the remaining interest held by the founding shareholders in Sherrin Ltd. Which of the following statements is correct regarding Adele Holdings Ltď's accounting in Sherrin Ltd?

the remaining interest held by the founding shareholders in Sherrin Ltd. Which of the following statements is correct regarding Adele Holdings Ltď's accounting in Sherrin Ltd?

Chapter18: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 26P

Related questions

Question

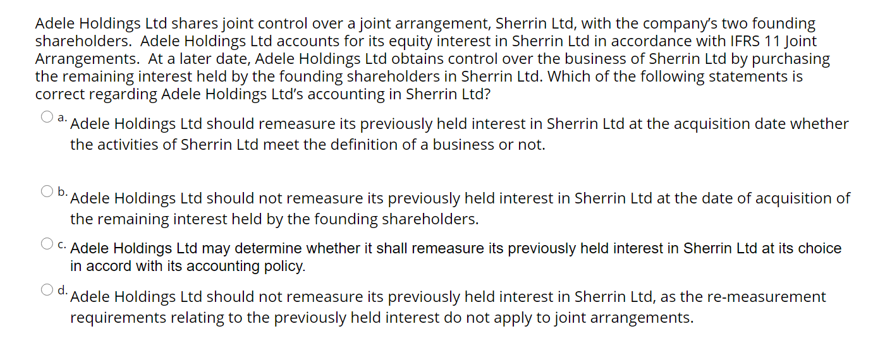

Transcribed Image Text:Adele Holdings Ltd shares joint control over a joint arrangement, Sherrin Ltd, with the company's two founding

shareholders. Adele Holdings Ltd accounts for its equity interest in Sherrin Ltd in accordance with IFRS 11 Joint

Arrangements. At a later date, Adele Holdings Ltd obtains control over the business of Sherrin Ltd by purchasing

the remaining interest held by the founding shareholders in Sherrin Ltd. Which of the following statements is

correct regarding Adele Holdings Ltd's accounting in Sherrin Ltd?

a: Adele Holdings Ltd should remeasure its previously held interest in Sherrin Ltd at the acquisition date whether

the activities of Sherrin Ltd meet the definition of a business or not.

O b.

Adele Holdings Ltd should not remeasure its previously held interest in Sherrin Ltd at the date of acquisition of

the remaining interest held by the founding shareholders.

C. Adele Holdings Ltd may determine whether it shall remeasure its previously held interest in Sherrin Ltd at its choice

in accord with its accounting policy.

d. Adele Holdings Ltd should not remeasure its previously held interest in Sherrin Ltd, as the re-measurement

requirements relating to the previously held interest do not apply to joint arrangements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage