Prepare a horizontal analysis of the income statement. (Negative answers should be indicated by a minus sign. Round your percentage answers to 1 decimal place. (i.e., 0.234 should be entered as 23.4).) Revenues Sales (net) Other revenues Total revenues Expenses FRANKLIN COMPANY Horizontal Analysis of Income Statements Year 4 Cost of goods sold Selling, general, and administrative expenses Interest expense Income tax expense Total expenses Net income (loss) $ 232,000 $ 210,400 8,800 5,700 240,800 216,100 $ 119,200 54,600 6,200 22,700 202,700 38,100 $ Year 3 < Analysis Bal Sheet 102,600 48,800 5,400 21,700 178,500 37,600 % Change % % Analysis Inc Stmt >

Prepare a horizontal analysis of the income statement. (Negative answers should be indicated by a minus sign. Round your percentage answers to 1 decimal place. (i.e., 0.234 should be entered as 23.4).) Revenues Sales (net) Other revenues Total revenues Expenses FRANKLIN COMPANY Horizontal Analysis of Income Statements Year 4 Cost of goods sold Selling, general, and administrative expenses Interest expense Income tax expense Total expenses Net income (loss) $ 232,000 $ 210,400 8,800 5,700 240,800 216,100 $ 119,200 54,600 6,200 22,700 202,700 38,100 $ Year 3 < Analysis Bal Sheet 102,600 48,800 5,400 21,700 178,500 37,600 % Change % % Analysis Inc Stmt >

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter20: Corporations: Organization And Capital Stock

Section: Chapter Questions

Problem 5SEA: STOCKHOLDERS EQUITY SECTION After closing its books on December 31, Pro Parts stockholders equity...

Related questions

Question

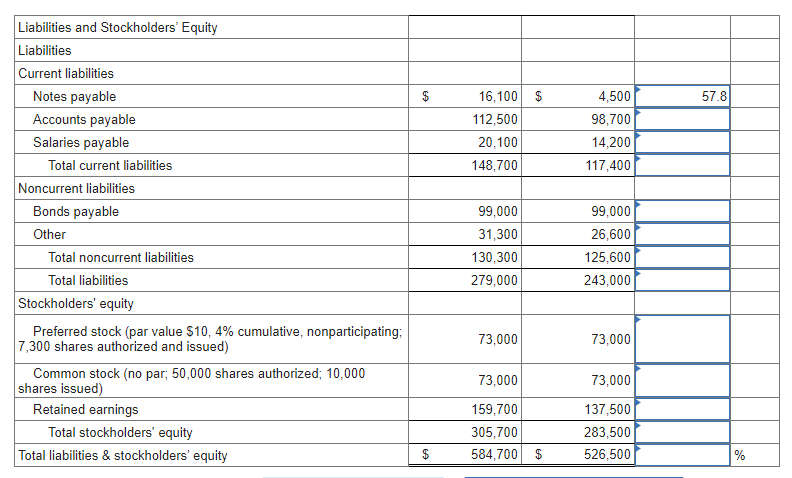

Prepare a horizontal analysis of the balance sheet. (Negative answers should be indicated by a minus sign. Round your percentage answers to 1 decimal place. (i.e., 0.234 should be entered as 23.4).)

Transcribed Image Text:Liabilities and Stockholders' Equity

Liabilities

Current liabilities

Notes payable

Accounts payable

Salaries payable

Total current liabilities

Noncurrent liabilities

Bonds payable

Other

Total noncurrent liabilities

Total liabilities

Stockholders' equity

Preferred stock (par value $10, 4% cumulative, nonparticipating;

7,300 shares authorized and issued)

Common stock (no par; 50,000 shares authorized; 10,000

shares issued)

Retained earnings

Total stockholders' equity

Total liabilities & stockholders' equity

$

16,100 $

112,500

20,100

148,700

99,000

31,300

130,300

279,000

73,000

73,000

159,700

305,700

584,700 $

4,500

98,700

14,200

117,400

99,000

26,600

125,600

243,000

73,000

73,000

137,500

283,500

526,500

57.8

%

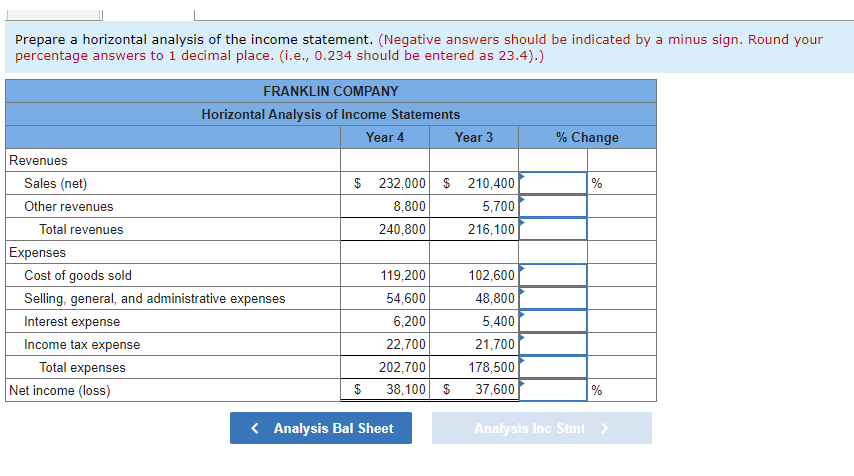

Transcribed Image Text:Prepare a horizontal analysis of the income statement. (Negative answers should be indicated by a minus sign. Round your

percentage answers to 1 decimal place. (i.e., 0.234 should be entered as 23.4).)

Revenues

Sales (net)

Other revenues

Total revenues

Expenses

FRANKLIN COMPANY

Horizontal Analysis of Income Statements

Year 4

Cost of goods sold

Selling, general, and administrative expenses

Interest expense

Income tax expense

Total expenses

Net income (loss)

$ 232,000 $ 210,400

8,800

5,700

240,800

216,100

$

119,200

54,600

6,200

22,700

202,700

38,100 $

Year 3

< Analysis Bal Sheet

102,600

48,800

5,400

21,700

178,500

37,600

% Change

%

%

Analysis Inc Stmt >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning