vorte Determine the following as a result of your audit: 1. How much is the correct amount of gross trade receivables as c December 31, 2021? 2. How much is the correct amount of "trade and other receivables reported in its December 31, 2021 statement of financial position? 3. How much is the balance of the allowance for bad debts as df December 31, 2021? 4. How much is the amount of bad debts expense recognized in its statement of comprehensive income in 2021? 0ooivnhlor renorted i

vorte Determine the following as a result of your audit: 1. How much is the correct amount of gross trade receivables as c December 31, 2021? 2. How much is the correct amount of "trade and other receivables reported in its December 31, 2021 statement of financial position? 3. How much is the balance of the allowance for bad debts as df December 31, 2021? 4. How much is the amount of bad debts expense recognized in its statement of comprehensive income in 2021? 0ooivnhlor renorted i

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter9: Auditing The Revenue Cycle.

Section: Chapter Questions

Problem 20CYBK

Related questions

Question

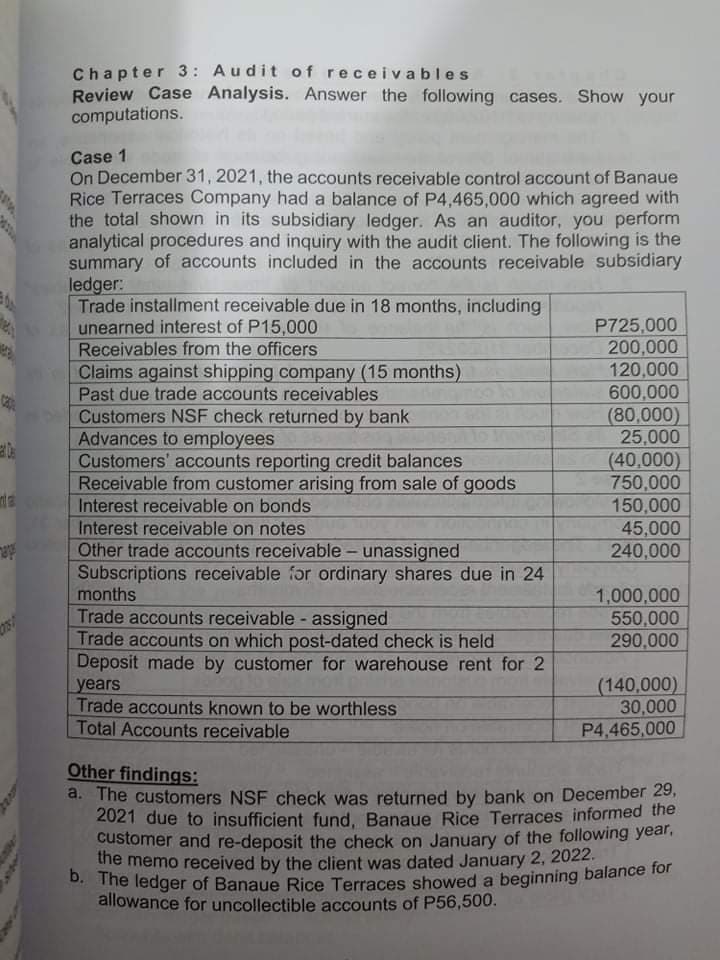

Transcribed Image Text:Chapter 3: Audit of receivables

Review Case Analysis. Answer the following cases. Show your

computations.

Case 1

On December 31, 2021, the accounts receivable control account of Banaue

Rice Terraces Company had a balance of P4,465,000 which agreed with

the total shown in its subsidiary ledger. As an auditor, you perform

analytical procedures and inquiry with the audit client. The following is the

summary of accounts included in the accounts receivable subsidiary

ledger:

Trade installment receivable due in 18 months, including

unearned interest of P15,000

Receivables from the officers

Claims against shipping company (15 months).

Past due trade accounts receivables

Customers NSF check returned by bank

Advances to employees

Customers' accounts reporting credit balances

Receivable from customer arising from sale of goods

Interest receivable on bonds

P725,000

200,000

120,000

600,000

(80,000)

25,000

(40,000)

750,000

150,000

45,000

240,000

Interest receivable on notes

Other trade accounts receivable- unassigned

Subscriptions receivable for ordinary shares due in 24

months

de

1,000,000

550,000

290,000

Trade accounts receivable - assigned

Trade accounts on which post-dated check is held

Deposit made by customer for warehouse rent for 2

years

Trade accounts known to be worthless

Total Accounts receivable

(140,000)

30,000

P4,465,000

Other findings:

a. The customers NSF check was returned by bank on December 29,

2021 due to insufficient fund, Banaue Rice Terraces informed the

customer and re-deposit the check on January of the following year.

the memo received by the client was dated January 2, 2022.

The ledger of Banaue Rice Terraces showed a beginning balance for

allowance for uncollectible accounts of P56,500.

w.

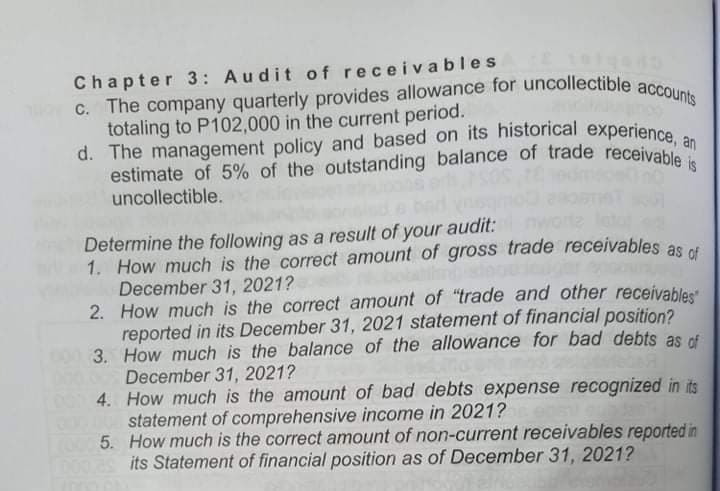

Transcribed Image Text:d. The management policy and based on its historical experience, an

estimate of 5% of the outstanding balance of trade receivable is

C. The company quarterly provides allowance for uncollectible accounts

Chapter 3: Audit of receiva bles

totaling to P102,000 in the current period.

d. The management policy and based on its historical experience

estimate of 5% of the outstanding balance of trade receivab an

uncollectible.

Determine the following as a result of your audit:

1. How much is the correct amount of gross trade receivables as t

December 31, 2021?

2. How much is the correct amount of "trade and other receivables

reported in its December 31, 2021 statement of financial position?

3. How much is the balance of the allowance for bad debts as rf

December 31, 2021?

4. How much is the amount of bad debts expense recognized in its

statement of comprehensive income in 2021?

5. How much is the correct amount of non-current receivables reported in

its Statement of financial position as of December 31, 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,