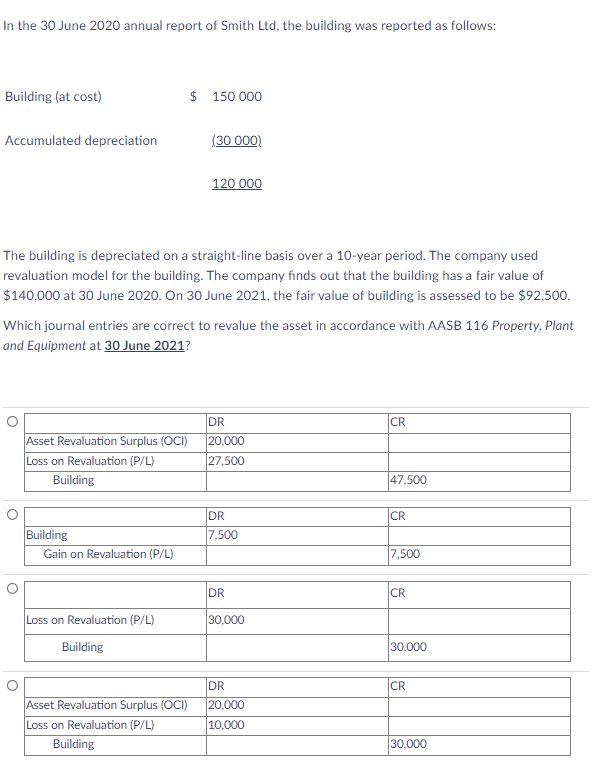

Which journal entries are correct to revalue the asset in accordance with AASB 116 Property, Plant and Equipment at 30 June 2021?

Q: Bezos Inc. charged customers $1,000 for services performed during the year ended December 31, 2021.…

A: The question is based on the concept of Financial Accounting. Revenue is the most significant item…

Q: Spiffy Shades Corporation manufactures artistic frames for sunglasses. Talia Demarest, controller,…

A: Budgets are the forecasts or estimates that is being used by the business. Production overhead means…

Q: Calculate PAYE and SRT by Dr. Vunna for the 2021 year.

A: Given in the question: Net Income of Shop 1 $104,000 Net Income of Shop 2 $190,000…

Q: #23 Ryan company declared a 5% share dividend on 100,000 issued and outstanding shares of P20 par…

A: A share dividend is a dividend distribution that is made in shares as opposed to cash to…

Q: Exercise 3 Using the following items (only the appropriate ones) prepare the balance sheet of "Toto"…

A: Based on the list of the balances provided, balance sheet of Toto Ltd. is to be prepared. Balance…

Q: Zack is single and has collected the following information for preparing his 2021 taxes: Gross…

A: According to the given question, we are required to compute the adjusted gross income and taxable…

Q: Deoro Company has identified the following overhead activities, costs, and activity drivers for the…

A: Activity costing is the method of determining the costs of overhead on the basis of the appropriate…

Q: Angela Lopez owns and manages a consulting firm called Metrix, which began operations on December 1.…

A: The financial statements are prepared by the business entity to show the performance of the…

Q: What is the difference between an account and a ledger?

A: Disclaimer: “Since you have asked multiple questions, we will solve the first question for you. If…

Q: (Related to Checkpoint 3.2) (Review of financial statements) A scrambled list of accounts from the…

A: Net working capital :— It is the difference of current assets and current liabilities. It shows the…

Q: From the following data for David ProElecticals, calculate the quick ratio. Cash…

A: The quick ratio measures a company's capacity to pay its current liabilities without needing to sell…

Q: Fast Wire Incorporated manufactures a scrambling device for cellular phones. The main component of…

A: Introduction: The productivity ratio is a metric used to compare output over time. The total…

Q: The following is a December 31, 2021, post-closing trial balance for Almway Corporation. Account…

A: A financial statement including categories such as current assets and liabilities, long-term…

Q: Speedy Auto Repairs uses a job-order costing system. The company’s direct materials consist of…

A: Job costing is a type of costing method that calculates the cost for each job done. Job costing is…

Q: Laura borrowed a total of $18000 from two different banks. one bank charged 6% simple interest and…

A: Simple interest method is easiest way to calculate interest. In this method interest is determined…

Q: A 5-year project will require an investment of $100 million. This comprises of plant andmachinery…

A: Cash Flow Statement The movement of cash or cash equivalents within the company is depicted in the…

Q: What is the significance of analyzing financial statements?

A: Introduction: A set of financial statements summarizes an organization's financial results,…

Q: Price Quantity Demanded Per Month $5 $4 $3 $2 $1 60 80 100 120 140 Quantity Supplied Per Month 200…

A: 1. The correct answer is option - c) The equilibrium price is $3 and equillibrium quantity is 100…

Q: Total Manufacturing Overhead Prime Conversion Cost Direct Materials Direct Labor Manufacturing Cost…

A: The prime costs comprise of the total direct costs incurred during the period including direct…

Q: a. Prepare an income statement in comparative form, stating each item for both years as an amount…

A: Introduction: In a comparative income statements, multiple period income statements are compared…

Q: Conner's Fixtures produces and sells a single product, a specialized plumbing fixture. The business…

A: >Direct material inventory is the cost of direct material that remained UN-USED at the end of…

Q: Which of the following is true regarding GAAP and IFRS? None of the answers are correct. GAAP and…

A: GAAP stands for General Accepted Accounting Principles and refers to rules and regulations of…

Q: Based on the above and the result of you 1. Collections from customers in 2018 2. Gross sales,…

A: You have asked six question which are the sub-parts of the same question but as per our protocol we…

Q: Describe the three fundamental conditions necessary for the commission of fraud. Provide an…

A: The commision of fraud is a type of the fraud in which the employee of the company creates some fake…

Q: Prepare the deferred tax worksheet and journal entries to adjust deferred tax accounts as at 30 July…

A: SOLUTION : DEFERRED TAX means the difference between the calculation of Tax implication of book…

Q: Mat Ltd borrows $360 000 from Place Ltd on 1 July 2022 with an interest rate of 6% p.a. The loan is…

A: 1. Gon Ltd records a loan of $360000 from Place Ltd on 1 July 2022. The loan has an interest rate of…

Q: Directions: Determine values for the missing items. Show all amounts as positive numbers even though…

A: Income statement is prepared to calculate the net income earned during the period. Income statement…

Q: K 716 Kira Steinbeck opened a medical practice. During July, the first month of operation, the…

A: Assets=Liabilities+Equity

Q: Federal Hill Corporation had the following transactions occurred during March 2024. Federal Hill…

A: Accounting Equation :— Accounting Equation is Help to measure effector Transaction in the heads of…

Q: Adjustment for Merchandise Inventory Using T Accounts: Periodic Inventory System Ibby Smith owns and…

A: Current asset includes cash and Cash equivalents and assets that will be realized in normal…

Q: Below are the Income Statement and Balance Sheet for Longborg Corporation for the years…

A: Leverage Ratios: One of the most crucial financial statistics is the leverage ratio, which shows how…

Q: Bellingham Industries, a manufacturer of the furniture industry, had the following…

A: Answer:- Comparative income statement meaning:- When different periods of the income statement are…

Q: On 1 July 2021, Mel Ltd took control of the assets and liabilities of Syd Ltd. At this date the…

A: If the value of consideration discharge more than the fair value of asset acquired then such an…

Q: Big Corporation reported the following income statement and balance sheet for the past two years:…

A: Lets understand the basics. Return on total assets is a ratio which shows how much earning before…

Q: Use the information below for 3M Company to answer the requirements (perform these computations from…

A: ROA stands for Return on Assets refers to the measure which determine that how effectively the…

Q: On June 30, 2010, Musk and Associates borrows money from a local bank, repayable in full on June 30,…

A: Introduction: Any liability which is repayable within next 12 months from the date of balance sheet…

Q: TB MC Qu. 8-48 (Static) A company purchases inventory for... A company purchases inventory for…

A: The inventory is recorded differently under different approaches as perpetual and periodic inventory…

Q: The following items were selected from among the transactions completed by O'Donnel Co. during the…

A: Note Payable :— Note Payable is Liability in nature sometimes Note payable are Long term Borrowing…

Q: what would be the difference if the ¹ Degree of completition: DM, were 10% instead of 100%

A: The total cost of producing a product, including raw materials and operating costs, is detailed in a…

Q: Yancey Productions is a film studio that uses a job-order costing system. The company’s direct…

A: The traditional method of overhead allocation is based on a predetermined overhead rate. The…

Q: Q1 The following is the general ledger summary for Akiko's Sushi Bar after posting transactions for…

A: A trial balance is a list of all the general ledger accounts in a business. Trial Balance is an…

Q: 7. At the beginning of the year, a company estimates total direct materials costs of $1,940,000 and…

A: Predetermined OH Rates :— A predetermined overhead rate is calculated at the start of the accounting…

Q: e note has been outstanding 10 months, what is the annual interest rate on that note?

A: Note payable refers to the long term liabilities which reflects the sum value of money a company…

Q: On January 1, 2022, Broncos Universal issued 12% bonds dated January 1, 2022, with a face amount of…

A: Bond Price :— It is sum of present value of periodic interest payment and face value amount. If…

Q: 3) FRCS? How much PAYE will a person earning chargeable income of $46,128 per annum pay to

A: Amount to be paid to FRCS can be calculated using the following table, For Resident Individuals

Q: Ledger Account balances (prior to any Balance Day Adjustments) as of 30 June 2018: Insurance $ Rent…

A: Prepaid insurance will be for July 2018 to November 2018 , ie 5 months Entries for Accrued Expenses…

Q: Required Journal Entry Mr. Lopez opened a mini grocery store with business name Lopez Fiesta…

A: Following are the Golden Rules of Accounting : Account Debit Credit Personal Accounts the…

Q: Required information Problem 8-5 (Algo) Various inventory costing methods [LO8-1, 8-4] [The…

A: FIFO Method :— It is one of the method of inventory valuation in which it is assumed that beginning…

Q: Which important duties are generally not separated in end-user computing environments?

A: Introduction: End-user computing (EUC) refers to the technology that IT professionals use to…

Step by step

Solved in 2 steps with 2 images

- On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000At the end of 2020, Magenta Manufacturing Company discovered that construction cost had been capitalized as a cost of the factory building in 2015 when it should have been treated as a cost of production equipment installation costs. As a result of the misclassification, the depreciation through 2018 was understated by 110,000, and depreciation for 2019 was understated by 90,000. What would be the consequences of correcting for the misclassification of the property cost? a. The taxpayer uses the FIFO inventory method, and 25% of goods produced during the period were included in the ending inventory. b. The taxpayer uses the LIFO inventory method, and no new LIFO layer was added during 2019.

- Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.Bliss Company owns an asset with an estimated life of 15 years and an estimated residual value of zero. Bliss uses the straight -line method of depreciation. At the beginning of the sixth year, the assets book value is 200,000 and Bliss changes the estimate of the assets life to 25 years, so that 20 years now remain in the assets life. Explain how this change will be accounted for in Blisss financial statements, and compute the current and future annual depreciation expense.

- Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.During 2019, White Company determined that machinery previously depreciated over a 7-year life had a total estimated useful life of only 5 years. An accounting change was made in 2019 to reflect the change in estimate. If the change had been made in 2018, accumulated depreciation at December 31, 2018, would have been 1,600,000 instead of 1,200,000. As a result of this change, the 2019 depreciation expense was 100,000 greater than it would have been if no change were made. Ignoring income tax considerations, what is the proper amount of the adjustment to Whites January 1, 2019, balance of retained earnings? a. 0 b. 100,000 c. 280,000 d. 400,000At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the following three situations: 1. Machine X was purchased for 100,000 on January 1, 2015. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 45,000. The estimated residual value remains at 10,000, but the service life is now estimated to be 1 year longer than originally estimated. 2. Machine Y was purchased for 40,000 on January 1, 2018. It had an estimated residual value of 4,000 and an estimated service life of 8 years. It has been depreciated under the sum-of-the-years-digits method for 2 years. Now, the company has decided to change to the straight-line method. 3. Machine Z was purchased for 80,000 on January 1, 2019. Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value is 8,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry for each situation to record the depreciation for 2020. Ignore income taxes.

- During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?At the end of 2020, while auditing Sandlin Companys books, before the books have been closed, you find the following items: a. A building with a 30-year life (no residual value, depreciated using the straight-line method) was purchased on January 1, 2020, by issuing a 90,000 non-interest-bearing, 4-year note. The entry made to record the purchase was a debit to Building and a credit to Notes Payable for 90,000; 12% is a fair rate of interest on the note. b. The inventory at the end of 2020 was found to be overstated by 15,000. At the same time, it was discovered that the inventory at the end of 2019 had been overstated by 35,000. The company uses the perpetual inventory system. c. For the last 3 years, the company has failed to accrue salaries and w-ages. The correct amounts at the end of each year were: 2018, 12,000; 2019, 18,000; and 2020, 10,000. Required: 1. Prepare journal entries to correct the errors. Ignore income taxes. 2. Assume, instead, that the company discovered the errors after it had closed the books. Prepare journal entries to correct the errors. Ignore income taxes.