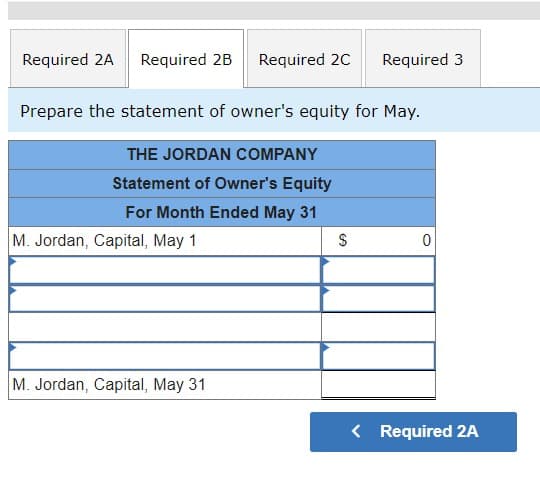

Prepare the statement of owner's equity for May. THE JORDAN COMPANY Statement of Owner's Equity For Month Ended May 31 M. Jordan, Capital, May 1 S 0

Q: Chris, age 5, has $3,000 of interest income and no earned income this year. Assuming the current…

A: The standard deduction is the part of your income that is not taxed and can be utilised to decrease…

Q: what is the anwser

A: Here, the expert has only answered question 3, as per the bartlyby policy, if multiple questions are…

Q: Reconciliations to yield government-wide financial statements (deferred revenues and compensated…

A: Deferred revenue generally defined as the payments received from customers for the goods or services…

Q: The relevant range refers to: Q Search with Bing *** Select one: a. a particular range of production…

A: In managerial accounting, the relevant range refers to the range of activity or production levels…

Q: Business Solutions's second-quarter 2022 fixed budget performance report for its computer furniture…

A: The variance is the difference between the standard and actual production cost data. The…

Q: If $581,000 of 10% bonds are issued at 95, the amount of cash received from the sale is O a $551.950…

A: Bonds :Bonds is a long-term debt issued by the government and companies to raise funds for their…

Q: Dristell Incorporated had the following activities during the year (all transactions are for cash…

A: Cash flow from Financing activities includes the transactions relating to the loan/debt,…

Q: The Porter Beverage Factory owns a building for its operations. Porter uses only half of the…

A: While making the decision to either sell or lease the unused space, costs and benefits involved in…

Q: Required: a. What amount is Jarvie required to include in taxable income from these purchases? b.…

A: As per income tax law, if price at which employees purchased any goods from employer company, i.e.…

Q: A family friend has asked your help in analyzing the operations of three anonymous companies…

A: Residual income- It calculates the profit that remains after deducting the minimum required return…

Q: A small firm has a beginning inventory of $52,000 as of January 1, 2020, and the following…

A: Inventory turnover is measured by a ratio that shows how many times inventory is sold and then…

Q: Production costs of the Finishing Department in June in Ivanhoe Company are materials $9,600, labor…

A: Cost per equivalent units :— It is calculated by dividing total costs by total equivalent units of…

Q: During 2022, Coronado Corp. produced 29,520 units and sold 29,520 for $15.00 per unit. Variable…

A: Income statement is the financial statement that records all the income and expenses of the business…

Q: Given the following cost and activity observations for Bounty Company's utilities, use the high-low…

A: High Low Method of Variable Utility Cost -The High-low method is a method used to separate costs.…

Q: Number the following in the order of the flow of manufacturing costs for a company:

A: Manufacturing cost means the direct cost which are incurred while producing a product

Q: Landen Corporation uses a job-order costing system. At the beginning of the year, the company made…

A: Manufacturing overhead is the amount of money incurred on the making or production of the goods. It…

Q: Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8…

A: Depreciation is an expense which is charged for the wear and tear of fixed asset. Different methods…

Q: Swifty Company applies overhead on the basis of machine hours. Given the following data, what is the…

A: Overhead cost is applied on the basis of a cost driver which is machine hours in the given…

Q: Use the following information for the Exercies below. (Algo) [The following information applies to…

A: Lets understand the basics.Income statement is prepared using either two methods.(1) Single step…

Q: Required information [The following information applies to the questions displayed below] Diego…

A: Absorption costing is a managerial method that captures all costs associated with manufacturing a…

Q: Manufacturing costs* Insurance expense*** Depreciation expense Property tax expense*** $159,000…

A: Lets understand the basics.Management prepares budget in order to estimate future profit and…

Q: Recording and Reporting a Legal Contingency Pitt Company is the defendant in a lawsuit filed by…

A: Contingent liabilities are possible obligations that may or may not get converted into actual…

Q: Job 62 was recently completed and the following data is available on the job cost sheet for Job 62:…

A: Direct material cost is the cost of raw material produced or purchased for producing the final…

Q: Primare Corporation has provided the following data concerning last month's manufacturing…

A: The Cost of Goods Manufactured is the total manufacturing costs of goods that…

Q: Which of the following statements about reconciling items is true? A Debit memoranda should be…

A: Bank reconciliation statement, which summarizes the differences between the adjusted bank balance…

Q: A store uses the gross profit method to estimate inventory and cost of goods sold for interim…

A: The following formula used to calculate as follows under:-Cost of goods sold = Beginning inventory +…

Q: A company purchases a 7,920-square-foot building for $410,000. The building has two separate rental…

A: Value Basis of Allocation of Joint CostsThe value basis of the joint cost allocation is a way of…

Q: Carolan Delivery Company, Inc., was organized in 2019 in New York. The following transactions…

A: T-account is an informal word for a set of financial records that use double-entry accounting. A…

Q: As an auditor, why would we be concerned with a high level of transactions that exceed the Bendford…

A: Benford's Law is a statistical principle that suggests certain digits (1 to 9) occur with…

Q: *P6.11 (LO 6), AP Rayre Books uses the retail inventory method to estimate its monthly ending…

A: The retail inventory method is a method used by the entity for the purpose of assessing the worth of…

Q: Prepare a December 31 balance sheet using the following select accounts and amounts. $ 30,900 4,400…

A: A balance sheet is a statement of assets, liability, and equity. It is prepared after the income…

Q: A business operated at 100% of capacity during its first month, with the following results: Sales…

A: Contribution margin is a financial metric that represents the amount of revenue remaining after…

Q: The following costs and inventory data were taken from the accounts of Crane Company for 2022:…

A: Raw Material used in production -Raw Material is an inventory purchased by the company to be used in…

Q: Carol wants to invest money in an investment account paying 8% interest compounding semi-annually.…

A: PRESENT VALUEPresent Value is the Current Value of Future…

Q: Exercise 20-1 (Algo) Change in principle; change in inventory methods [LO20-2] During 2019 (its…

A: In distinct columns, a comparative income statement summarises the outcomes of different accounting…

Q: 2. On July1, 2018, Dixon Inc. issued bonds with a $500,000 face value at 96.0 and the 5-year bonds…

A: Journal entries refers to the official book of a company which is used to record the day to day…

Q: Long-term capital assets with a(n) _____ may not be depreciable. O finite life O indefinite life O…

A: All long term capital assets are depreciated because of usage and passage of time.

Q: You have decided to start saving money for your future. What is the future value of a 17-year…

A: Future value refers to the total value that an investment or a series of cash flows will accumulate…

Q: Practice 6: The following is an analysis of the bills discounted from the books of accounts of a AM…

A: Date of billsAmountterm of monthsDiscount % per annumdue date of the billsDays due from…

Q: Required: a. Assume that only one product is being sold in each of the four following case…

A: Contribution Margin: Sales - Variable CostContribution margin ratio: Net Operating Income (Loss):…

Q: Hi-Tek Manufacturing, Incorporated, makes two types of industrial component parts-the B300 and the…

A: Traditional Costing System: A traditional costing system is a method used to allocate manufacturing…

Q: Question 2 of 12 Payments of $1,450 in 1 year and another $2,700 in 4 years to settle a loan are to…

A: Future value refers to the current value of the an asset today that will be present at some future…

Q: 16) Doles Corporation uses the following activity rates from its activity-based costing to assign…

A: The overhead is applied to the production differently using different overhead rates such as…

Q: Condensed financial data are presented below for the Phoenix Corporation: 20X2 20X1 Accounts…

A: Return on Common Stockholder's Equity -Return on Common Stockholder's Equity represents net income…

Q: Calculate the value of an real option value of an oil producing company which has the target of a…

A: To calculate the value of the real option using the Black-Scholes Option Pricing Model (BSOPM), we…

Q: Mojo Industries tracks the number of units purchased and sold throughout each accounting period but…

A: Inventory Valuation Methd includes:FIFO MethodLIFO MethodWeighted average cost methodFIFO Method- As…

Q: Annette is currently in the 24% marginal tax bracket. She had a long-term capital gain from the sale…

A: Tax rate on most of the Net Capital Gains is 15%. However, for certain items, the Net Capital Gains…

Q: There are four steps in the two-stage cost allocation process using ABC. Which of the following not…

A: Activity-Based costing system: Activity-based costing is a costing method that identifies activities…

Q: The adjusted trial balance for Carter Bowling Alley at December 31, 2022, contains the following…

A: Balance SheetOne sort of financial statement that lists a company's assets and liabilities is a…

Q: Analyzing Financial Risk Presented below are summary financial data from the Bristol-Myers Squibb…

A: Ratio analysis is a method or technique to find out the operational efficiency , profitability…

Owe

![Required information

[The following information applies to the questions displayed below.]

Michael Jordan started The Jordan Company, a new business that started on May 1. The Jordan Company had the

below transactions in May.

May 1 M. Jordan invested $43,000 cash in the company.

May 1 The company rented a furnished office and paid $2,300 cash for May's rent.

May 3 The company purchased $1,930 of equipment on credit.

May 5 The company

May 8 The company provided consulting services for a client and immediately collected $5,500 cash.

May 12 The company provided $2,800 of consulting services for a client on credit.

paid $730 cash for this month's cleaning services.

May 15 The company paid $760 cash for an assistant's salary for the first half of this month.

May 20 The company received $2,800 cash payment for the services provided on May 12.

May 22 The company provided $3,500 of consulting services on credit.

May 25 The company received $3,500 cash payment for the services provided on May 22.

May 26 The company paid $1,930 cash for the equipment purchased on May 3.

May 27 The company purchased $75 of equipment on credit.

May 28 The company paid $760 cash for an assistant's salary for the second half of this month.

May 30 The company paid $400 cash for this month's telephone bill.

30 The company paid $300 cash for this month's utilities.

May 31 M. Jordan withdrew $1,800 cash from the company for personal use.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fd76dac07-7d2c-4fa7-b2df-10a6f0497c0c%2F58f13f51-25a3-49ef-9812-ce84fbbf8786%2Fg2vrnes_processed.jpeg&w=3840&q=75)

Step by step

Solved in 3 steps

- In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001 (Rent Expense). e. Sold services for cash for the first half of the month, 6,927 (Service Income). f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004 (Utilities Expense). i. Received a bill for gas and oil for the truck, 218 (Gas and Oil Expense). j. Sold services on account, 3,603 (Service Income). k. Sold services for cash for the remainder of the month, 4,612 (Service Income). l. Paid wages to the employees, 3,958, Ck. Nos. 30053007 (Wages Expense). m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.Discuss how each of the following transactions will affect assets, liabilities, and stockholders equity, and prove the companys accounts will still be in balance. A. A company purchased $450 worth of office supplies on credit. B. The company parking lot was plowed after a blizzard. A check for $75 was given to the plow truck operator. C. $250 was paid on account. D. A customer paid $350 on account. E. Provided services for a customer, $500. The customer asked to be billed.Journal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.

- B. Kelso established Computer Wizards during November of this year. The accountant prepared the following chart of accounts: The following transactions occurred during the month: a. Kelso deposited 45,000 in a bank account in the name of the business. b. Paid the rent for the current month, 1,800, Ck. No. 2001. c. Bought office desks and filing cabinets for cash, 790, Ck. No. 2002. d. Bought a computer and printer from Cyber Center for use in the business, 2,700, paying 1,700 in cash and placing the balance on account, Ck. No. 2003. e. Bought a neon sign on account from Signage Co., 1,350. f. Kelso invested her personal computer software with a fair market value of 600 in the business. g. Received a bill from Country News for newspaper advertising, 365. h. Sold services for cash, 1,245. i. Received and paid the electric bill, 345, Ck. No. 2004. j. Paid on account to Country News, a creditor, 285, Ck. No. 2005. k. Sold services for cash, 1,450. l. Paid wages to an employee, 925, Ck. No. 2006. m. Received and paid the bill for the city business license, 75, Ck. No. 2007. n. Kelso withdrew cash for personal use, 850, Ck. No. 2008. o. Kelso withdrew cash for personal use, 850, Ck. No. 2008. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance, with a three-line heading, dated November 30, 20--.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.A business has the following transactions: The business is started by receiving cash from an investor in exchange for common stock $20,000 The business purchases supplies on account $500 The business purchases furniture on account $2,000 The business renders services to various clients on account totaling $9,000 The business pays salaries $2,000 The business pays this months rent $3,000 The business pays for the supplies purchased on account. The business collects from one of its clients for services rendered earlier in the month $1,500. What is total income for the month?

- P. Schwartz, Attorney at Law, opened his office on October 1. The account headings are presented below. Transactions completed during the month follow. a. Schwartz deposited 25,000 in a bank account in the name of the business. b. Bought office equipment on account from QuipCo, 9,670. c. Schwartz invested his personal law library, which cost 2,800. d. Paid the office rent for the month, 1,700, Ck. No. 2000. e. Bought office supplies for cash, 418, Ck. No. 2001. f. Bought insurance for two years, 944, Ck. No. 2002. g. Sold legal services for cash, 8,518. h. Paid the salary of the part-time receptionist, 1,820, Ck. No. 2003. i. Received and paid the telephone bill, 388, Ck. No. 2004. j. Received and paid the bill for utilities, 368, Ck. No. 2005. k. Sold legal services for cash, 9,260. l. Paid on account to QuipCo, 2,670, Ck. No. 2006. m. Schwartz withdrew cash for personal use, 2,500, Ck. No. 2007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.A business has the following transactions: A. The business is started by receiving cash from an investor in exchange for common stock $10,000. B. Rent of $1,250 is paid for the first month. C. Office supplies are purchased for $375. D. Services worth $3,450 are performed. Cash is received for half. E. Customers pay $1,250 for services to be performed next month. F. $6,000 is paid for a one year insurance policy. G. We receive 25% of the money owed by customers in D. H. A customer has placed an order for $475 of services to be done this coming week. How much total revenue does the company have?Journal entries and trial balance On October 1, 20Y6, Jay Crowley established Affordable Realty, which completed the following transactions during the month: a. Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 40,000. b. Paid rent on office and equipment for the month, 4,800. c. Purchased supplies on account, 2,150. d. Paid creditor on account, 1,100. e. Earned sales commissions, receiving cash, 18,750. f. Paid automobile expenses (including rental charge) for month, 1,580, and miscellaneous expenses, 800. g. Paid office salaries, 3,500. h. Determined that the cost of supplies used was 1,300. i. Paid dividends, 1,500. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of October 31, 20Y6. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for October. 5. Determine the increase or decrease in retained earnings for October.

- EFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS) Jon Wallace started a business. During the first month (March 20--), the following transactions occurred. Show the effect of each transaction on the accounting equation: Assets= Liabilities + Owners Equity. After each transaction, show the new account totals. (a) Invested cash in the business, 30,000. (b) Bought office equipment on account, 4,500. (c) Bought office equipment for cash, 1,600. (d) Paid cash on account to supplier in transaction (b), 2,000. EFFECTS OF TRANSACTIONS (REVENUE, EXPENSE, WITHDRAWALS) This exercise is an extension of Exercise 2-3B. Lets assume Jon Wallace completed the following additional transactions during March. Show the effect of each transaction on the basic elements of the expanded accounting equation: Assets = Liabilities + Owners Equity (Capital Drawing + Revenues Expenses). After transaction (k), report the totals for each element. Demonstrate that the accounting equation has remained in balance. (e) Performed services and received cash, 3,000. (f) Paid rent for March, 1,000. (g) Paid March phone bill, 68. (h) Jon Wallace withdrew cash for personal use, 800. (i) Performed services for clients on account, 900. (j) Paid wages to part-time employee, 500. (k) Received cash for services performed on account in transaction (i), 500.ANALYSIS OF TRANSACTIONS Charles Chadwick opened a business called Charlies Detective Service in January 20--. Set up T accounts for the following accounts: Cash; Accounts Receivable; Office Supplies; Computer Equipment; Office Furniture; Accounts Payable; Charles Chadwick, Capital; Charles Chadwick, Drawing; Professional Fees; Rent Expense; and Utilities Expense. The following transactions occurred during the first month of business. Record these transactions in T accounts. After all transactions are recorded, foot and balance the accounts if necessary. (a) Invested cash in the business, 30,000. (b) Bought office supplies for cash, 300. (c) Bought office furniture for cash, 5,000. (d) Purchased computer and printer on account, 8,000. (e) Received cash from clients for services, 3,000. (f) Paid cash on account for computer and printer purchased in transaction (d), 4,000. (g) Earned professional fees on account during the month, 9,000. (h) Paid cash for office rent for January, 1,500. (i) Paid utility bills for the month, 800. (j) Received cash from clients billed in transaction (g), 6,000. (k) Withdrew cash for personal use, 3,000. TRIAL BALANCE Based on the transactions recorded in Exercise 3-7A, prepare a trial balance for Charlies Detective Service as of January 31, 20--.ANALYSIS OF TRANSACTIONS Charles Chadwick opened a business called Charlies Detective Service in January 20--. Set up T accounts for the following accounts: Cash; Accounts Receivable; Office Supplies; Computer Equipment; Office Furniture; Accounts Payable; Charles Chadwick, Capital; Charles Chadwick, Drawing; Professional Fees; Rent Expense; and Utilities Expense. The following transactions occurred during the first month of business. Record these transactions in T accounts. After all transactions are recorded, foot and balance the accounts if necessary. (a) Invested cash in the business, 30,000. (b) Bought office supplies for cash, 300. (c) Bought office furniture for cash, 5,000. (d) Purchased computer and printer on account, 8,000. (e) Received cash from clients for services, 3,000. (f) Paid cash on account for computer and printer purchased in transaction (d), 4,000. (g) Earned professional fees on account during the month, 9,000. (h) Paid cash for office rent for January, 1,500. (i) Paid utility bills for the month, 800. (j) Received cash from clients billed in transaction (g), 6,000. (k) Withdrew cash for personal use, 3,000.