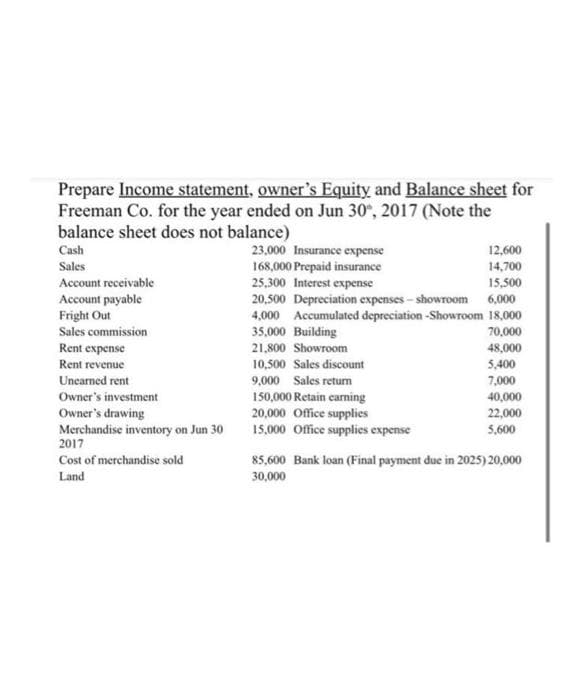

Prepare Income statement, owner's Equity and Balance sheet for Freeman Co. for the year ended on Jun 30, 2017 (Note the balance sheet does not balance) Cash Sales 12,600 14,700 23,000 Insurance expense 168,000 Prepaid insurance 25,300 Interest expense 20,500 Depreciation expenses- showroom 6,000 4,000 Accumulated depreciation -Showroom 18,000 35,000 Building 21,800 Showroom Account receivable 15,500 Account payable Fright Out Sales commission 70,000 Rent expense 48,000 Rent revenue 10,500 Sales discount 5,400 7,000 40,000 Unearned rent 9,000 Sales return 150,000 Retain carning 20,000 Office supplies 15,000 Office supplies expense Owner's investment Owner's drawing Merchandise inventory on Jun 30 2017 22,000 5,600 Cost of merchandise sold 85,600 Bank loan (Final payment due in 2025) 20,000 Land 30,000

Prepare Income statement, owner's Equity and Balance sheet for Freeman Co. for the year ended on Jun 30, 2017 (Note the balance sheet does not balance) Cash Sales 12,600 14,700 23,000 Insurance expense 168,000 Prepaid insurance 25,300 Interest expense 20,500 Depreciation expenses- showroom 6,000 4,000 Accumulated depreciation -Showroom 18,000 35,000 Building 21,800 Showroom Account receivable 15,500 Account payable Fright Out Sales commission 70,000 Rent expense 48,000 Rent revenue 10,500 Sales discount 5,400 7,000 40,000 Unearned rent 9,000 Sales return 150,000 Retain carning 20,000 Office supplies 15,000 Office supplies expense Owner's investment Owner's drawing Merchandise inventory on Jun 30 2017 22,000 5,600 Cost of merchandise sold 85,600 Bank loan (Final payment due in 2025) 20,000 Land 30,000

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter4: Income Measurement And Accrual Accounting

Section: Chapter Questions

Problem 4.33E

Related questions

Question

Transcribed Image Text:Prepare Income statement, owner's Equity and Balance sheet for

Freeman Co. for the year ended on Jun 30", 2017 (Note the

balance sheet does not balance)

Cash

23,000 Insurance expense

168,000 Prepaid insurance

25,300 Interest expense

20,500 Depreciation expenses - showroom 6,000

4,000 Accumulated depreciation -Showroom 18,000

35,000 Building

12,600

Sales

14,700

Account receivable

15,500

Account payable

Fright Out

Sales commission

70,000

Rent expense

Rent revenue

21,800 Showroom

48,000

10,500 Sales discount

9,000 Sales retum

150,000 Retain earning

20,000 Office supplies

15,000 Office supplies expense

5,400

Unearned rent

7,000

Owner's investment

40,000

Owner's drawing

Merchandise inventory on Jun 30

2017

22,000

5,600

Cost of merchandise sold

85,600 Bank loan (Final payment due in 2025) 20,000

Land

30,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning