)Present the journal entries for the transactions above. (b)Journalise the adjusting entry. Show workings. (c)Determine the net realizable value of the accounts receivable as at 31 Dec.

)Present the journal entries for the transactions above. (b)Journalise the adjusting entry. Show workings. (c)Determine the net realizable value of the accounts receivable as at 31 Dec.

Chapter6: Business Expenses

Section: Chapter Questions

Problem 44P

Related questions

Question

a)Present the

(b)Journalise the

(c)Determine the net realizable value of the

(d)Is the Allowance Method of accounting for doubtful debt better compared to the direct write-off method? Explain.

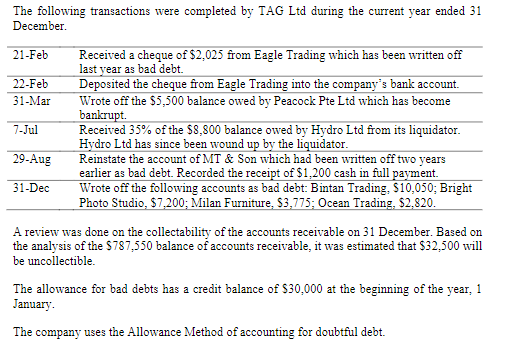

Transcribed Image Text:The following transactions were completed by TAG Ltd during the current year ended 31

December.

21-Feb

Received a cheque of $2,025 from Eagle Trading which has been written off

last year as bad debt.

Deposited the cheque from Eagle Trading into the company's bank account.

Wrote off the $5,500 balance owed by Peacock Pte Ltd which has become

bankrupt.

Received 35% of the $8,800 balance owed by Hydro Ltd from its liquidator.

Hydro Ltd has since been wound up by the liquidator.

Reinstate the account of MT & Son which had been written off two years

earlier as bad debt. Recorded the receipt of $1,200 cash in full payment.

Wrote off the following accounts as bad debt: Bintan Trading, $10,050; Bright

Photo Studio, $7,200; Milan Furniture, $3,775; Ocean Trading, $2,820.

22-Feb

31-Mar

7-Jul

29-Aug

31-Dec

A review was done on the collectability of the accounts receivable on 31 December. Based on

the analysis of the $787,550 balance of accounts receivable, it was estimated that $32,500 will

be uncollectible.

The allowance for bad debts has a credit balance of $30,000 at the beginning of the year, 1

January.

The company uses the Allowance Method of accounting for doubtful debt.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College