Prepare Cookie Creations’ bank reconciliation for June 30. Prepare any necessary adjusting entries at June 30. If a balance sheet is prepared for Cookie Creations at June 30, what balance will be reported as cash in the Current Assets section?

Prepare Cookie Creations’ bank reconciliation for June 30. Prepare any necessary adjusting entries at June 30. If a balance sheet is prepared for Cookie Creations at June 30, what balance will be reported as cash in the Current Assets section?

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 2.1C

Related questions

Question

100%

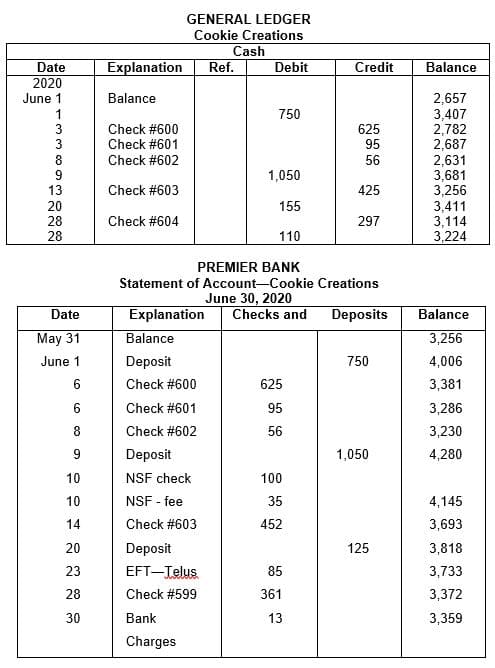

Natalie decides that she cannot afford to hire John to do her accounting. One way that she can ensure that her cash account does not have any errors and is accurate and up-to-date is to prepare a bank reconciliation at the end of each month. Natalie would like you to help her. She asks you to prepare a bank reconciliation for June 2020 using the information below.

Please refer to the image attached

Please refer to the image attached

Additionally, take the following information into account.

- On June 30th, there were two outstanding checks: #595 for $238 and #604 for $297.

- Premier Bank made a posting error to the bank statement: Check #603 was issued for $425, not $452.

- The deposit made on June 20 was for $125, which Natalie received for teaching a class. Natalie made an error in recording this transaction.

- The electronic funds transfer (EFT) was for Natalie’s cell phone use. Remember that she uses this phone only for business.

- The NSF check was from Ron Black. Natalie received this check for teaching a class to Ron’s children. Natalie contacted Ron, and he assured her that she will receive a check in the mail for the outstanding amount of the invoice and the NSF bank charge.

Complete the tasks below.- Prepare Cookie Creations’ bank reconciliation for June 30.

- Prepare any necessary

adjusting entries at June 30. - If a balance sheet is prepared for Cookie Creations at June 30, what balance will be reported as cash in the Current Assets section?

It can be completed in either Word or Excel.

Transcribed Image Text:GENERAL LEDGER

Cookie Creations

Cash

Date

Explanation

Ref.

Debit

Credit

Balance

2020

June 1

Balance

2,657

3,407

2,782

2,687

2,631

3,681

3,256

3,411

3,114

3,224

1

750

Check #600

Check #601

625

95

Check #602

56

1,050

Check #603

425

20

155

Check #604

297

110

PREMIER BANK

Statement of Account-Cookie Creations

June 30, 2020

Checks and

Date

Explanation

Deposits

Balance

May 31

Balance

3,256

June 1

Deposit

750

4,006

6

Check #600

625

3,381

6

Check #601

95

3,286

Check #602

56

3,230

9

Deposit

1,050

4,280

10

NSF check

100

10

NSF - fee

35

4,145

14

Check #603

452

3,693

20

Deposit

125

3,818

23

EFT-Telus.

85

3,733

28

Check #599

361

3,372

30

Bank

13

3,359

Charges

3389388

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you