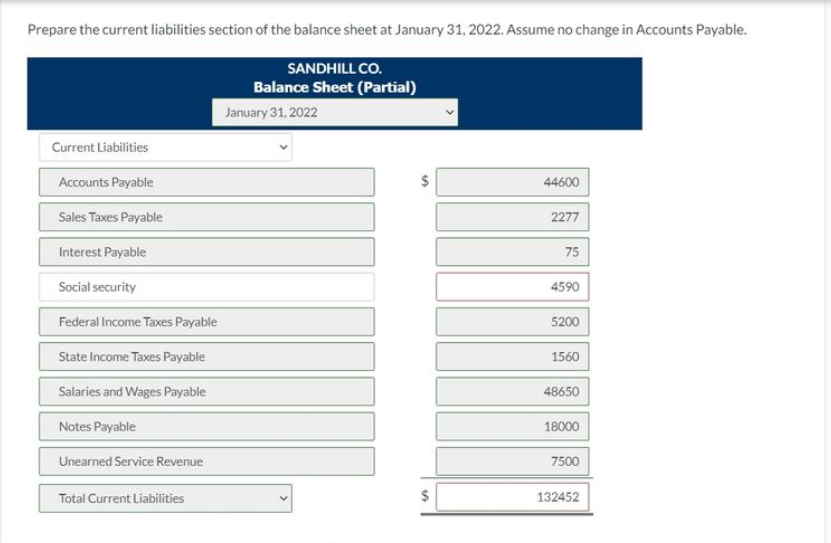

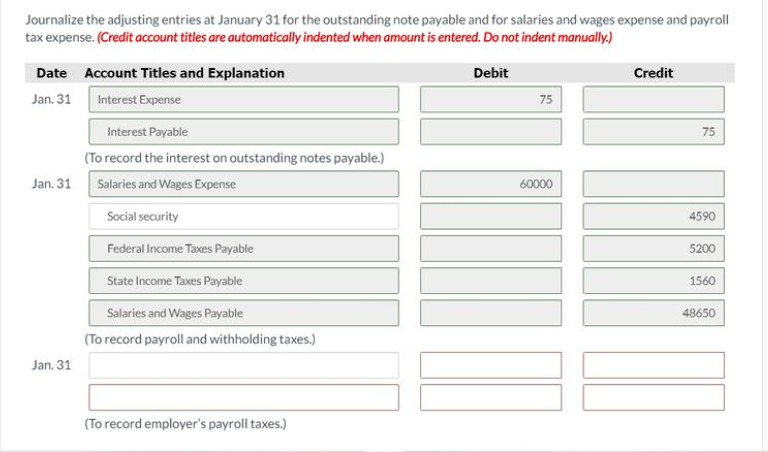

Prepare the current liabilities section of the balance sheet at January 31, 2022. Assume no change in Accounts Payable. SANDHILL CO. Balance Sheet (Partial) January 31, 2022 Current Liabilities Accounts Payable 44600 Sales Taxes Payable 2277 Interest Payable 75 Social security 4590 Federal Income Taxes Payable 5200 State Income Taxes Payable 1560 Salaries and Wages Payable 48650 Notes Payable 18000 Unearned Service Revenue 7500 Total Current Liabilities 132452 %24 %24 Journalize the adjusting entries at January 31 for the outstanding note payable and for salaries and wages expense and payrll tax expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 31 Interest Expense 75 Interest Payable 75 (To record the interest on outstanding notes payable.) Jan. 31 Salaries and Wages Expense 60000 Social security 4590 Federal Income Taxes Payable 5200 State Income Taxes Payable 1560 Salaries and Wages Payable 48650 (To record payroll and withholding taxes.) Jan. 31 (To record employer's payroll taxes.)

Prepare the current liabilities section of the balance sheet at January 31, 2022. Assume no change in Accounts Payable. SANDHILL CO. Balance Sheet (Partial) January 31, 2022 Current Liabilities Accounts Payable 44600 Sales Taxes Payable 2277 Interest Payable 75 Social security 4590 Federal Income Taxes Payable 5200 State Income Taxes Payable 1560 Salaries and Wages Payable 48650 Notes Payable 18000 Unearned Service Revenue 7500 Total Current Liabilities 132452 %24 %24 Journalize the adjusting entries at January 31 for the outstanding note payable and for salaries and wages expense and payrll tax expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 31 Interest Expense 75 Interest Payable 75 (To record the interest on outstanding notes payable.) Jan. 31 Salaries and Wages Expense 60000 Social security 4590 Federal Income Taxes Payable 5200 State Income Taxes Payable 1560 Salaries and Wages Payable 48650 (To record payroll and withholding taxes.) Jan. 31 (To record employer's payroll taxes.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 28E: On January 1, 2019, Northfield Corporation becomes delinquent on a 100,000, 14% note to First...

Related questions

Question

On January 1, 2022, the ledger of Sandhill Co. contained these liability accounts.

| Accounts Payable | $44,600 | |

| Sales Taxes Payable | 8,700 | |

| Unearned Service Revenue | 21,100 |

During January, the following selected transactions occurred.

| Jan. 1 | Borrowed $18,000 in cash from Apex Bank on a 4-month, 5%, $18,000 note. | |

| 5 | Sold merchandise for cash totaling $6,360, which includes 6% sales taxes. | |

| 12 | Performed services for customers who had made advance payments of $13,600. (Credit Service Revenue.) | |

| 14 | Paid state treasurer’s department for sales taxes collected in December 2021, $8,700. | |

| 20 | Sold 710 units of a new product on credit at $54 per unit, plus 5% sales tax. |

During January, the company’s employees earned wages of $60,000. Withholdings related to these wages were $4,590 for Social Security (FICA), $5,200 for federal income tax, and $1,560 for state income tax. The company owed no money related to these earnings for federal or state

Transcribed Image Text:Prepare the current liabilities section of the balance sheet at January 31, 2022. Assume no change in Accounts Payable.

SANDHILL CO.

Balance Sheet (Partial)

January 31, 2022

Current Liabilities

Accounts Payable

44600

Sales Taxes Payable

2277

Interest Payable

75

Social security

4590

Federal Income Taxes Payable

5200

State Income Taxes Payable

1560

Salaries and Wages Payable

48650

Notes Payable

18000

Unearned Service Revenue

7500

Total Current Liabilities

132452

%24

%24

Transcribed Image Text:Journalize the adjusting entries at January 31 for the outstanding note payable and for salaries and wages expense and payrll

tax expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date Account Titles and Explanation

Debit

Credit

Jan. 31

Interest Expense

75

Interest Payable

75

(To record the interest on outstanding notes payable.)

Jan. 31

Salaries and Wages Expense

60000

Social security

4590

Federal Income Taxes Payable

5200

State Income Taxes Payable

1560

Salaries and Wages Payable

48650

(To record payroll and withholding taxes.)

Jan. 31

(To record employer's payroll taxes.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning