Prepare the Property, Plant and Equipment note as it would appear in the financial statements of The Hammer-Mill for the financial year ended 31 December 2019. Note:

Prepare the Property, Plant and Equipment note as it would appear in the financial statements of The Hammer-Mill for the financial year ended 31 December 2019. Note:

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 41P

Related questions

Question

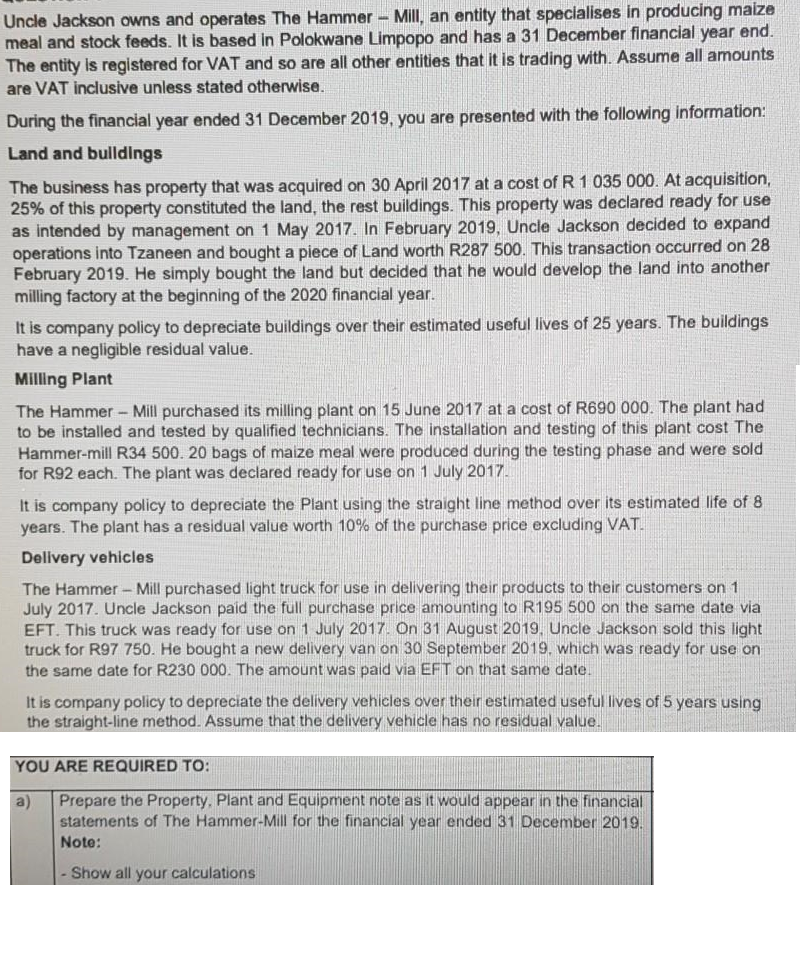

Transcribed Image Text:Uncle Jackson owns and operates The Hammer- Mill, an entity that specialises in producing maize

meal and stock feeds. It is based in Polokwane Limpopo and has a 31 December financial year end.

The entity is registered for VAT and so are all other entities that it is trading with. Assume all amounts

are VAT inclusive unless stated otherwise.

During the financial year ended 31 December 2019, you are presented with the following information:

Land and bulldings

The business has property that was acquired on 30 April 2017 at a cost of R 1 035 000. At acquisition,

25% of this property constituted the land, the rest buildings. This property was declared ready for use

as intended by management on 1 May 2017. In February 2019, Uncle Jackson decided to expand

operations into Tzaneen and bought a piece of Land worth R287 500. This transaction occurred on 28

February 2019. He simply bought the land but decided that he would develop the land into another

milling factory at the beginning of the 2020 financial year.

It is company policy to depreciate buildings over their estimated useful lives of 25 years. The buildings

have a negligible residual value.

Milling Plant

The Hammer - Mill purchased its milling plant on 15 June 2017 at a cost of R690 000. The plant had

to be installed and tested by qualified technicians. The installation and testing of this plant cost The

Hammer-mill R34 500. 20 bags of maize meal were produced during the testing phase and were sold

for R92 each. The plant was declared ready for use on 1 July 2017.

It is company policy to depreciate the Plant using the straight line method over its estimated life of 8

years. The plant has a residual value worth 10% of the purchase price excluding VAT.

Delivery vehicles

The Hammer- Mill purchased light truck for use in delivering their products to their customers on 1

July 2017. Uncle Jackson paid the full purchase price amounting to R195 500 on the same date via

EFT. This truck was ready for use on 1 July 2017. On 31 August 2019, Uncle Jackson sold this light

truck for R97 750. He bought a new delivery van on 30 September 2019, which was ready for use on

the same date for R230 000. The amount was paid via EFT on that same date.

It is company policy to depreciate the delivery vehicles over their estimated useful lives of 5 years using

the straight-line method. Assume that the delivery vehicle has no residual value.

YOU ARE REQUIRED TO:

a)

Prepare the Property, Plant and Equipment note as it would appear in the financial

statements of The Hammer-Mill for the financial year ended 31 December 2019.

Note:

Show all your calculations

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning