ash. accounts Receivable. supplies.. repaid Insurance. Office Equipment.. Accounts Payable.. Unearned Revenue.. Peyton Smith, Capital.. Peyton Smith, Drawing. Fors Earned. July Account No. 11 12 14 15 17 21 23 31 32 41 50 51 Debit Credit Balances Balances 9,945 2.750 1,020 2,700 7,500 1,750 2,800 2.550 8,350 7,200 9,000 16,200

ash. accounts Receivable. supplies.. repaid Insurance. Office Equipment.. Accounts Payable.. Unearned Revenue.. Peyton Smith, Capital.. Peyton Smith, Drawing. Fors Earned. July Account No. 11 12 14 15 17 21 23 31 32 41 50 51 Debit Credit Balances Balances 9,945 2.750 1,020 2,700 7,500 1,750 2,800 2.550 8,350 7,200 9,000 16,200

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter4: Completing The Accounting Cycle

Section: Chapter Questions

Problem 4.24EX: Adjustment data on an end-of-period spreadsheet Alert Security Services Co. offers security services...

Related questions

Question

Please help me

Transcribed Image Text:156

Chapter 3 The Adjusting Process

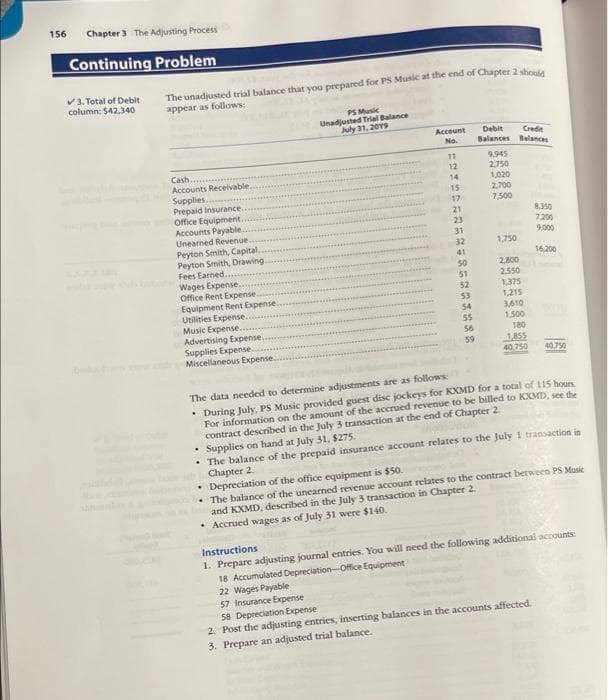

Continuing Problem

3. Total of Debit

column: $42.340

The unadjusted trial balance that you prepared for PS Music at the end of Chapter 2 should

appear as follows:

Cash.

Accounts Receivable.

Supplies.

Prepaid Insurance.

Office Equipment.

Accounts Payable.

Unearned Revenue

Peyton Smith, Capital.

Peyton Smith, Drawing.

Fees Earned.

Wages Expense...

Office Rent Expense.

Equipment Rent Expense.

Utilities Expense..

Music Expense...

Advertising Expense...

Supplies Expense.

Miscellaneous Expense..

PS Music

Unadjusted Trial Balance

July 31, 2019

Account

No.

11

12

14

15

17

22 Wages Payable

57 Insurance Expense

21

23

31

32

41

50

51

52

53

54

55

56

59

Debit

Balances

9,945

2,750

1,020

2,700

7,500

1,750

Credit

Balances

2,800

2.550

1,375

1,215

3,610

1,500

180

1.855

40,750

8,350

7,200

9,000

16.200

The data needed to determine adjustments are as follows:

• During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours

For information on the amount of the accrued revenue to be billed to KXMD, see the

contract described in the July 3 transaction at the end of Chapter 2.

40.750

• Supplies on hand at July 31, $275.

• The balance of the prepaid insurance account relates to the July 1 transaction in

Chapter 2

Depreciation of the office equipment is $50.

The balance of the unearned revenue account relates to the contract between PS Music

and KXMD, described in the July 3 transaction in Chapter 2.

• Accrued wages as of July 31 were $140.

Instructions

1. Prepare adjusting journal entries. You will need the following additional accounts:

18 Accumulated Depreciation Office Equipment

58 Depreciation Expense

2. Post the adjusting entries, inserting balances in the accounts affected.

3. Prepare an adjusted trial balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning