calculate the ratio (expressed to two decimal places) that would reflect each of the following: The amount of funds available relative to sales, to pay the company’s expenses other than its cost of sales (expressed as a percentage) The company's net income as a percentage of the company's net sales. The ability of the company to generate profits from its shareholders investments in the company. A measure of the dividend pay-out per share of the company's ordinary shares. The capacity of the company to pay off its current commitments using just its most liquid assets. The degree to which the company’s assets are financed by debt. A measure of how easily the company can pay the interest on its outstanding debt.

calculate the ratio (expressed to two decimal places) that would reflect each of the following: The amount of funds available relative to sales, to pay the company’s expenses other than its cost of sales (expressed as a percentage) The company's net income as a percentage of the company's net sales. The ability of the company to generate profits from its shareholders investments in the company. A measure of the dividend pay-out per share of the company's ordinary shares. The capacity of the company to pay off its current commitments using just its most liquid assets. The degree to which the company’s assets are financed by debt. A measure of how easily the company can pay the interest on its outstanding debt.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 19BEA

Related questions

Question

100%

calculate the ratio (expressed to two decimal places) that would reflect each of the following: The amount of funds available relative to sales, to pay the company’s expenses other than its cost of sales (expressed as a percentage)

The company's net income as a percentage of the company's net sales.

The ability of the company to generate profits from its shareholders investments in the company.

A measure of the dividend pay-out per share of the company's ordinary shares.

The capacity of the company to pay off its current commitments using just its most liquid assets.

The degree to which the company’s assets are financed by debt.

A measure of how easily the company can pay the interest on its outstanding debt.

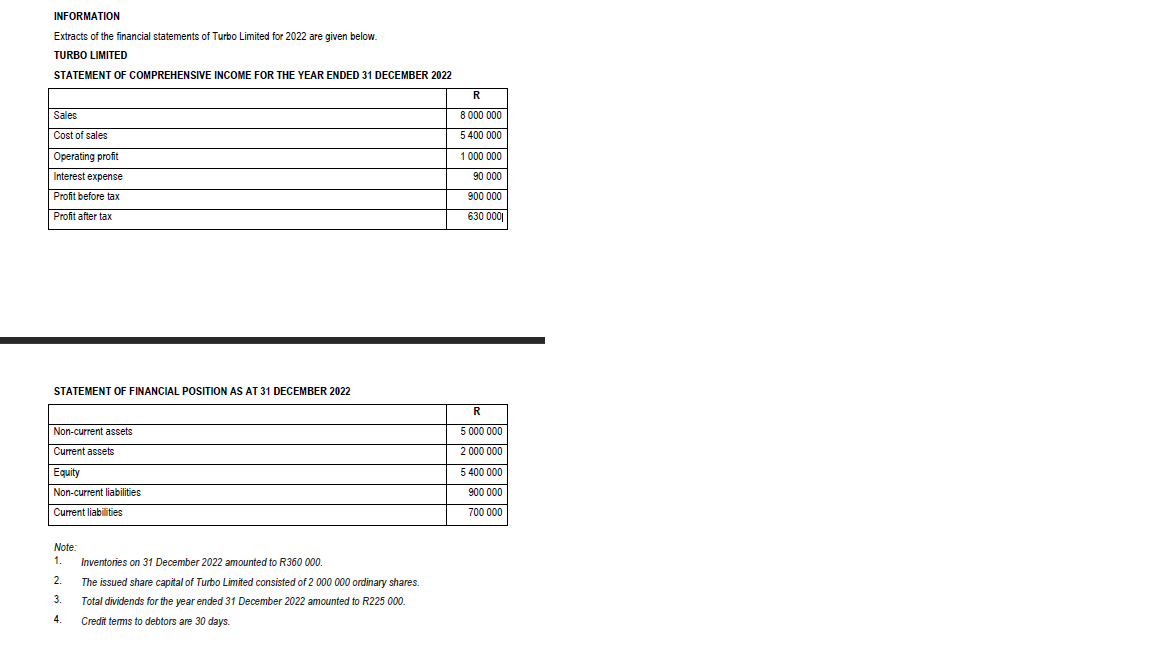

Transcribed Image Text:INFORMATION

Extracts of the financial statements of Turbo Limited for 2022 are given below.

TURBO LIMITED

STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2022

Sales

Cost of sales

Operating profit

Interest expense

Profit before tax

Profit after tax

STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022

Non-current assets

Current assets

Equity

Non-current liabilities

Current liabilities

Note:

1.

2.

3.

4.

Inventories on 31 December 2022 amounted to R360 000.

The issued share capital of Turbo Limited consisted of 2 000 000 ordinary shares.

Total dividends for the year ended 31 December 2022 amounted to R225 000.

Credit terms to debtors are 30 days.

R

8 000 000

5 400 000

1 000 000

90 000

900 000

630 000

R

5 000 000

2 000 000

5 400 000

900 000

700 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning