,000Accounts payable 173,000Accrued expenses 45,000Notes payable 100,000Mortgage payable 250,000Common stock 100,000Retained earnings 172,000Totals $1,120,000 $1,120,000Additional Information:1. The short-term investments account includes $18,000 in U.S. treasury bills purchased in May. The billsmature in July.2. The accounts receivable account consists of the following:a. Amounts owed by customers $225,000 b. Allowance for uncollectible accounts—trade customers (15,000)c. Nontrade note receivable (due in three years) 65,000 d. Interest receivable on note (due in four months) 5,000Total $280,0003. The notes payable account consists of…

- You are presented with the following trial balance of Carl Ltd at 31 October 2018. DrCr R,000Building at costBuildings, accumulated depreciation, 1 November 2018 Plant at costPlant, accumulated depreciation, 1 November 2018 Land at costBank balanceRevenuePurchasesDiscounts receivedReturns inwardsWagesEnergy expensesTrade PayablesTrade ReceivablesInventory at 1 November 2018Allowance for debtors at 1 November 2018 Administrative expensesDirector's remunerationAccumulated profit at 1 November 201810% DebentureDividend paidR1 Ordinary sharesShare premium accountR,000 74060 220110 23550 1,8001,1059035 180 105250 3201601080 70306503,28080 3,280130 50Additional information as at 31 October 2019.a. Closing inventory has been counted and is valued at R75,000b. An invoice of R15 000 for energy expenses for October 2019 has not been received.c. The allowance for debtors is to be increased to 5% of trade receivable.d. Buildings are depreciated at 5% per annum on their original cost, allocated 30%…Imagine you are the financial accountant of Happiness Ltd. You have the following final balances for the different accounts on 31st December 2021 (the accounting-year end): Value (£) Buildings 300,000 Transportation element 148,000 Accumulated depreciation (buildings) at 01/01/2021 52,500 Accumulated depreciation (transportation element) at 01/01/2021 36,800 Salary expense 16,500 Share premium 7,200 Capital 20,000 Retained earnings at 31/12/2020 97,900 Long term debt 190,300 Cash 60,000 Trade receivables 62,500 Inventory at 31/12/2020 40,000 Purchases 10,000 Sales 200,000 Allowance for trade receivables 2,500 Accrued Expenses 19,500 Trade payables 10,300 Required: a)Prepare the Trial Balance corresponding to the above information. b)Considering the following additional information, prepare the Income Statement for Happiness Ltd. on 31/12/2021. Additional…The following information was extracted from the records of Lodh Ltd for the year ended 30 June 2021. Lodh LTD Statement of financial position (extract) As at 30 June 2021 Relevant Assets Accounts Receivable $50,000 Allowance for doubtful debts (4,000) $46,000 Prepaid rent 42,000 Plant 200,000 Accumulated depreciation – Plant (25% on cost) (50,000) 150,000 DTA beginning balance 1,000 … Relevant Liabilities Interest Payable 2,000 Provision for long service leave 10,000 Unearned revenue 20,000 DTL beginning balance 5,000 … Additional information · The tax depreciation for plant is considered at 30% of $200,000 (original cost) at 30 June 2021. · Long service leave has not been taken by any employee during the year. · There…

- The net income reported on the income statement for the current year was $290,000. Depreciation recorded on equipment and a building amounted to $150,500 for the year. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: Endof Year Beginningof Year Cash $117,600 $135,000 Accounts receivable (net) 132,500 141,100 Inventories 291,900 274,300 Prepaid expenses 5,600 7,100 Accounts payable (merchandise creditors) 143,400 172,400 Salaries payable 11,300 6,300 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from (used for) operating activities: $- Select - Adjustments to reconcile net income to net cash flows from (used for)…The net income reported on the income statement for the current year was $210,000. Depreciation recorded on equipment and a building amount to $62,500 for the year. Balances of the current asset and current liabilities accounts at the beginning and end of the year are as follows: End of Year Beginning of Year Cash $56,000 $59,500 Accounts receivable (net) 71,000 73,400 Inventories 140,000 126,500 Prepaid expenses 7,800 8,400 Accounts payable (merchandise creditors) 62,600 66,400 Salaries payable 9,000 8,250 Required: a. Prepare the cash flows from operating activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. Operating Activities Section Cash flows from operating activities: Net income $fill in the blank 5fff63fd0fdcfac_2 Adjustments to reconcile net income to net cash flow from operating activities:…The net income reported on the income statement for the current year was $210,000. Depreciation recorded on equipment and a building amount to $62,500 for the year. Balances of the current asset and current liabilities accounts at the beginning and end of the year are as follows: End of Year Beginning of Year Cash $56,000 $59,500 Accounts receivable (net) 71,000 73,400 Inventories 140,000 126,500 Prepaid expenses 7,800 8,400 Accounts payable (merchandise creditors) 62,600 66,400 Salaries payable 9,000 8,250 Required: a. Prepare the cash flows from operating activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. Operating Activities Section Cash flows from operating activities: $ Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating…

- Selected accounts from Phipps Corporation’s trial balance are as follows. Phipps Corporation Trial Balance December 31 (Selected Accounts) Debit Credit Cash $50,000 Short-Term Marketable Securities 27,000 Accounts Receivable 13,000 Inventories 48,000 Other Current Assets 10,000 Land 100,000 Equipment 45,000 Accumulated Depreciation-Equipment $5,000 Goodwill 30,000 Other Intangible Assets 15,000 Prepare the assets section of the company’s balance sheet. Phipps CorporationBalance SheetDecember 31 Assets Current Assets: $Cash Property, Plant, and Equipment, Net Accounts Receivable Inventories Other Current Assets Total Current Assets $fill in the blank 11 Short-Term Marketable Securities Goodwill Other Intangible Assets Total Assets $fill in the blank 18The net income reported on the income statement for the current year was $281,847. Depreciation recorded on fixed assets and amortization of patents for the year were $32,101 and $10,127, respectively. Balances of current asset and current liability accounts at the end and at the beginning of the year are as follows: End Beginning Cash $37,628 $62,683 Accounts Receivable 120,761 105,004 Inventories 105,470 86,078 Prepaid Expenses 4,242 8,185 Accounts Payable (merchandise creditors) 47,812 74,478 What is the amount of the net cash flows from operating activities reported on the statement of cash flows prepared by the indirect method? a.$351,049 b.$288,926 c.$266,203 d.$255,489Hi pls, make income statement, statement of retained earnings, and ending trial balance. Trial balances (amount in Php) Particulars Debit amount Credit amount Accounts payable Accounts receivable Share capital, common stock Cash Notes payable Property, plant and equipment Accumulated depreciation Allowances for doubtful debts Inventories Prepaid expense Goodwill Estimated tax liability Marketable securities Accrued expense Patents and trademarks Bonds payable Investments Deferred revenue Other liabilities(long term) Retained earnings - 4325 - 11660 - 6200 - - 1750 1250 100 - 1750 - 500 - 1500 - - - 1965 - 9990 - 800 - 3100 540 - - - 750 - 1000 - 2000 - 1650 1000 6240 29035 29035