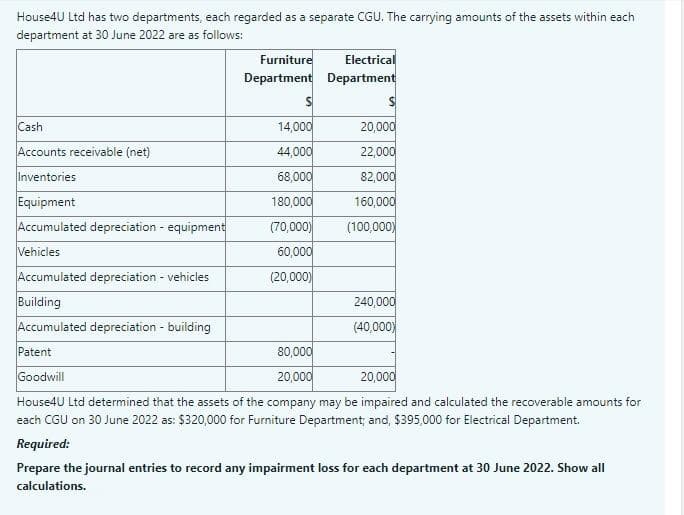

Prepare the journal entries to record any impairment loss for each department at 30 June 2022. Show all calculations.

Q: Dr. (1) Accrue salaries expense. Cr. Cr. (2) Adjust the Unearned Services Revenue account to…

A: Adjusting journal entry: At year-end when the company finalizes its accounts then any unrecognized…

Q: Questions. A sweatshirt is being sold for 25% off its regular sale price of $117.88. a) The best…

A: Disclaimer: "Since you have asked multiple questions in a single so we answered the first question…

Q: The accounting records of Calvin Architects include the following selected, unadjusted balances at…

A: Balance of office supplies account is $ 600 And given that office supplies in hand is $100 So…

Q: How much should be debited for the land account?

A: Land account should be debited with p5,000,000

Q: 10 March Olga withdrew cash, $300 15 March Purchased goods on credit, $200 31 March Received cash…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: Consider the following data: Activity Budgeted OH Materials Handling P 10,000 Setup Costs P 20,000…

A: Activity based costing system is a method of assigning overhead and indirect costs. Activity based…

Q: At their request, a few members are furnished prenumbered predated envelopes in which to insert…

A: Internal controls are indeed the processes, rules, and procedures put in place by a corporation to…

Q: 1 March Olga started the business with $30,000 in cash 2 March Bought goods for cash $2,900 3 March…

A: Journal Entry :- The purpose of preparing the journal entry to segregate the transaction which are…

Q: In your audit of Entity A, you noted that the Rent expense account has an ending balance of…

A: Note:- Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: The bank statement for Farmer Co. indicates a balance of $7,735 on June 30. After the journals for…

A: A bank reconciliation analysis compares the cash position on a balance sheet of a company to a…

Q: a bicycle for $2500, plus 13% HST. He arranged to make a payment ars. The store is charging 6%…

A: The loans are paid by equal monthly instalments and these equal monthly instalments carry the…

Q: a) Find the net present value of the differential cash flows attaching to purchase of the new…

A: Calculation of present value of estimated cash outflows local authorities fire services .…

Q: Remington Communications has been providing cellular phone service for several years. During…

A: Introduction: Journals: All the business transactions are to be recorded in Journals. Journals are…

Q: On January 1, 2023, the stockholders’ equity section of Kay Corporation shows common stock ($7 par…

A: Introduction: Ownership of a company is represented by shares. When someone purchases stock in your…

Q: A construction project has a cost of $650,000. There is a 10 percent chance that the costs will…

A: A contingency reserve is retained earnings that have been set aside to guard against possible future…

Q: Current Attempt in Progress Carla Vista Distributors has the following transactions related to notes…

A: Notes receivable is a negotiable instrument that provides interest to the holder of the receivable.…

Q: IFRS11-1 On May 10, Romano Corporation issues 1,000 shares of $10 par value ordinary shares for cash…

A: Introduction: A journal entry can be used to record a transaction in a company's accounting records.…

Q: To create 16,000 pieces of final product, the organisation budgeted $400,000 for 40,000 hours of…

A: The variance is the difference between the actual and standard costs incurred for the production.…

Q: Pier Exports purchased equipment on January 1, 2018, at a cost of $600,000. The company estimates…

A: The depreciation expense is charged on fixed assets as reduction in the value of fixed assets. The…

Q: All else equal, which statement regarding Australia's current account is correct? O a. An increase…

A: Current account represents country's imports and exports of goods and services, net transfer…

Q: Nick steals two checks from Pauline-a blank check and a check payable to the order of Retail Outlets…

A:

Q: Suka Tenis Group manufactured 100,000 tennis rackets in 2022 and reported the following costs: RM RM…

A: Cost of goods sold means the cost incurred on the manufacturing or purchase of goods which has been…

Q: 4. Production department records show the following: beginning work in process of 25,000 units (80%…

A: The equivalent units are calculated on the basis of percentage of the work completed during the…

Q: XYZ Company used the direct method to prepare the statement of cash flows. The entity had the…

A: Cash flow from operating activities include all cash transitions which made to run day to day…

Q: Which of the following is not one of the tasks undertaken during the phase use of t of the audit? A)…

A: Auditing is an examination of financial data of any entity with a view to express an opinion thereon…

Q: A ladies' suit selling for $145 is marked down 25% for a special promotion. It is later marked down…

A: Lets understand the basics. Management gives offer for the discount for attracting more selling than…

Q: Due to erratic sales of its sole product-a high-capacity battery for laptop computers-PEM,…

A: (Since you have posted a multi-part question, we will solve the first three sub-parts for you. For…

Q: What challenges does functional diversity represent for the business environment?

A: Introduction: A business environment is a confluence of internal and external elements and forces…

Q: A professional services firm has been analysing the cost of collecting management information by…

A: The cost of a firm's direct data capture is 5000$

Q: An explanation of the accounting role of a business. What is the purpose of the function, and why is…

A: Accounting is the discipline of recording and reporting on a company's financial transactions and…

Q: For each of the adjusting entries (1), (2), and (3), indicate the account to be debited and the…

A: Introduction: Journals: Each and every business transactions are to be recorded in Journal books.…

Q: PRODUCT COSTS VS PERIOD COSTS

A: Cost is the amount which is spent or paid or incurred on making the product or rendering service.…

Q: On January 1, 2016, Rexford Company purchased a drilling machine for $11,500. The machines has an…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: vet income? Units sold = 8700 games units Selling price per unit = $ 69 Variable expenses = $ 49…

A: Cost volume profit analysis is the technique used by the management for decision-making. The methods…

Q: required: (d) What is the new Residual income if Proposal 1 is selected? (e) What is the new…

A: The residual income can be defined as the income earned over and above the opportunity cost of the…

Q: decides which of three mutually exclusive products to make in its roducts is shown in the following…

A: Throughput return ratio refers to the form of ratio which reflects the comparison between the actual…

Q: A company received dividends of $0.35 per share on 300 shares of stock it holds as a stock…

A: Total dividend received = $105 $0.35 × 300 shares Hence Total dividend received $105

Q: Budgeted sales are 1,400 sets for the first quarter and expected to increase by 150 sets per…

A: Sales- The amount of money received by a corporation during a given period from the sale of goods or…

Q: The assects of fir 60000 ad capital 450000 it’s liabilities are

A: Accounting equation is the equation which proves that aggregate of liabilities and capital is equal…

Q: Problem 14-16 (PHILCPA Adapted) Calapan Company provided the following data: January 1 1,200,000…

A: Accrual Basis- Accrual accounting is founded on the idea of recording transactions as they happen.…

Q: In 2023 Collingwood Ltd commenced operating a power generating facility in outback Australia. The…

A: Contingent Liability The purpose of providing the contingent liabilities to meet up the cost of…

Q: Novak Auto Suplies Balance Sheet December 31, 2020 Cash Prepaid Insurance Accounts Receivable…

A: The balance sheet represents the financial position of the business with assets, liabilities and…

Q: mentions at least four elements that people with functional diversity add to the company

A: A workplace diversity place is essential for every organization because the work environment can be…

Q: Question 5 A piece of machinery is purchased for $400,000. Accountants have decided to use a…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Amber gears sells gears to HTC Car Repair during 2018.It offers rebates of 2% on purchases up to…

A: Normal purchase made in parts during the year= $300,000 Purchases on March 25, 2018= $74,000 of…

Q: ge benefits (vehicles) worth 100,000 (ownership transferred to X); 13th month pay of 100,000; rice…

A: Fringe Benefit: An extra befits given by the company to its employees money wages or salary e.g.…

Q: vet income 9 Units sold = 8700 games units Selling price per unit = $ 69 Variable expenses = $ 49…

A: Net income is calculated by deducting all the variable costs and fixed costs from the sales. It is…

Q: Melisandre Merchandising sold merchandise on credit to Ellaria, terms 2/10, r/45, $26,000, on April…

A: Introduction: Journals: All the business transactions are to be recorded in Journals. Another name…

Q: How would you compare the costs and benefits estimated in

A: It is important to analyse the benefits and cost associated with the tool . This analysis provide…

Q: raphic designers create visual concepts using computer software or by hand to communicate ideas that…

A: Federal Insurance Contributions Act [FICA] is the tax deduction in US's federal payroll system from…

Step by step

Solved in 8 steps

- The following assets are included in the December 31, 2022, balance sheet ofFortible Auto Parts, Inc.Accounts Receivable(net of Allowance for Uncollectible Accounts) $ 75,000Accumulated Depreciation, Building 20,000Building 170,000Cash 90,000Land 145,000Merchandise Inventory 92,000Trademark 125,500The total dollar amount of assets classified as property, plant, and equipment onFortible Auto Part's December 31, 2022, classified balance sheet is ____Refer to the following data of SG Company: Assets to be realized1,375,000Liabilities liquidated1,875,000Assets acquired825,000Liabilities not liquidated1,700,000Assets realized1,200,000Liabilities to be liquidated2,250,000Assets not realized1,375,000Supplementary charges3,125,000Liabilities assumed1,625,000Supplementary credits2,800,000Compute the beginning cash balance assuming that the ending balance of ordinary share and retained earnings are P1,200,000 and (400,000), respectively.Refer to the following data of SG Company: Assets to be realized1,375,000Liabilities liquidated1,875,000Assets acquired825,000Liabilities not liquidated1,700,000Assets realized1,200,000Liabilities to be liquidated2,250,000Assets not realized1,375,000Supplementary charges3,125,000Liabilities assumed1,625,000Supplementary credits2,800,000Compute the beginning cash balance assuming that the ending balance of ordinary share and retained earnings are P1,200,000 and (400,000), respectively.A. P1,325,000b. P1,475,000c. P2,075,000d. P1,450,000

- Sumit Ltd reported the following assets in its statement of financial position at 30 June 2021: Land 25,000 Patent 100,000 Plant 250,000 Accumulated Depreciation (75,000) Goodwill 20,000 Inventory 40,000 Accounts receivables 30,000 Cash 5,000 Accounts payables 20,000 The recoverable amount of the entity was calculated to be $354,000. All assets are measured using the cost method. Inventory is measured at the lower of cost and net realisable value in accordance with AASB102 Inventories. The receivables were all considered to be collectable. Required: 1. Allocate the impairment loss to assets in the CGU as per AASB136 (Please round off to the nearest dollar). 2. Prepare journal entries to record the allocation of the impairment loss at 30 June 2021. Descriptions/Narrations are NOT required. Asset Carrying Amount Proportion Allocation of Loss Adjusted Carrying Amount…On March 31, 2022, the balances of accounts appearing in the ledger of April Furnishings Company, afurniture wholesales, are as follows:Accumulated Depreciation-Building$419,000Administrative Expenses302,000Building1,397,000Cash98,000Cost of Merchandise Sold2,123,000Interest Expense6,000April, Capital887,000April, Drawing98,000Merchandise Inventory $547,000Notes Payable140,000Office Supplies11,000Salaries Payable4,000Sales3,582,000Selling Expenses400,000Store Supplies50,000Create create a multi step income statement.The following trial balance relates to Golden Ltd at 30th September 2018GHS'000GHS'000Sales (a)760,000Material purchases (b) 128,000Production labour (b) 248,000Factory overheads (b) 160,000Distribution costs 28,400Administrative expenses (c) 92,800Finance costs 700Investment income1,600Leased property - at cost (b) 100,000Plant and equipment - at cost (b) 89,000Accumulated amortisation/depreciation at 1/10/2017- leased property20,000- plant and equipment29,000Equity investments (e) 36,000Inventory at 1/10/17 93,400Trade receivables 67,100Trade payables55,600Bank4,600Stated capital (GHS0.2)100,000Income surplus (1/10/2017)67,200Deferred tax (f)5,4001,043,4001,043,400The following notes are relevant:(a) Sales include goods sold and dispatched in September 2018 on a 30-day right of return basis. Their sellingprice was GHS4.8m and they were sold at a gross profit margin of 25%. In the past, Golden Ltd’scustomers have always met their obligations under this type of agreement.(b)…

- The comparative statement of financial position for Moose Jaw Ltd. is as follows:Moose Jaw Ltd.Comparative Statement of Financial PositionAs at December 312021 2020Cash $20,500 $12,500Accounts receivable 34,000 25,500Inventories 20,000 30,000Prepaid insurance 2,500 2,000Equipment 102,000 90,000Accumulated depreciation - equipment (22,500) (12,500)Total assets $156,500 $147,500Accounts payable $23,000 $20,000Interest payable 2,000 3,000Wages payable 4,000 2,000Income taxes payable 4,000 5,000Long-term note payable 30,000 34,500Common shares 65,000 65,000Retained earnings 28,500 18,000Total liabilities and equity $156,500 $147,500More information about Moose Jaw’s operations for 2021:• A machine which the company paid $10,000 for was sold for a gain of$1,000. The equipment’s accumulated depreciation was $7,000.• The company had net income for of $13,500.RequiredConstruct the operating activities section of Moose Jaw Ltd.’s statement of cashflows using the indirect method. Use proper…The following are the financial statement Kin Ltd. for the year ended 31 March 2020: Kin Ltd. Income statement For the year ended 31 March 2020 $”M” Revenue 1276.50 Cost of sales (907.00) 369.50 Distribution costs (62.50) Administrative expenses (132.00) 175.00 Interest received 12.50 Interest paid (37.50) 150.00 Tax (70.00) Profit after tax 80.00 Kin Ltd. Statement of financial position as at 31 March 2020 2019 $”M” $”M” ASSETS: Non- current assets: Property, plant and equipment 190 152.5 Intangible assets 125 100 Investments 12.5 Current assets: Inventories 75 51 Receivables 195 157.5 Short-term investment 25 Cash in hand 1 0.5 Total assets 611 474 Equity and liabilities: Equity: Share capital (10 million ordinary shares of $ 10 per value) 100 75 Share premium 80 75 Revolution reserve 50 45.5 Retained earnings 130 90 Non-current liabilities:…The general ledger of Megan Corporation as of December 31, 2018, includes the following accounts: Copyrights $ 30,000 Deposits with advertising agency (will be used to promote goodwill) 27,000 Bond sinking fund 70,000 Excess of cost over fair value of identifiable net assets of acquired subsidiary 390,000 Trademarks 120,000 In the preparation of Megan's statement of financial position as of December 31, 2018, what should be reported as total intangible assets?

- Naughty Company assembles the following data relative to a certain entity in determining the amount to be paid for net assets and goodwill: Assets at fair value before goodwill 2, 600, 000Liabilities 900, 000Shareholders’ equity 1, 700, 000 Net earnings after elimination of unusual or infrequent items:2008 200, 0002009 230, 0002010 300, 0002011 250, 0002012 270, 000 Required:Calculate the amount of goodwill under the following:1. Average earnings are capitalized at 10%2. A return of 8% is considered normal on net assets at fair value. Excess earnings are capitalized at 15%.3. A return of 10% is considered normal on net assets at fair value. Goodwill is measured at 5 years excess earnings.4. A return of 10% is considered normal on net assets at fair value. Excess earnings are expected to…The following are selected account balances from Penske Company and Stanza Corporation as of December 31, 2021: Penske Stanza Revenues $ (816,000 ) $ (724,000 ) Cost of goods sold 290,600 181,000 Depreciation expense 163,000 368,000 Investment income Not given 0 Dividends declared 80,000 60,000 Retained earnings, 1/1/21 (700,000 ) (216,000 ) Current assets 460,000 550,000 Copyrights 950,000 447,000 Royalty agreements 662,000 1,122,000 Investment in Stanza Not given 0 Liabilities (554,000 ) (1,508,000 ) Common stock (600,000 ) ($20 par) (200,000 ) ($10 par) Additional paid-in capital (150,000 ) (80,000 ) Note: Parentheses indicate a credit balance. On January 1, 2021, Penske acquired all of Stanza’s outstanding stock for $790,000 fair value in cash and common stock. Penske also paid…The following are selected account balances from Penske Company and Stanza Corporation as of December 31, 2021: Penske Stanza Revenues $ (816,000 ) $ (724,000 ) Cost of goods sold 290,600 181,000 Depreciation expense 163,000 368,000 Investment income Not given 0 Dividends declared 80,000 60,000 Retained earnings, 1/1/21 (700,000 ) (216,000 ) Current assets 460,000 550,000 Copyrights 950,000 447,000 Royalty agreements 662,000 1,122,000 Investment in Stanza Not given 0 Liabilities (554,000 ) (1,508,000 ) Common stock (600,000 ) ($20 par) (200,000 ) ($10 par) Additional paid-in capital (150,000 ) (80,000 ) Note: Parentheses indicate a credit balance. On January 1, 2021, Penske acquired all of Stanza’s outstanding stock for $790,000 fair value in cash and common stock. Penske also paid…