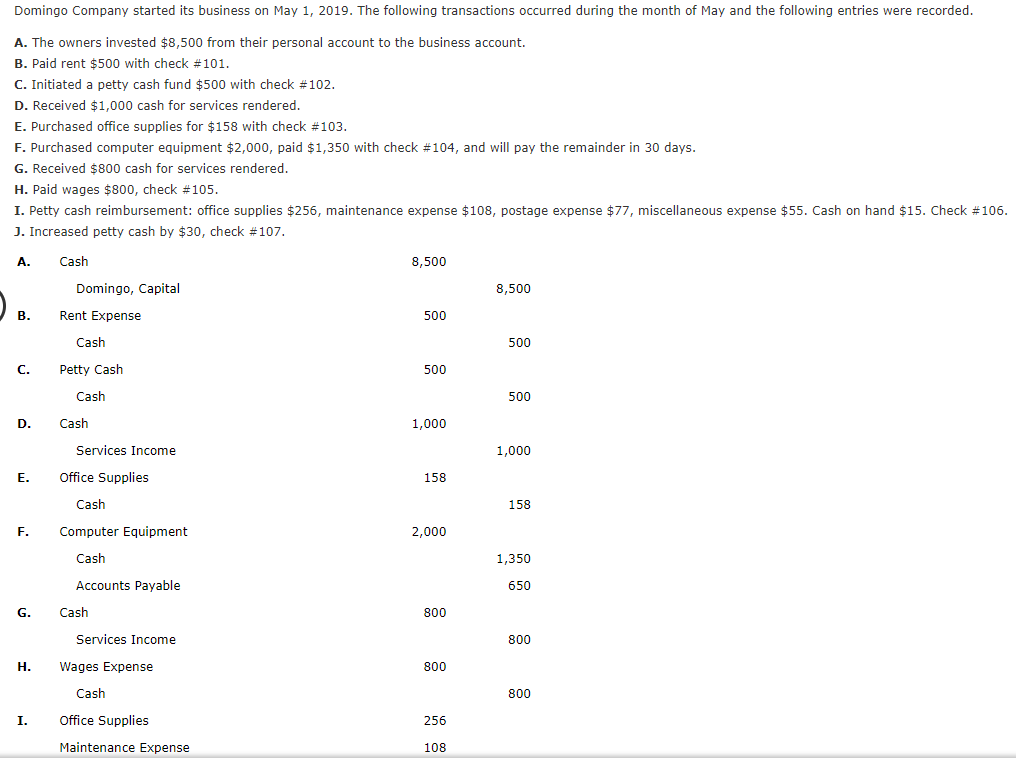

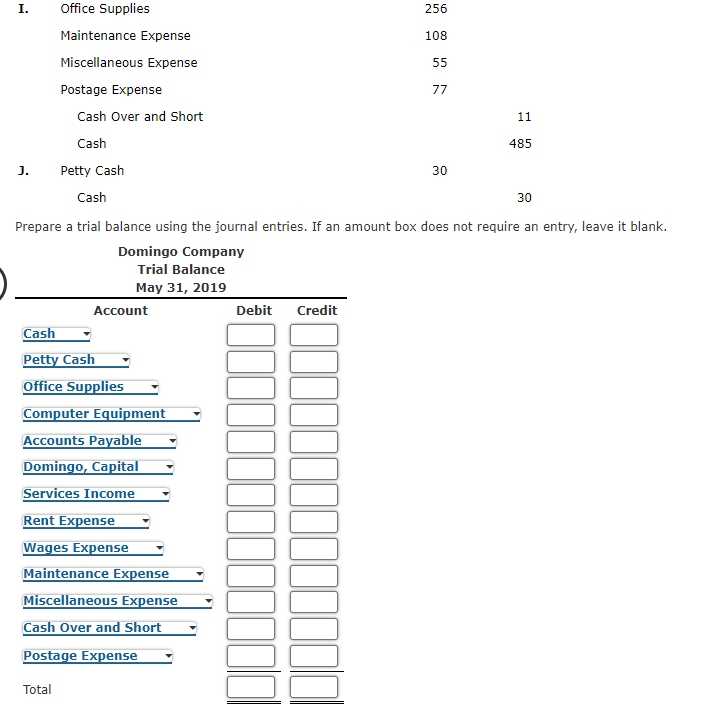

Prepare a trial balance using the journal entries. If an amount box does not require an entry, leave it blank.

Q: An adjusted trial balance should be prepared immediately: Multiple Choice after posting normal…

A: Adjusted trial balance reflects the year ending adjustments made due to prepaid and deferral…

Q: Normally revenue is recognized when:

A: Answer

Q: Recreate the Post-Closing Trial Balance that wou require an entry, leave it blank.

A: A trial balance is the statement of debits credits that can only be prepared in case of double-entry…

Q: Prepare a ledger using T-accounts. Enter the trial balance amounts and post the adjusting entries. (

A: Given:

Q: Among these statements which one is incorrect regarding journal entry? The debited account titles…

A: Journal Entry: Keeping or creating records of any transactions, whether economic or non-economic, is…

Q: Posting the journal entry is the preparation of the trial balance. True O False

A: Accounting is a process of identifying, recording, classifying, summarising and then analysing…

Q: Required: For each item, (a)-(d), prepare the journal entry to correct the balances presently…

A: Given: Payable accounts = $ 12,000 Balance in inventory = $ 6,000 Selling price of lens = $ 17,000…

Q: To create a journal with adjusting entries and as well as an adjusted trial balance. Need help.…

A: Adjusting entries: Adjusting entries are those entries that are recorded at the end of the year, to…

Q: If an incorrect amount is journalized and posted to the accounts, how should the error be corrected?

A: Accounting: Accounting is the art of recording, classifying and summarizing in a significant…

Q: Prepare an unadjusted trial balance, in correct format, from the following alphabetized account…

A: The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger…

Q: What is a worksheet, and how is it used to help prepare an adjusted trial balance?

A: An accounting worksheet is a spreadsheet used to prepare accounting information and reports.…

Q: Prepare journal entries for the above transactions. If an amount box does not require an entry,…

A: Pass necessary journal entry to record replenishment of cash fund.

Q: balances, prepare the trial balance for Craymar Fu ure Repair's accounts.)

A: A trial balance is a list of all the ledger accounts with their closing balances reflecting on the…

Q: The following Post-Closing Trial Balance contains errors. Prepare a corrected Post-Closing Trial…

A: Post-closing trial balance summarizes the list of permanent account balances.

Q: Transform the raw data into an ordered trial balance. Then pass adjusting entries in pure journal…

A: Adjusting entries are entries that are prepared at the end of the period in order to accurately…

Q: Prepare an adjusted trial balance from the following adjusted account balances (assume accounts have…

A: Adjusted Trial balance is the summary of all adjusted general ledger balances in the business. This…

Q: If a journal entry includes a debit or credit to the Cash account, it is most likely which of…

A: A cash account, commonly referred to as a cash book, appears to be a ledger whereby all cash…

Q: Which of the following procedures is correct when determining the amount to enter within the…

A: The worksheet includes trial balance, adjustments, adjusted trial balance, income statement, and…

Q: Identify the group of accounts that are NOT SHOWN IN THE DEBIT COLUMN of the Trial Balance. O a.…

A: Ledger balances square measure sequestered into debit balances and credit balances. Quality and…

Q: Adjusted Trial Balances

A: Unadjusted Adjusted Cash 72000 72000 Accounts Receivable 331000 331000…

Q: Prepare adjusting journal entries, as needed, considering the account balances excerpted from the…

A: Introduction: Journal: Recording of a business transactions in a chronological order. First step in…

Q: Why is it necessary to record the adjusting entries in the preparation of final accounts?

A: Adjusting Entries: Adjusting Entries are Entries which are made At Year End to record the Pending…

Q: The journal entry to close revenues and expenses would involve:

A: Journal entry refers to recording and classifying the business transaction into books of accounts…

Q: How are adjusting entries completed? Is there a short-hand way to remember or a technique? What…

A: Adjusting entries are the journal entries passed at the end of the financial year to close all the…

Q: Prepare a journal entry for each transaction. If an amount box does not require an entry, leave it…

A: Journal entry: A journal entry is used to record day-to-day transactions of the business by debiting…

Q: a. Post the Transactions to T-Account b. Prepare a Trial Balance

A: Cash Account Date Particulars Dr. Amount Date Particulars Cr. Amount 01-Jun To Farooq Capital…

Q: What are the journal entry, t-account, and trial balance of the following;

A: Journal entries are the entries to record the transactions in the books and every transaction have…

Q: when preparing a trial balance a bookkeeper finds a difference. this difference should be: a-…

A: When a error is detected in a trial balance i.e when the total amounts of debits and credit does not…

Q: Identify which of the following accounts would be included in a post-closing trial balance. Land

A: Post closing trial balance is the summary of ledger accounts balances after all the adjustments. It…

Q: Why on closing journal entries you debit revenue and captial then credit expenses and drawing…

A: Closing entries are used to transfer the balance from a temporary account to a permanent account. We…

Q: Calculating balance of any account, after posting all entries in ledger account, is known as O a.…

A: The numerical has covered the concept of ledger accounts. The Ledger accounts have done in 'T' form…

Q: Which of the following is not transferred from the journal to the ledger in the posting process?…

A: Journal- it is the book of prime entry in which day to day transactions are recorded when they…

Q: Prepare journal entries to record the following adjustments. If an amount box does not require an…

A: Journal entries:- Journal entries are the initial entries that are recorded in the books of…

Q: A revenue account is closed by debiting Income Summary and crediting Service Revenue. True or False

A: A major step in the accounting cycle that must not be skipped by any company is the closing process.…

Q: What is the relationship between the amount shown in the adjusted trial balance column for an…

A: Adjusted trial balance: Adjusted trial balance is that statement which contains complete list of…

Q: Is it okay to put Balance column in journal entries? Why?

A: Journal entries: These are the first record of the transactions which take place in the entity which…

Q: Kellogg's journal entry to close the revenue and expense accounts should include a:

A: For the closure of revenues and expense accounts, net income for the period should be transferred to…

Q: Is adjusting, closing reversing entries work sheet same thing as trial balance

A: A closing entry is a journal entry that is made at the end of an accounting period to transfer…

Q: Complete the worksheet by entering adjustments and prepare adjusted trial balance.

A: Trial balance: It is referred to as a balance of balances. A trial balance is a statement prepared…

Q: Post the unadjusted balances and adjusting entries into the appropriate t-accoun

A:

Q: Journalize the adjusting entry to record the accrued fees. If an amount box does not require an…

A: “Hey, since there are multiple questions posted, we will answer first question. If you want any…

Q: Required : i Rewrite the trial balance, entering the difference if any to a suspense account a…

A: Ryan Hinds have prepared the trial balance for the year ended 31st Dec 2001. The trial balance is…

Q: A trial balance will disclose that an error has been made in Entering an amount on the wrong side…

A: Trial balance is prepared to check the arithmatical accuracy of the ledgers accounts. A trial…

Q: 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted…

A: I am assuming rent unearned at July 31, $300. To tally the adjusted trial balance. Trial balance:…

Q: What information is entered in the Posting Reference column of the journal as an amount is posted to…

A: General ledger: General ledger is a record of all accounts of assets, liabilities, and stockholder's…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Inner Resources Company started its business on April 1, 2019. The following transactions occurred during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $8,500 from their personal account to the business account. B. Paid rent $650 with check #101. C. Initiated a petty cash fund $550 check #102. D. Received $750 cash for services rendered. E. Purchased office supplies for $180 with check #103. F. Purchased computer equipment $8,500, paid $1,600 with check #104 and will pay the remainder in 30 days. G. Received $1,200 cash for services rendered. H. Paid wages $560, check #105. I. Petty cash reimbursement office supplies $200, Maintenance Expense $140, Miscellaneous Expense $65. Cash on Hand $93. Check #106. J. Increased Petty Cash by $100, check #107.Hajun Company started its business on May 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $5,000 from their personal account to the business account. B. Paid rent $400 with check #101. C. Initiated a petty cash fund $200 check #102. D. Received $400 cash for services rendered E. Purchased office supplies for $90 with check #103. F. Purchased computer equipment $1,000, paid $350 with check #104 and will pay the remainder in 30 days. G. Received $500 cash for services rendered. H. Paid wages $250, check #105. I. Petty cash reimbursement office supplies $25, Maintenance Expense $125, Miscellaneous Expense $35. Cash on hand $18. Check #106. J. Increased Petty Cash by $50, check #107.Lavender Company started its business on April 1, 2019. The following are the transactions that happened during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $7,500 from their personal account to the business account. B. Paid rent $600 with check #101. C. Initiated a petty cash fund $250 check #102. D. Received $350 cash for services rendered. E. Purchased office supplies for $125 with check #103. F. Purchased computer equipment $1,500, paid $500 with check #104, and will pay the remainder in 30 days. G. Received $750 cash for services rendered. H. Paid wages $375, check #105. I. Petty cash reimbursement Office Supplies $50, Maintenance Expense $80, Miscellaneous Expense $60. Cash on hand $8. Check #106. J. Increased Petty Cash by $70, check #107.

- On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?On July 1, K. Resser opened Ressers Business Services. Ressers accountant listed the following chart of accounts: The following transactions were completed during July: a. Resser deposited 25,000 in a bank account in the name of the business. b. Bought tables and chairs for cash, 725, Ck. No. 1200. c. Paid the rent for the current month, 1,750, Ck. No. 1201. d. Bought computers and copy machines from Ferber Equipment, 15,700, paying 4,000 in cash and placing the balance on account, Ck. No. 1202. e. Bought supplies on account from Wigginss Distributors, 535. f. Sold services for cash, 1,742. g. Bought insurance for one year, 1,375, Ck. No. 1203. h. Paid on account to Ferber Equipment, 700, Ck. No. 1204. i. Received and paid the electric bill, 438, Ck. No. 1205. j. Paid on account to Wigginss Distributors, 315, Ck. No. 1206. k. Sold services to customers for cash for the second half of the month, 820. l. Received and paid the bill for the business license, 75, Ck. No. 1207. m. Paid wages to an employee, 1,200, Ck. No. 1208. n. Resser withdrew cash for personal use, 700, Ck. No. 1209. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance as of July 31, 20--. 6. Prepare an income statement for July 31, 20--. 7. Prepare a statement of owners equity for July 31, 20--. 8. Prepare a balance sheet as of July 31, 20--. LO 1, 2, 3, 4, 5, 6In July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.

- Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2019), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. The accounts receivable from customers at the end of the year are 120,000. You note that the accounts receivable at the beginning of the year were 190,000. The cash sales included 30,000 of prepayments for services to be provided over the period January 1, 2019, through December 31, 2021. a. Compute the companys accrual basis gross income for 2019. b. Would you recommend that Blue use the cash method or the accrual method? Why? c. The company does not maintain an allowance for uncollectible accounts. Would you recommend that such an allowance be established for tax purposes? Explain.In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001. e. Sold services for cash for the first half of the month, 6,927. f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004. i. Received a bill for gas and oil for the truck, 218. j. Sold services on account, 3,603. k. Sold services for cash for the remainder of the month, 4,612. l. Paid wages to the employees, 3,958, Ck. Nos. 30053007. m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. Record the transactions and the balance after each transaction 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501 (Rent Expense). e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012 (Catering Income). g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307 (Catering Income). i. Received and paid the heating bill, 248, Ck. No. 504 (Utilities Expense). j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128 (Gas and Oil Expense). k. Sold catering services for cash for the remainder of the month, 2,649 (Catering Income). l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506 (Salary Expense). Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.