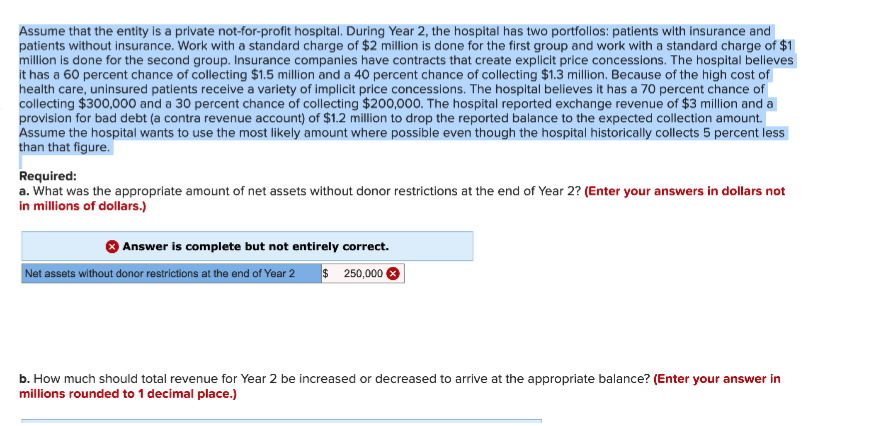

Assume that the entity is a private not-for-profit hospital. During Year 2, the hospital has two portfolios: patients with insurance and patients without insurance. Work with a standard charge of $2 million is done for the first group and work with a standard charge of $1 million is done for the second group. Insurance companies have contracts that create explicit price concessions. The hospital believes it has a 60 percent chance of collecting $1.5 million and a 40 percent chance of collecting $1.3 million. Because of the high cost of health care, uninsured patients receive a variety of implicit price concessions. The hospital believes it has a 70 percent chance of collecting $300,000 and a 30 percent chance of collecting $200,000. The hospital reported exchange revenue of $3 million and a provision for bad debt (a contra revenue account) of $1.2 million to drop the reported balance to the expected collection amount. Assume the hospital wants to use the most likely amount where possible even though the hospital historically collects 5 percent less than that figure. Required: a. What was the appropriate amount of net assets without donor restrictions at the end of Year 2? (Enter your answers in dollars not in millions of dollars.) Answer is complete but not entirely correct. Net assets without donor restrictions at the end of Year 2 $ 250,000 b. How much should total revenue for Year 2 be increased or decreased to arrive at the appropriate balance? (Enter your answer in millions rounded to 1 decimal place.)

Assume that the entity is a private not-for-profit hospital. During Year 2, the hospital has two portfolios: patients with insurance and patients without insurance. Work with a standard charge of $2 million is done for the first group and work with a standard charge of $1 million is done for the second group. Insurance companies have contracts that create explicit price concessions. The hospital believes it has a 60 percent chance of collecting $1.5 million and a 40 percent chance of collecting $1.3 million. Because of the high cost of health care, uninsured patients receive a variety of implicit price concessions. The hospital believes it has a 70 percent chance of collecting $300,000 and a 30 percent chance of collecting $200,000. The hospital reported exchange revenue of $3 million and a provision for bad debt (a contra revenue account) of $1.2 million to drop the reported balance to the expected collection amount. Assume the hospital wants to use the most likely amount where possible even though the hospital historically collects 5 percent less than that figure. Required: a. What was the appropriate amount of net assets without donor restrictions at the end of Year 2? (Enter your answers in dollars not in millions of dollars.) Answer is complete but not entirely correct. Net assets without donor restrictions at the end of Year 2 $ 250,000 b. How much should total revenue for Year 2 be increased or decreased to arrive at the appropriate balance? (Enter your answer in millions rounded to 1 decimal place.)

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 5CE: Keating Hospital is considering two different low-field MRI systems: the Clearlook System and the...

Related questions

Question

Transcribed Image Text:Assume that the entity is a private not-for-profit hospital. During Year 2, the hospital has two portfolios: patients with insurance and

patients without insurance. Work with a standard charge of $2 million is done for the first group and work with a standard charge of $1

million is done for the second group. Insurance companies have contracts that create explicit price concessions. The hospital believes

it has a 60 percent chance of collecting $1.5 million and a 40 percent chance of collecting $1.3 million. Because of the high cost of

health care, uninsured patients receive a variety of implicit price concessions. The hospital believes it has a 70 percent chance of

collecting $300,000 and a 30 percent chance of collecting $200,000. The hospital reported exchange revenue of $3 million and a

provision for bad debt (a contra revenue account) of $1.2 million to drop the reported balance to the expected collection amount.

Assume the hospital wants to use the most likely amount where possible even though the hospital historically collects 5 percent less

than that figure.

Required:

a. What was the appropriate amount of net assets without donor restrictions at the end of Year 2? (Enter your answers in dollars not

in millions of dollars.)

Answer is complete but not entirely correct.

Net assets without donor restrictions at the end of Year 2 $ 250,000

b. How much should total revenue for Year 2 be increased or decreased to arrive at the appropriate balance? (Enter your answer in

millions rounded to 1 decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College