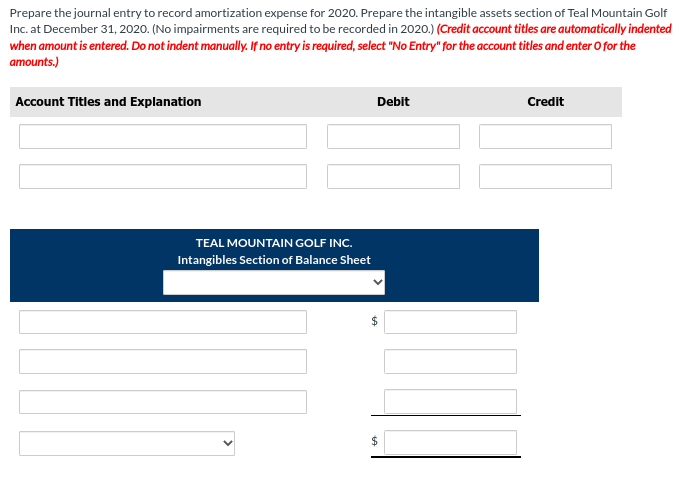

Prepare the journal entry to record amortization expense for 2020. Prepare the intangible assets section of Teal Mountai Inc. at December 31, 2020. (No impairments are required to be recorded in 2020.) (Credit account titles are automatically in when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit

Prepare the journal entry to record amortization expense for 2020. Prepare the intangible assets section of Teal Mountai Inc. at December 31, 2020. (No impairments are required to be recorded in 2020.) (Credit account titles are automatically in when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 17P: On December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and...

Related questions

Question

Transcribed Image Text:Prepare the journal entry to record amortization expense for 2020. Prepare the intangible assets section of Teal Mountain Golf

Inc. at December 31, 2020. (No impairments are required to be recorded in 2020.) (Credit account titles are automatically indented

when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the

amounts.)

Account Titles and Explanation

TEAL MOUNTAIN GOLF INC.

Intangibles Section of Balance Sheet

Debit

$

Credit

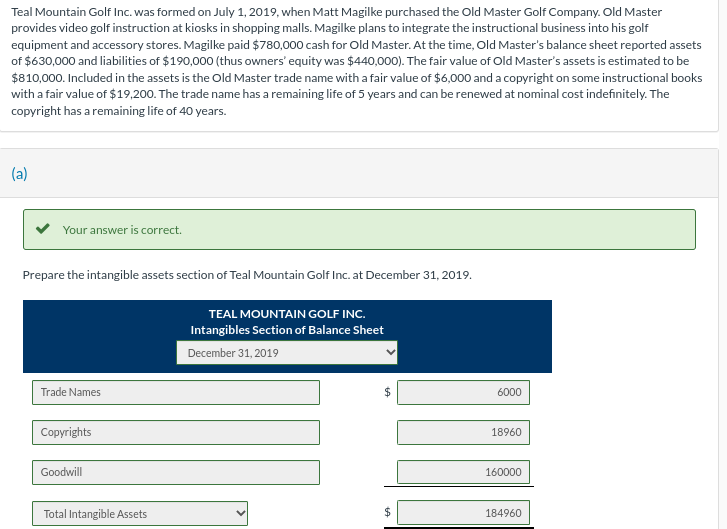

Transcribed Image Text:Teal Mountain Golf Inc. was formed on July 1, 2019, when Matt Magilke purchased the Old Master Golf Company. Old Master

provides video golf instruction at kiosks in shopping malls. Magilke plans to integrate the instructional business into his golf

equipment and accessory stores. Magilke paid $780,000 cash for Old Master. At the time, Old Master's balance sheet reported assets

of $630,000 and liabilities of $190,000 (thus owners' equity was $440,000). The fair value of Old Master's assets is estimated to be

$810,000. Included in the assets is the Old Master trade name with a fair value of $6,000 and a copyright on some instructional books

with a fair value of $19,200. The trade name has a remaining life of 5 years and can be renewed at nominal cost indefinitely. The

copyright has a remaining life of 40 years.

(a)

Your answer is correct.

Prepare the intangible assets section of Teal Mountain Golf Inc. at December 31, 2019.

Trade Names

Copyrights

Goodwill

Total Intangible Assets

TEAL MOUNTAIN GOLF INC.

Intangibles Section of Balance Sheet

December 31, 2019

6000

18960

160000

184960

Expert Solution

Step 1

Introduction:-

Journal entry is the first stage of accounting process.

Journal entry used to record business transactions.

It plays vital role in accounting cycle.

it plays important role in book keeping.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning